Camden Property Trust

CEO : Mr. Richard J. Campo

Quarterly earnings growth(YoY,%)

| Period | Revenue | Operating Income | EPS | Release Date |

|---|---|---|---|---|

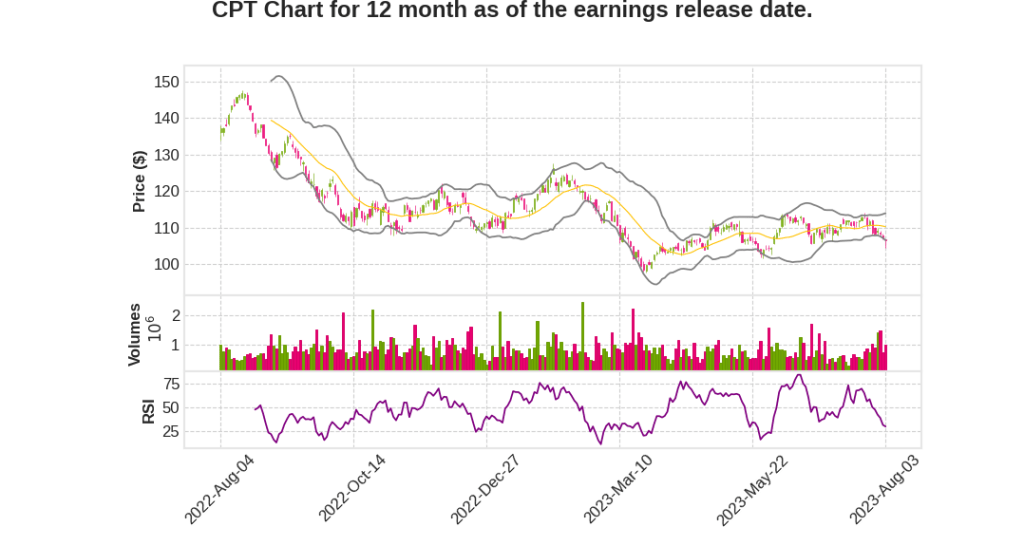

| 2023 Q2 | 6.6% YoY | 65.1% | -81.7% | 2023-08-04 |

Ric Campo says,

Key Points from Speech #1

- Camden celebrated its 30th birthday as a public company with a closing bell ceremony at the New York Stock Exchange.

- Camden’s business has grown significantly, from 6,000 apartments in three Texas markets to 60,000 apartments worth $15.5 billion.

- The company has built a strong operating and investment team platform that focuses on constant improvement.

- Market conditions are moderating from the post-COVID housing boom, with a 70% decline in the transaction market compared to last year.

- New permits are starting to fall due to difficult financing and increased cost of capital, which should benefit Camden’s markets as supply is absorbed over the next 18 months.

- Move-outs from family homes are trending lower than in previous years and quarters.

- Recognition and appreciation for Camden’s teams and their commitment to providing excellent living experiences to residents.

Keith Oden says,

Revenue Growth and Guidance

- Same-property revenue growth for Q2 2023 was 6.1%, in line with expectations.

- Camden has maintained the midpoint of its 2023 revenue guidance.

Strong Markets

- Three Florida markets (Tampa, Orlando, and Southeast Florida) showed the highest growth rates.

- Charlotte and Nashville also had strong results.

Demand and Leases

- Despite concerns about supply levels, demand for high-quality apartments in Camden’s markets remains strong.

- Blended lease growth rate for Q2 2023 was 4.1%, with new leases up 2.2% and renewals up 5.9%.

- Preliminary July results show moderating growth rates, with blended rates in the mid-3% range.

- Renewal offers for August and September were sent out in the high 5% range.

Occupancy

- Average occupancy for Q2 2023 was 95.4% and slightly higher in July at 95.6%.

- The portfolio is currently 95.8% occupied, which positions Camden well for the usual seasonal slowdown in Q4.

Turnover and Home Purchases

- Net turnover for Q2 2023 was 44%.

- Move-outs to purchase homes were 11.8% for the quarter and 11% year-to-date.

- This is a decrease from 15.1% in Q2 2022 and 13.8% for the full year of 2022.

Q & A sessions,

Impact of Declining Starts on the Market

- Starts in May were down 13.5% and down 33% from last year, indicating a decline in the market.

- Tight financial markets and difficulty in securing bank financing and equity financing, along with increased cost of capital, are slowing down the market.

- However, absorption has been better than anticipated in most markets, indicating a positive outlook for absorption in the next 12-18 months.

- The supply side of the market is expected to be constructive towards the end of 2024 and into 2025.

- Approximately 15% of the total supply market is impacting Camden’s communities, despite the scary headline numbers of 400,000 apartments being delivered.

Impact of Short Notice Move Outs on Occupancy

- Elevated level of short notice move outs is more than double historical levels and has impacted occupancy numbers.

- Marketing spend and pricing adjustments have been made to maintain occupancy during this period.

- Expected to see a return to normal occupancy levels after a quarter or so of grinding through the process of evictions and move outs.

Construction Cost and Availability of Funds

- Construction cost has flattened but has not gone down, making it difficult to pencil development yields.

- Land costs have decreased, but the lack of motivated land sellers makes it challenging to take advantage of the decline.

- Rental rates and occupancy rates are not increasing as much as before, making it harder to justify development projects.

- Availability of funds is not the only issue, as the overall cost of construction, especially with the rising interest rate costs, makes many projects unfeasible.

- No relief in construction costs is expected, and cost reductions may only be seen in 2025-2026 when contractors start competing for fewer projects.

Concerns of Fraud and Identity Theft

- Identity theft and fraud in the rental industry, where people live in apartments for free, is a growing issue.

- Personal experiences of identity theft highlight the challenges faced by both individuals and competitors in the industry.

- Fraud prevention measures and repairing credit scores after such incidents can take time.

Portfolio Diversity and Middle Market Properties

- Camden’s portfolio is geographically diversified and includes properties with different price points.

- New development tends to be at the top end of the market due to cost structures, leading to a shortage of affordable apartments in America.

- A significant portion of Camden’s properties are in the middle market, where rents are 30-40% lower than new developments.

- Renters in middle market properties are unlikely to move to higher-end properties because they can’t afford them, benefiting Camden’s portfolio.

- Even in the face of oversupply concerns, Camden has operated successfully in the Sunbelt market for 30 years and expects a market correction in the next 18 months.