Charles River Laboratories International, Inc.

CEO : Mr. James C. Foster J.D.

Quarterly earnings growth(YoY,%)

| Period | Revenue | Operating Income | EPS | Release Date |

|---|---|---|---|---|

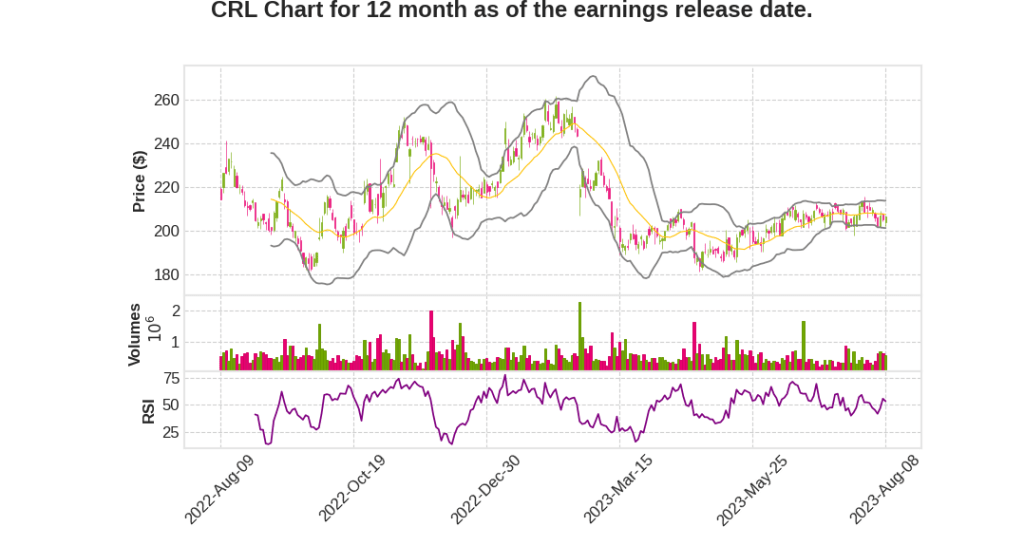

| 2023 Q2 | 8.9% YoY | 11.6% | -12.1% | 2023-08-09 |

Jim Foster says,

Revenue Growth and Guidance

- Organic revenue growth in Q2 2023 was 11.2%, with improvement seen in the RMS and Manufacturing segments.

- Revenue growth rates in the DSA segment remained strong, with low double-digit growth and improved operating margins.

- Revenue growth in the second half of 2023 is expected to be pressured primarily in the DSA segment due to lower backlog and booking trends, challenging year-over-year comparisons, and modest impact from NHP supply constraints.

- Biopharmaceutical clients are reprioritizing their pipelines and tightening their R&D budgets, which may impact demand trends.

- Non-GAAP earnings per share guidance for 2023 has been narrowed to the upper end of the previous range.

NHP Supply and Mitigation Efforts

- The company has successfully mitigated the logistical challenges posed by NHP supply constraints by conducting more studies outside of the U.S. and leveraging their global infrastructure.

- Progress has been made in study scheduling, logistics, quarantine operations, and retraining of staff at international sites.

- No significant NHP supply constraints are expected to affect the business in Q4 2023 and next year.

- The impact from NHP supply constraints is now expected to be less than the initial outlook of a 2%-4% impact to consolidated revenue growth this year.

Q2 2023 Performance

- Revenue in Q2 2023 was $1.06 billion, an 8.9% increase over the previous year.

- Organic revenue growth of 11.2% was driven by strong performance in the RMS and DSA segments, as well as improvement in the manufacturing growth rate.

- Global biopharmaceutical clients outpaced small and mid-sized biotech clients, demonstrating the diversity and stability of the overall client base.

- Operating margin was 20.4%, a decrease of 140 basis points year-over-year, primarily due to margin pressure in the manufacturing segment and higher unallocated corporate costs.

- Earnings per share were $2.69, a decrease of 2.9% from the previous year.

Revenue and Non-GAAP Earnings Guidance

- Organic revenue growth guidance for 2023 has been narrowed to a range of 5.5% to 7.5%.

- Non-GAAP earnings per share guidance for 2023 has been narrowed to a range of $10.30 to $10.90.

- The lower end of the guidance ranges has been increased by 50 basis points for organic revenue growth and $0.40 per share for earnings.

- Existing DSA backlog and assessment of demand trends give confidence in achieving financial outlook for the year.

Segment Performance: DSA

- DSA revenue in Q2 2023 was $663.5 million, an 11.7% increase on an organic basis.

- Safety Assessment business drove DSA revenue growth, with contributions from base pricing, study volume, and small benefit from NHP pricing.

- Discovery services business posted lower revenue due to the current market environment and shorter-term nature of projects and backlog.

- DSA backlog decreased modestly on a sequential basis, primarily due to higher cancellation rates as clients rationalize lower priority projects in their pipeline.

- Gross bookings remain robust, supporting healthy revenue growth rates once cancellation rates decline.

- DSA margin was 27.6%, a 230 basis point increase from Q2 2022, driven by operating leverage associated with higher revenue in the Safety Assessment business.

Segment Performance: RMS

- RMS revenue in Q2 2023 was $209.9 million, a 13.9% increase on an organic basis.

- RMS segment benefited from broad-based growth in all geographic regions, with exceptional performance from the end-sourcing solutions business.

- Timing of large model shipments in China and stable demand and pricing for small research models in North America and Europe contributed to growth.

- Services businesses, particularly in-sourcing solutions, drove growth, with CRADL operations expanding and generating client interest.

- RMS operating margin increased by 150 basis points to 26.4%, primarily due to leverage from higher revenue growth in China.

James Foster says,

Enhanced Centers of Excellence

- The company now has three centers of excellence in gene-modified cell therapy manufacturing, viral vector manufacturing, and plasmids.

- This change from the acquired companies is aimed at improving the overall operations and expertise.

Improved Staffing and Books of Business

- The company has upgraded staffing across the board, including sales, regulatory, and general management.

- There is an improvement in the books of business in all three areas of focus.

- However, the time frame for generating new business may vary across these areas.

Transition to Commercial Domain

- The company is in discussions with a few clients to move into a commercial domain in the cell therapy manufacturing business.

- It may take some time for the market to acknowledge the company’s presence and take their products and services seriously.

Confidence in Higher Growth Rates

- Despite a challenging year of retooling, the company is confident in achieving higher growth rates this year.

- Meaningful improvement is expected compared to the previous year.

Hopes for Top Line Growth and Margin Improvement

- The company has high hopes for significant top line growth, which would benefit both manufacturing and overall company performance.

- Improvements in margins are anticipated as the scale of operations improves.

Q & A sessions,

Backlog and Slippage

- Clients booked studies far in advance due to concerns about getting slots

- Current backlog is around thirteen months, with a reduction in slippage expected

- Studies are expected to be booked closer to when they start

Business Performance

- First half of the year was strong, but second half may be less strong

- Demand for studies is solid, with a strong competitive situation

- Testing for biologics is expected to improve in the back half of the year

- CDMO business is improving on both the top and bottom line

Pricing and Volume

- Price will continue to be an important factor given the complexity of the work

- Capacity is expected to be tight, with a busy worldwide basis

- Access to capital and IPO markets will impact cash flow

New Modalities and Franchises

- The microbial business is strong, with potential for growth

- CDMO business is improving, while the biologics business is anticipated to improve in the second half of the year

- Cell and gene therapies are a focus, with multiple clients and commercial opportunities

Market Conditions and Client Base

- Market conditions are difficult to gauge due to different factors each cycle

- Clients are favoring the clinic over early discovery work

- Client base includes both small biotech companies and big pharma companies