Catalent, Inc.

CEO : Mr. Alessandro Maselli

Quarterly earnings growth(YoY,%)

| Period | Revenue | Operating Income | EPS | Release Date |

|---|---|---|---|---|

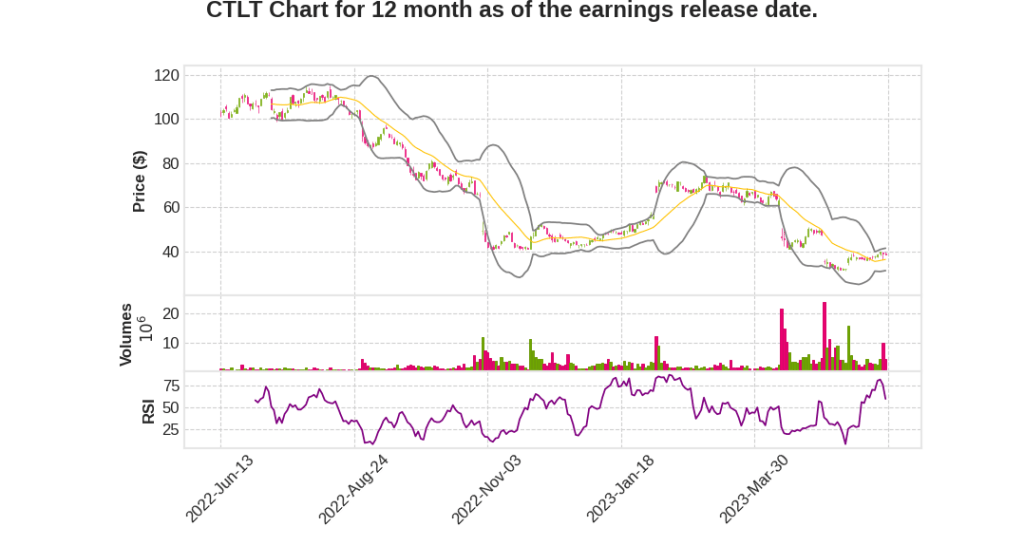

| 2023 Q3 | -18.5% YoY | -111.8% | -260.3% | 2023-06-12 |

Ricky Hopson says,

Net Revenue and EBITDA

- Net revenue in Q3 2023 was $1.04 billion, down 19% on a reported basis or a 17% decrease on a constant currency basis compared to Q3 2022.

- Organic revenue declined 19% measured in constant currency.

- Adjusted EBITDA decreased 69% to $105 million or 10.1% of net revenue compared to 26.6% in Q3 2022.

- Adjusted net income was negative $17 million or negative $0.09 per diluted share compared to adjusted net income of $188 million or $1.04 per diluted share in Q3 2022.

Biologics Segment Performance

- Q3 net revenue in the Biologics segment was $475 million, a decrease of 32% compared to Q3 2022.

- The decline is primarily driven by significantly lower year-on-year COVID demand.

- COVID revenue declined approximately 68% to $120 million in Q3.

- Long-term COVID take or pay agreements are now concluded, and COVID volumes will be tied to more standard ordering arrangements in fiscal 2024.

- Non-COVID growth in Biologics in Q3 was approximately 11% year-on-year.

- Segment’s EBITDA margin was 1.1%, compared to 31.1% in Q3 2022.

Pharma and Consumer Health Segment Performance

- Pharma and Consumer Health segment generated net revenue of $563 million, an increase of 1% compared to Q3 2022.

- The recently acquired Metrics business contributed 4 percentage points to the segment’s top line and 5 percentage points to adjusted EBITDA.

- Organic revenue decline in the lower single digits.

- Segment’s EBITDA margin was 22.3%, lower by roughly 290 basis points year-over-year.

Debt and Capital Allocation

- Debt load is well-structured and flexible.

- Net leverage ratio as of March 31, 2023, was 4.9x, an increase compared to December 31, 2022.

- Cash balance was approximately $300 million as of March 31, 2023.

- Positive cash generation and allocation of capital are top priorities, including reducing net leverage ratio, completion of essential CapEx projects, and reducing cost base.

Financial Outlook for Fiscal 2023

- Net revenue expected in a range of $4.225 billion up to $4.325 billion.

- Adjusted EBITDA expected in a range of $700 million up to $750 million.

- Adjusted net income expected in a range of $169 million up to $210 million.

- Tax rate remains 27% to 29% for the full year.

Alessandro Maselli says,

Q3 Financial Results

- Recorded accounting adjustments in Q3 at Bloomington, including raw material write-offs and an increase to the inventory reserve of $55 million.

- Corrected a $26 million revenue recognition error related to the fourth quarter of fiscal 2022.

- Finalized accounting for a goodwill impairment of $210 million for the Consumer Health business.

- Reviewed significant items in accounting for Q1 and Q2 of fiscal 2023 and confirmed soundness of debt accounting.

- Delayed completion of Q3 Form 10-Q and amendment to the annual report on Form 10-K due to the accounting adjustments and revenue recognition error.

Operational Updates

- Productivity improvements seen in Bloomington and Brussels, but more work and time needed to return to previous margin levels.

- Implemented organizational changes in Bloomington to regain efficiencies and focus on supervisory and management levels.

- Resolved operational challenges at BWI and currently seeing strong operational performance at the site.

- Expect lower gene therapy revenues in Q4 compared to Q3 due to lower utilization rate and work needed to restore previous operational levels.

- Margin issues in Biologics segment due to low absorption and utilization of new modalities, creating an impact on the EBITDA margin.

Updated Guidance

- Expect both revenue and EBITDA increases sequentially from Q3 in the PCA segment, but not as strongly as previously expected.

- More rigorous forecasting and delays in fulfilling demand contribute to lower expectations in the PCH segment.

- Cost reduction plan in place to drive margins aligned to historic levels, with a goal of doubling previous commitment of $75 million to $85 million of annualized run rate savings.

- Limiting new CapEx and actively evaluating current portfolio for sustainable, profitable growth.

Investor Concerns

- Disclosed nine different inspections over the last six months, confident in addressing all observations with corrective and preventive actions.

Note: Please note that this summary is based on a hypothetical speech and does not reflect the actual content of the earnings call transcript. The summary is for demonstration purposes only.

Q & A sessions,

Productivity and Operational Progress

- CTLT is focused on regaining productivity at locations that have been disrupted due to remediation efforts and portfolio shifts.

- They have made progress in improving operational efficiency and expect continued improvement over the next period.

- CTLT is working on delivering uptime on production lines to enhance productivity.

Aligning Headcount and Cost Structure

- CTLT is aligning headcount with the new mix of products and services, but they are doing so thoughtfully and responsibly to avoid potential turmoil.

- They are working to ensure the business stays in control, which may delay full margin recovery.

- The goal is to address additional sites and assets added for pursuing new modalities without affecting the margin of the segment.

Revenue Expectations for New Modalities

- CTLT acknowledges that the ramp-up for new modalities, such as cell therapies and plasmid, may be slower than initially expected.

- They are aligning their cost structure and investment to match the new revenue outlook for these assets.

- The focus is on bringing these assets into good order in the short term without negatively impacting the margin of the segment.

Capacity and Demand

- CTLT’s capacity, including planned CapEx investments, is estimated to be capable of delivering $6.5 billion in revenue.

- There are areas of the business where capacity needs to be accelerated to meet high demand, such as in syringe fill/finish and Zydis offering.

- CTLT is investing in capacity expansion in these areas to optimize return on capital.

Challenges with COVID-19 Response

- CTLT highlights the unique challenges they faced in responding to the COVID-19 pandemic, especially with the production of COVID vaccines.

- The product mix, transitioning between different products, and the rapid demand fluctuations presented significant complexities.

- Retraining, changing over production lines, and technical work were required to adapt to the changing demands.