DuPont de Nemours, Inc.

CEO : Mr. Edward D. Breen

Quarterly earnings growth(YoY,%)

| Period | Revenue | Operating Income | EPS | Release Date |

|---|---|---|---|---|

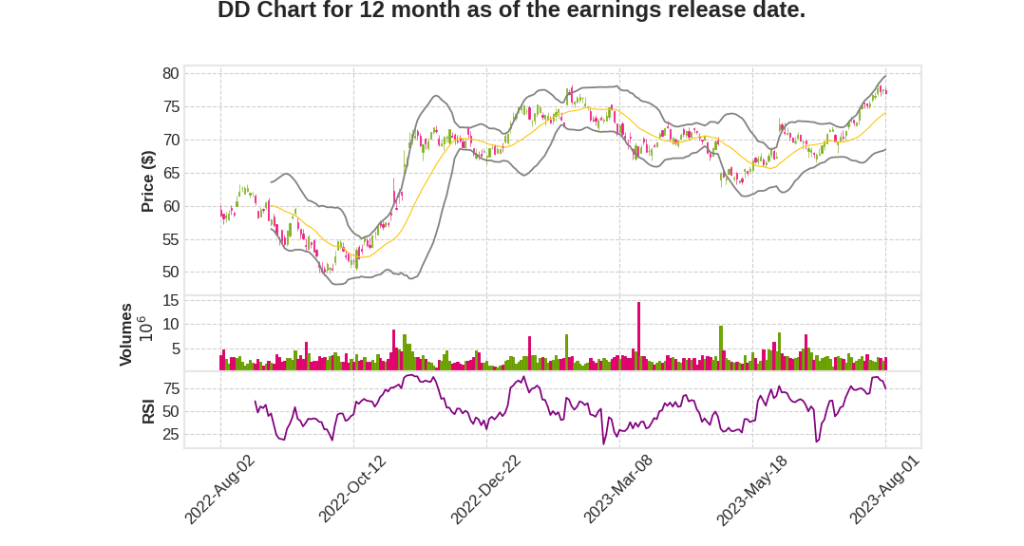

| 2023 Q2 | -6.9% YoY | -163.0% | -140.3% | 2023-08-02 |

Lori Koch says,

Net Sales and Organic Growth

- Second quarter net sales of $3.1 billion decreased 7% as reported and 4% on an organic basis versus the year ago period.

- Breaking down the 4% organic sales decline, a 6% volume decline was partially offset by a 2% pricing gain.

- Volume decline primarily reflects continued demand weakness in consumer electronics and some softness in North American construction related markets.

Regional Sales Performance

- Europe sales in the quarter were up 4% on an organic basis, while North America and Asia Pacific were down 3% and 8%, respectively versus the year ago period.

- China sales were down 14% on an organic basis, driven mainly by the electronics demand weakness, but increased sequentially versus the first quarter.

Operating EBITDA and Margins

- Second quarter operating EBITDA of $738 million decreased 11% versus the year ago period.

- Operating EBITDA margin during the quarter of 23.9% was down 110 basis points versus the year ago period.

- Decremental margins for the quarter was 40%, excluding the impact of absorption headwinds related to reduced production rates within electronics, decremental margin was below 20%.

Cash Flow and Free Cash Flow

- Cash flow from operations during the quarter of $400 million less CapEx of $123 million resulted in adjusted free cash flow of $277 million and associated conversion of 73%.

- Adjusted free cash flow included a benefit of about $80 million in reduced inventory and a headwind of about $200 million related to interest payments.

Adjusted EPS and Tax Rate

- Adjusted EPS in the quarter of $0.85 per share was down 3% versus last year.

- Higher tax rate during the quarter resulted in adjusted EPS headwind of $0.08 per share.

Guidance for Q3 2023 and Full Year 2023

- Expect mid-single-digit sequential growth in Interconnect Solutions business in the third quarter.

- Expect net sales to be between $12.45 billion and $12.55 billion, operating EBITDA to be between $2.975 billion and $3.025 billion, and adjusted EPS to be between $3.40 and $3.50 per share for full year 2023.

- For the third quarter 2023, expect revenue of approximately $3.15 billion, operating EBITDA of approximately $755 million, and adjusted EPS of approximately $0.84 per share.

Ed Breen says,

Strong Execution and Revenue Performance

- Second quarter revenue and operating EBITDA exceeded previously communicated guidance.

- Organic revenue declined 4% compared to the year ago period, mainly due to declines in Interconnect Solutions and Semiconductor lines of business within E&I.

- Industrial end markets, including water, automotive, aerospace, and healthcare, showed broad demand strength.

Strategic Acquisition of Spectrum

- Completed the acquisition of Spectrum, a leader in critical specialty devices for healthcare end markets.

- Spectrum fits nicely with existing Liveo franchise, increasing total revenue in healthcare markets to about 10% of the portfolio.

- Spectrum’s performance aligns with deal model estimates, including an estimated operating EBITDA margin of approximately 22%.

- Expect to leverage growth opportunities through cross-selling, complementary accounts, new product development, and partnerships with OEMs.

Progress on M&A and Share Repurchases

- Making progress with the divestiture of Delrin business, expected to close by year-end 2023.

- Expect to complete the $3.25 billion accelerated share repurchase transaction within a month, followed by a new $2 billion ASR.

Water District Settlement and Capital Allocation

- Announced a comprehensive settlement for PFAS-related claims of public water systems, with the company’s portion being about $400 million.

- Expect final approval of the settlement about six months following preliminary approval.

- Deployment of excess cash from the M&M divestiture is completed with the Spectrum deal and the new $2 billion ASR.

- Comfortable with net leverage point around 2x as an equilibrium target going forward.

Growth Drivers and Innovation

- Visible growth drivers enabled by technical innovation teams and application engineers.

- Expect strong growth in the semiconductor industry with investment in new fabs and significant technology support from the emerging generative AI revolution.

- Driving growth in desalination and water markets to help customers achieve sustainability goals.

- Auto adhesives business well-positioned to capture growth with product offerings in electric vehicles.

Q & A sessions,

ICS segment

- ICS segment started to decline and destocking started in the middle of 2022

- 7% sequential pickup in the first quarter

- Mid-single-digit pickup expected in the third quarter

- Inflection point expected in the fourth quarter

- Bottom seen in the second quarter for the semi 1 segment

Procurement and raw materials

- Procurement team has been working aggressively to secure raw materials

- Effects of raw material shortages expected to be seen in 2024

- Absorption charge affecting E&I margins in the second quarter

- Similar charge expected in the third and fourth quarter

- Margins in E&I expected to be north of 30% without absorption charge

Sundry and discretionary spend

- Sundry includes interest income and gains on asset sales

- Not primarily related to operating investment

- Aggressive control on discretionary spend to minimize decrementals

- Decrementals in the mid-20s when excluding absorption headwinds

- Reduction in headcount primarily in G&A space through restructuring

- Reductions to annual discretionary consultations and bonuses