Dow Inc.

CEO : Mr. James R. Fitterling

Quarterly earnings growth(YoY,%)

| Period | Revenue | Operating Income | EPS | Release Date |

|---|---|---|---|---|

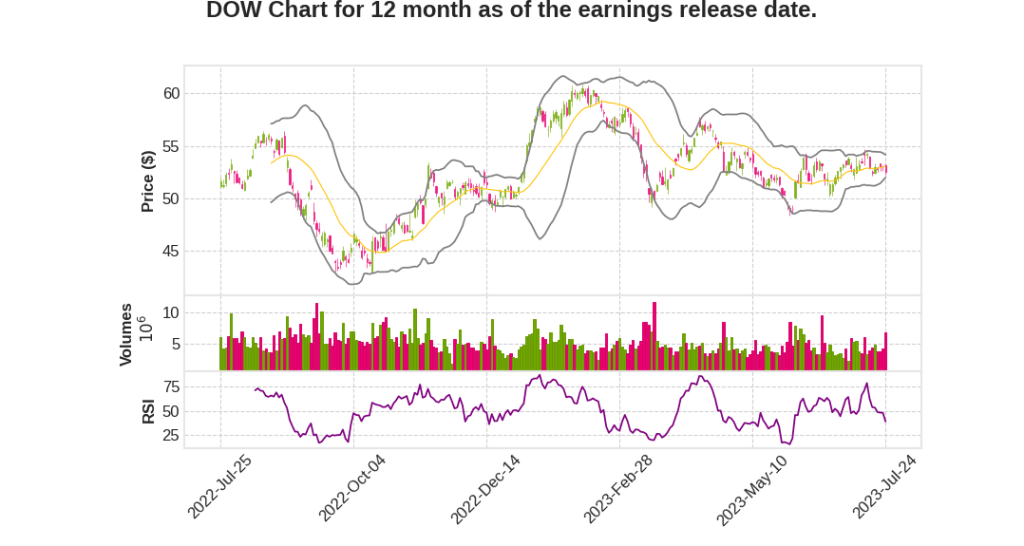

| 2023 Q2 | -27.1% YoY | -69.5% | -70.2% | 2023-07-25 |

Howard Ungerleider says,

Macroeconomic Environment

- Expect a challenging macroeconomic environment in Q3

- Inflation starting to moderate

- Slowdown of industrial economic activity globally

- US industrial activity remains weak, but consumer demand resilient

- Recessionary conditions persist in Europe

- China’s economic rebound has yet to fully materialize

Outlook for Q3

- Packaging and Specialty Plastics segment: Lower average prices and increased feedstock costs expected

- Industrial Intermediates and Infrastructure segment: Continued demand pressure in consumer durable end markets

- Performance Materials and Coatings segment: Price pressure in siloxanes and below normal seasonal demand

- Earnings expected to be down approximately $150 million sequentially

Financial and Operational Discipline

- On track to deliver $1 billion of cost savings in 2023

- Global workforce reduction program ongoing

- $300 million reduction in planned maintenance turnaround spending on track

- Continuing to execute actions to rationalize select higher cost, lower return assets

- Lowered cash commitments by approximately $1 billion since spin

- Annual net interest expense expected to be down more than 40% versus 2019

- No substantive debt maturities due until 2027

Jim Fitterling says,

Net Sales

- Net sales were $11.4 billion, down 27% year-over-year

- Sales were down 4% sequentially

- Volume decreased 8% year-over-year

- Volume increased 1% sequentially

- Local price decreased 18% year-over-year

- Local price decreased 5% sequentially

Operating EBIT

- Operating EBIT for the quarter was $885 million, down from $2.4 billion in the year ago period

- Operating EBIT increased $177 million sequentially

- In the Packaging and Specialty Plastics segment, operating EBIT was $918 million compared to $1.4 billion in the year ago period

- In the Industrial Intermediates and Infrastructure segment, operating EBIT was a loss of $35 million, compared to earnings of $426 million in the year ago period

- In the Performance Materials and Coatings segment, operating EBIT was $66 million compared to $561 million in the year ago period

Cash Flow

- Generated cash flow from operations of more than $1.3 billion, up more than $800 million versus the prior quarter

- Trailing 12-month cash flow conversion is 98%

Capital Allocation

- Returned $743 million to shareholders through dividends and share repurchases in the quarter

- Returned nearly $1.4 billion year to date

Outlook

- Challenging macroeconomic environment with slow global growth

- Continuing to implement proactive and targeted cost savings actions

- Strong financial position gives flexibility to advance long-term strategic priorities

Q & A sessions,

Decarbonizing Growth Strategy and Sustainability

- Expected increase in underlying earnings by $3 billion annually

- Target of reducing greenhouse gas emissions by 30% by 2030

- FCDH unit fully operational, ramping up rates, and reducing energy usage and emissions

- Submission of construction permit application for small modular nuclear energy facility

- Capital efficient approach to scale production of recycled and bio based products

- Expected commercialization of 3 million metric tons per year of circular and renewable solutions by 2030

Path to Zero Project

- Creation of world’s first net zero CO2 emissions ethylene and derivatives complex

- Decarbonization of 20% of global ethylene capacity and expansion of polyethylene supply

- Projected construction to begin in 2024 and start-up in two phases

- Expected average annual CapEx of $1 billion on the project

- Anticipated delivery of $1 billion EBITDA annually and targeted returns on invested capital above 13% over the economic cycle

Financial Highlights

- Raised underlying earnings above pre-pandemic levels

- Substantial improvement in three-year cumulative free cash flow

- Reduction of net debt and pension liabilities by more than $10 billion

- Delivered around 84% of net income back to shareholders since spin

- Financial flexibility and operating discipline to navigate short-term market dynamics

Market Dynamics and Pricing

- Strong volume increases in packaging, especially plastics, across all regions

- Price headwind due to softer pricing in June, but expecting lower pricing in July

- Improvement in integrated margins in North America and expected improvement in Europe

- Dynamic feedstock costs and potential changes in ethane availability

- Strong exports to China and ability to supplement domestic supply

Global Economic Outlook and Volume Performance

- Global economic slowdown with decline in GDP expected in Q2, Q3, and Q4

- Volumes down 8% overall, with significant decline in Europe (-14%)

- Asia Pacific and Latin America volumes stronger, North America relatively flat

- Expectation of economic ramp back in 2024

- Polyethylene holding up well and cost advantage showing through results