DexCom, Inc.

CEO : Mr. Kevin Ronald Sayer

Quarterly earnings growth(YoY,%)

| Period | Revenue | Operating Income | EPS | Release Date |

|---|---|---|---|---|

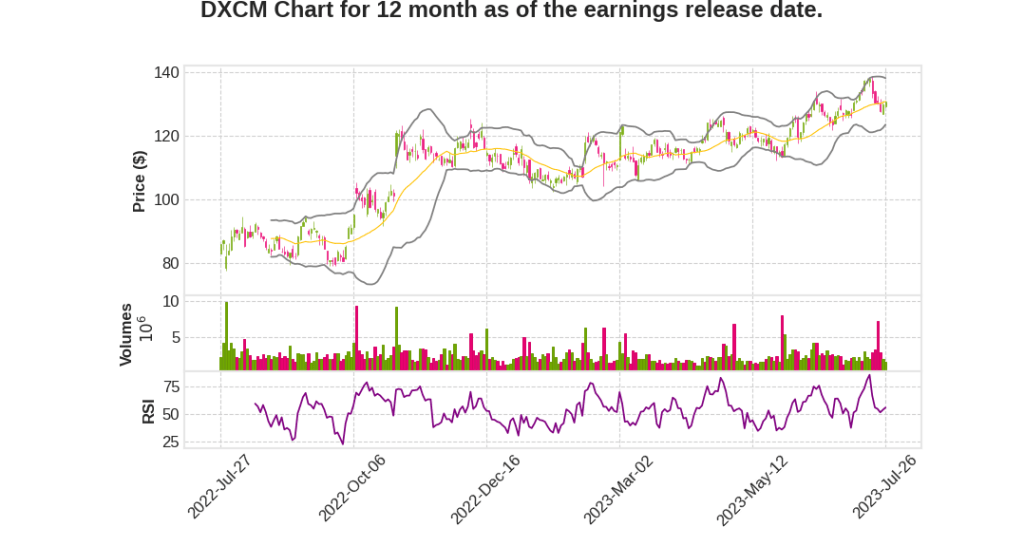

| 2023 Q2 | 25.2% YoY | 66.4% | 130.8% | 2023-07-27 |

Kevin Sayer says,

Q2 Organic Revenue Growth

- Q2 organic revenue growth of 26% compared to Q2 2022

G7 Launch and Positive Feedback

- G7 launch gaining momentum with positive feedback from customers and clinicians

- G7 offers improved ease of use, discrete form factor, faster warm-up time, and redesigned software platform

- Majority of G7 users are new to Dexcom

- 8,000 physicians in the US are now prescribing G7 who were previously not prescribing Dexcom

Reimbursement for G7

- All major PBMs now cover Dexcom G7, strengthening the position as the most covered CGM brand

- Majority of customers pay less than $20 per month out of pocket in the pharmacy channel

Expansion of Coverage for Basal Insulin Users

- CMS decision to expand Medicare coverage for people with type 2 diabetes using basal insulin only

- Commercial payers quickly followed suit with greater than 60% commercial coverage for the basal population

- Physicians prescribing Dexcom to basal patients for better outcomes

- Highest new patient quarter within the Medicare channel in Q2

International Expansion

- Share gains accelerated in Q2 with expansion into 6 new markets

- G7 launch in Canada and regulatory clearance received

- DexCom ONE rollout in Argentina marks initial entrance into Latin America

Evidence of Dexcom CGM’s Impact

- Studies demonstrate Dexcom CGM’s ability to drive greater health and economic outcomes

- Real-world study of adults with type 2 diabetes not using insulin showed a 40% increase in time in range and improvement in A1c levels

- High levels of engagement and utilization of Dexcom CGM in type 2 studies

Future Plans and Product Launch

- Increased LRP and plan to launch a product specifically for people not on insulin utilizing G7 hardware and custom software experience

- Expect to launch early next year with a 15-day wear time and cash pay option

- New product provides a glimpse into future plans to serve larger populations with tailored experiences

Jereme Sylvain says,

Revenue Growth

- Q2 2023 worldwide revenue was $871 million, representing a growth of 26% on an organic basis compared to Q2 2022.

- U.S revenue totaled $617 million, a growth of 21% compared to Q2 2022.

- International revenue grew 38%, totaling $255 million in Q2 2023.

New Customer Growth

- The company achieved another record new customer star quarter in Q2 with continued momentum in the U.S.

- The G7 launch and recently finalized CMS coverage provided a new tailwind to the Medicare business in the U.S.

International Expansion

- International organic revenue growth was 40% for the second quarter.

- The company has consistently taken market share across its footprint in recent quarters and gained international market share for the ninth straight quarter.

- In the U.K market, the company experienced acceleration in growth, posting one of the highest growth rates in recent years.

- The company expanded connectivity leadership in the U.K market as Insulet extended their launch of Omnipod 5, powered by the G6 system.

Gross Margin

- Q2 2023 gross profit was $553.5 million or 63.5% of revenue, slightly lower than Q2 2022.

- The decline in gross margin was expected as G7 production scaled up, but cost profile will gradually improve with increased production volumes.

- The Malaysia facility recently initiated commercial production, and similar dynamic is expected as production scales up in the near-term.

Guidance and Financial Position

- Full year 2022 revenue guidance is raised to a range of $3.50 billion to $3.55 billion, representing growth of 20% to 22% for the year.

- Non-GAAP gross margin guidance is 63%, representing the high-end of the previous guidance range.

- Non-GAAP operating margin is projected to be approximately 17% and adjusted EBITDA margin of 26.5% for fiscal year 2023.

- The company closed Q2 with over $3.6 billion of cash and cash equivalents, leaving them in a strong financial position.

Q & A sessions,

Revenue Growth and Market Share

- Q2 was the highest revenue quarter ever for the company

- Record new customer starts worldwide

- Gained market share in nearly every major reimbursed geography

G7 Launch and International Expansion

- G7 product launched in 13 international markets

- Built broad reimbursement in the U.S.

- G7 app had five flawless upgrades

Financial Performance

- Operating expense leverage of over 450 basis points

- Doubled earnings per share year-over-year

- Posted one of the largest free cash flow quarters in company’s history

Challenges and Opportunities in the Market

- Basal launch presents a big opportunity as it addresses the needs of a new patient group

- Challenges in document gathering and distribution for Medicare patients

- CJM adoption and awareness are more positive now compared to when the company initially launched

- Education and expansion into the primary care physician market are ongoing efforts

Guidance and Outlook

- Raised guidance due to strength in international markets and coverage/access wins in the U.S.

- Expectation of a good back half of the year with derisked base case

- No significant stocking, revenue growth driven by patient growth and market share gains