EQT Corporation

CEO : Mr. Toby Z. Rice

Quarterly earnings growth(YoY,%)

| Period | Revenue | Operating Income | EPS | Release Date |

|---|---|---|---|---|

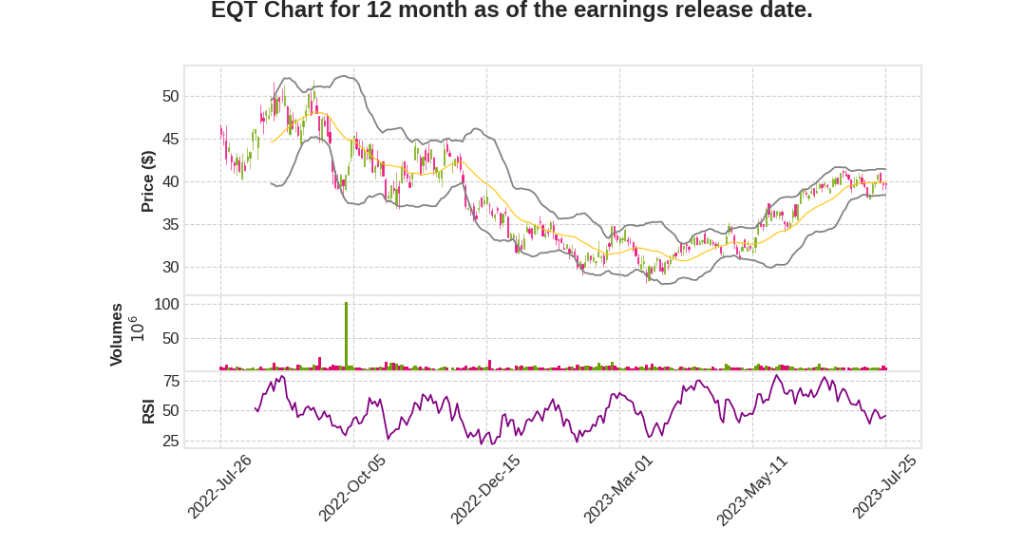

| 2023 Q2 | -74.7% YoY | -102.6% | -107.5% | 2023-07-26 |

Jeremy Knop says,

Financial Strategy

- The new CFO emphasizes the company’s focus on maintaining a strong balance sheet and executing a value-oriented shareholder return framework.

- Capital expenditures were in line with guidance at $470 million.

- Adjusted operating cash flow was $341 million, and free cash flow was negative $129 million.

- The company retired $800 million of debt during the quarter, bringing the total debt retired to over $1.9 billion since 2021.

Balance Sheet and Liquidity

- The company’s net leverage ratio decreased to 1.1x, down from 1.6x a year ago.

- Net debt at the end of the quarter was $3.5 billion, with $1.2 billion of cash on hand.

- Liquidity stood at $4.9 billion, including cash, availability under the credit facility, and a term loan for the pending Tug Hill acquisition.

Hedging

- The company realized $237 million of cash NYMEX hedge gains in the second quarter.

- For 2024, the company has hedged 30% of production with a weighted average floor price of $3.64 per MMBtu and a weighted average ceiling of $4.14 per MMBtu.

- The hedge position is tilted towards the first half of 2024 to mitigate potential downside risk.

Natural Gas Market

- Gas-directed activity cuts are expected to continue, with 35 gas rigs laid down in the second quarter.

- Lower oil-directed activity will likely result in associated gas growth underperforming, supporting natural gas prices in 2024 and 2025.

- Strong gas-fired power demand and LNG performance provide market support for natural gas prices.

Capital Allocation and Guidance

- The company reiterates its 2023 production outlook of 1,900 to 2,000 Bcfe and capital budget of $1.7 billion to $1.9 billion.

- Adjusted EBITDA for 2023 is expected to be approximately $2.8 billion, with free cash flow of around $900 million.

- The company will maintain a bias towards debt repayment and assess investment opportunities with strong risk-adjusted returns.

Toby Rice says,

New CFO Appointment

- Jeremy Knop has been appointed as the new Chief Financial Officer of EQT, bringing extensive experience in strategic decision-making, investment management, and M&A.

- His appointment is expected to drive value creation, strengthen the balance sheet, and ensure the realization of the company’s long-term vision.

Operational Performance

- EQT’s drilling team achieved record-breaking results, drilling 12,318 feet in 24 hours and 18,200 feet in 48 hours on the SGL 8H well in Green County.

- Recent benchmarking exercise shows EQT’s drilling speed is 60% faster than peers, resulting in average spud-to-TD days that are 20% less than nearby operators.

- Completions team set records by completing and drilling out 20,818 feet of lateral on the Michael 4H well, one of the longest completed laterals in US shale development.

Production and Financials

- Despite lower-than-expected volumes from downtime at the Shell ethane cracker and fewer non-operated TILs, EQT achieved the midpoint of second quarter production guidance.

- LOE (Lease Operating Expense) came in at $0.08 per Mcfe, contributing to EQT’s peer-leading LOE. West Virginia water system investment and increased water recycling also contributed to cost savings.

- $800 million of incremental debt was retired in the second quarter, bringing the total debt retired to $1.9 billion since late 2021.

LNG Opportunities

- EQT signed a Heads of Agreement with Lake Charles LNG, securing a 15-year tolling agreement to supply 1 million-ton per annum (135 million cubic feet per day) to international markets.

- The company aims to pursue more integrated deals with direct connectivity to end users of its gas, providing downside price protection and visibility into global downstream markets.

ESG Progress

- EQT received multiple accolades for its ESG leadership, including achieving the UN’s OGMP 2.0 gold standard and receiving an A grade rating for methane intensity.

- Emissions reduction initiatives resulted in a 20% decrease in Scope 1 and 2 GHG emissions compared to the previous year, with further reductions expected from pneumatic device replacement.

- The company is preparing nature-based projects to generate carbon offsets and aims to become the first energy company of its scale to achieve a verifiable net zero Scope 1 and 2 emissions.

MVP Completion and Tug Hill Acquisition

- The completion of the Mountain Valley Pipeline (MVP) is seen as imperative to address electricity affordability and climate goals in the Southeastern United States.

- While there is timing uncertainty due to a recent stay from the Fourth Circuit Court, MVP is expected to enter service by the first half of 2024.

- The completion of MVP is expected to bring better price realizations, enhance the value for EQT, and lower energy prices for consumers in the Southeast.

- The pending Tug Hill acquisition is expected to close in Q3 and bring low-risk, high-quality assets that will offset existing acreage and contribute to corporate free cash flow breakeven improvement.

Q & A sessions,

EQT’s Operational Execution

- Operational execution has been strong in Q2 2023, setting multiple internal and world records.

Value-oriented Capital Returns Framework

- $800 million of debt was retired in Q2, bringing the cumulative debt retirement to over $1.9 billion since late 2021.

LNG Strategy

- An HOA for tolling capacity at Lake Charles represents a step towards diversifying production into international markets and mitigating downside risk.

2024 Hedge Position

- EQT strategically added to its 2024 hedge position to accelerate debt retirement goals and provide maximum upside exposure to gas prices in late 2024, 2025, and beyond.

ESG Performance

- EQT’s 2022 ESG report highlights a 20% year-over-year decline in greenhouse gas emissions, bringing the company closer to its ambitious 2025 net zero emissions goal.

2024 Outlook

- Activity levels in 2024 are expected to be slightly lower compared to 2023 due to catch-up activity in the previous year.

- Focus will be on reducing service cost inflation and benefiting from Tug Hill’s cost structure and step-down in gathering rates.

MACH3 Science Campaign

- The operational execution of the MACH3 science campaign has been completed, and the company is currently in monitoring mode for its impact.

- Best practices and tighter controls have been incorporated into EQT’s well design program based on the campaign’s results.

Hedging Strategy

- EQT has leaned more into swaps for near-term hedging to derisk debt repayment goals.

- The options and future strip market for 2025 is not reflective of the expected market tightness, so the company is remaining patient in hedging for that period.

- Market participants and analysts anticipate increased tightness in the market for winter 2024, 2025, which may lead to a more asymmetric market next summer.