Evergy, Inc.

CEO : Mr. David A. Campbell

Quarterly earnings growth(YoY,%)

| Period | Revenue | Operating Income | EPS | Release Date |

|---|---|---|---|---|

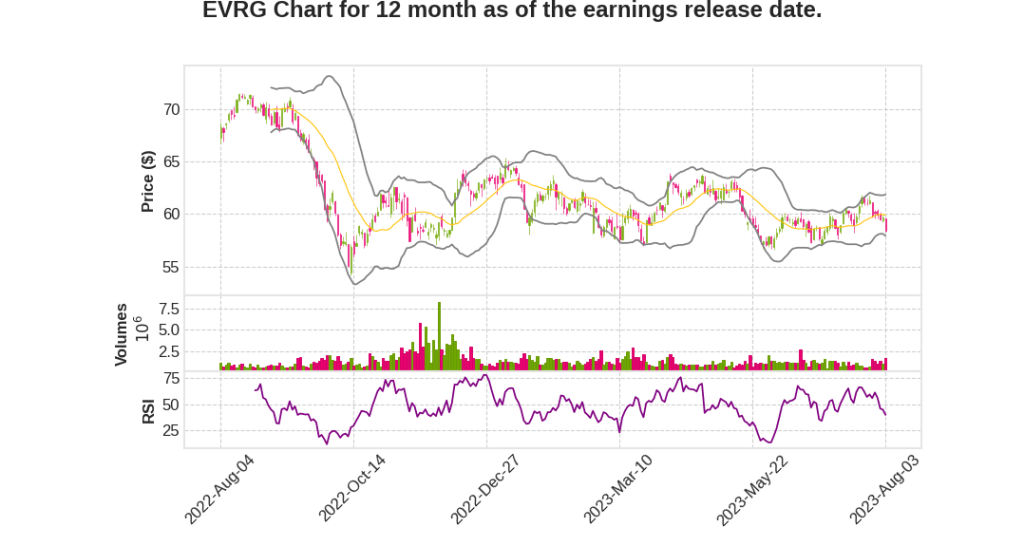

| 2023 Q2 | -6.4% YoY | 0.3% | -8.2% | 2023-08-04 |

David Campbell says,

Second Quarter Earnings

- Adjusted earnings per share for Q2 2023 were $0.81, compared to $0.84 per share in the same period last year.

- The decrease in earnings was primarily due to less favorable weather, higher depreciation and amortization interest expense, partially offset by growth in weather normalized sales, transmission margin, and lower O&M expenses.

Severe Storm Impact

- A severe storm on July 14 caused significant damage to Evergy’s service territory, resulting in nearly 200,000 customers without power and damage to 500 power poles.

- The estimated O&M costs for storm recovery efforts are $6.5 million.

Guidance and Long-term Growth

- Evergy reaffirms its 2023 adjusted EPS guidance range of $3.55 to $3.75 per share.

- The company also maintains its target long-term annual adjusted EPS growth of 6% to 8% from 2021 to 2025.

Integrated Resource Plan Updates

- Evergy plans to add over 3,000 megawatts of new wind and solar resources in the next 10 years, taking advantage of federal subsidies and the region’s resource potential.

- Due to global supply chain challenges, the timing of these additions may be affected.

- The preferred plan includes introducing hydrogen-capable combined cycle gas turbines in the latter half of the decade and ceasing all coal operations in Lawrence units 4 and 5 by 2028.

Regulatory and Legislative Priorities

- In Kansas, Evergy is awaiting intervenor testimony and is involved in pending rate cases.

- In Missouri, the securitization of extraordinary costs from Winter Storm Uri is in the state appeal process, with oral arguments scheduled for September 7.

Strategy Focus

- Affordability: Evergy aims to improve regional rate competitiveness and keep rate trajectory below the rate of inflation.

- Reliability: The company emphasizes resiliency and ongoing investments in transmission and distribution infrastructure.

- Sustainability: Evergy continues to transition its generation fleet, reducing carbon emissions and advancing the responsible energy transition in the region.

Kirkland Andrews says,

Earnings Results for Q2 2023

- Evergy reported adjusted earnings of $186.1 million or $0.81 per share for Q2 2023

- This is compared to $194.5 million or $0.84 per share in Q2 2022

- The year-over-year decrease in adjusted EPS was driven by factors such as a decrease in cooling degree days, weather-normalized demand growth, transmission margins, adjusted O&M, higher depreciation and amortization, interest expense, and other items

Year-to-Date Results

- Adjusted earnings for the first 6 months of 2023 were $322 million or $1.40 per share

- This is compared to $324 million or $1.41 per share for the same period last year

- The year-to-date EPS drivers include factors such as weather conditions, weather-normalized demand growth, transmission margins, decreased O&M, higher depreciation expense, interest expense, and other items

Sales Trends

- Weather-normalized retail sales increased 1.1% in Q2 2023 compared to last year

- This was primarily driven by increases in residential and commercial usage

- Year-to-date weather-normalized demand is up by approximately 1.6%

- Lower industrial demand is primarily driven by 2 refining customers, excluding which, remaining industrial weather-normalized demand would have increased

- Demand growth is supported by a strong local labor market with low unemployment rates in Kansas and Kansas City Metro area

Long-Term Financial Expectations

- Evergy reaffirms its adjusted EPS guidance range of $3.55 to $3.75 for 2023

- The long-term compounded annual EPS growth rate target is 6% to 8% from 2021 to 2025

- The company plans to address its outlook for earnings growth beyond 2025 on its year-end call in February

- A $11.6 billion 5-year capital plan through 2027 is focused on new infrastructure investment to improve customer service, enhance reliability and resiliency, and meet the evolving needs of customers and communities

Q & A sessions,

Capital Investment Plan

- The overall capital investment plan for 2023-2027 is in line with the updates made in the last quarter.

- The Integrated Resource Plan includes a higher overall total level of resource additions, but there are some phasing shifts due to supply chain constraints and product availability and costs.

- There will be an uptick in capital expenditures over the 10-year timeframe, with significant resource additions planned for the latter part of the capital plan.

Rate Case

- The rate case process is ongoing, with rigorous back and forth and questions being addressed.

- The first round of testimonies will be filed on August 29, providing more insight into the case.

- The rate case primarily focuses on infrastructure investments and cost savings achieved through the merger.

- The company aims to work constructively with all parties and seek a settlement.

Transmission Grid and Future Plans

- The Southwest Power Pool (SPP) has the grid of the future and the long-term transmission plan on its agenda.

- Tranches 1, 2, and 3, similar to those in MISO, are not yet seen in SPP, but it is on their strategic agenda.

- The company advocates for advancing the transmission grid to prepare for the evolving federal EPA rules and changes in the resource plan.

Demand Growth

- The integrated resource plan includes a low, medium, and high demand case, with a mid-range expectation of 0.5% rate of growth.

- Structural factors such as electrification, onshoring, and proliferation of data centers could lead to higher demand growth in the long term.

- The long-term fundamentals for resource planning and demand are strong, especially in the latter part of this decade and the 2030s.

Cost Management and Affordability

- The company manages its business dynamically to offset factors outside of its control, such as weather variations.

- Proud of the team’s cost management efforts and the ongoing cost savings as part of the plan.

- Affordability is supported by spreading costs across a larger demand base, especially with projected demand growth.

Time Use Rates

- The transition to time use rates for all customers in Missouri is being implemented as part of the commission’s order.

- The company emphasizes high communication and offers several options for customers to understand and select the best plan for them.

- Implementation is scheduled for the fall, outside the hot weather season, to facilitate customer understanding and transition.