FactSet Research Systems Inc.

CEO : Mr. Frederick Philip Snow

Quarterly earnings growth(YoY,%)

| Period | Revenue | Operating Income | EPS | Release Date |

|---|---|---|---|---|

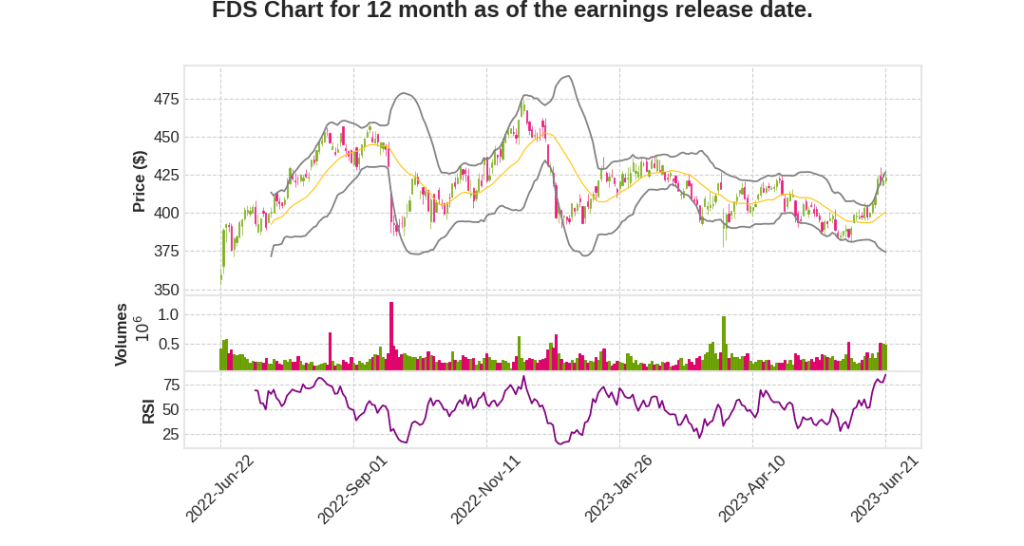

| 2023 Q3 | 8.4% YoY | 17.5% | 78.2% | 2023-06-22 |

Phil Snow says,

Organic ASV and Professional Services Growth

- Organic ASV plus professional services grew 8% year-over-year.

- Double-digit ASV growth in analytics, driven by asset managers, asset owners, and hedge funds.

- Successful execution of international price increase.

- Headwinds in workstation growth among wealth, banking, and corporate clients.

- Deceleration in expansion among partners.

Growth Across Firm Types

- Broad-based growth across all firm types.

- Double-digit ASV growth from wealth management, banking, hedge fund, corporate, and private equity and venture capital clients.

- Strength in middle office with portfolio reporting, fixed income, performance, and risk solutions.

- Double-digit ASV growth in Content & Technology Solutions with demand for company data and data management solutions.

- Opportunities to capture additional desktops in banking and wealth with research management solutions.

Financial Performance

- Adjusted diluted EPS of $3.79.

- Adjusted operating margin of 36%.

Expense Management and Workforce Reduction

- Focused on operational efficiencies and disciplined expense management.

- Working to reduce the run-rate of expense base by about 3%.

- Expecting a decrease of about 3% in workforce.

- Reducing real estate costs.

Market Conditions and Client Decision-Making

- Modest deceleration in ASV growth.

- Clients remain cautious and executing their own downturn playbooks.

- Delayed decisions and restricted spending.

- Staffing adjustments with firms reducing headcount, targeting mid and senior level professionals.

- Pipeline is stronger than last year, but client decision-making is taking longer.

Reaffirmed Guidance and Reorganization

- Reaffirming guidance for organic ASV growth and revenue, but guiding to the lower end of ranges.

- Increasing guidance for adjusted operating margin and adjusted diluted EPS.

- Reorganizing by firm type to better align operations with clients.

- Buy-side organization focusing on asset managers, asset owners, and hedge fund workflows.

- Dealmakers in wealth focusing on banking and sell-side research, wealth management, corporate, private equity, and venture capital workflows.

- Combining Content and Content & Technology Solutions to create one data solutions organization.

Investments in Generative AI and Content Automation

- Investing in generative AI technology to drive next-generation workflow solutions.

- Using generative AI to improve client support, automate content collection, and transform products.

- Testing AI-powered agent assist tools for FactSet proprietary codes.

- Opportunities to accelerate content automation using generative AI.

- Focusing on content and increasing investment in real-time and deep sector data.

Regional Performance

- Americas’ organic ASV growth accelerated to 8% with wins in asset managers and asset owners.

- EMEA delivered the biggest contribution to growth with organic ASV growth of 7.4%.

- Asia-Pacific had organic ASV growth of 10.5% driven by wealth management, hedge funds, and private equity and venture capital clients.

Helen Shan says,

Market Softening and Reduced Guidance

- End markets began to soften, leading to a reduction in guidance of $15 million in the last call.

- Banking sector experienced a slowdown, particularly in middle-market firms and universal banks.

- Client decisions made in Q1 or early spring of the calendar year are reflecting in this quarter, resulting in a net reduction.

Timing and Budget Constraints

- Client reviews are taking longer with more authorization on spend.

- More deals moved from Q3 to Q4 and early FY ’24 due to budget constraints and lack of IT resources.

- Clients are looking for help with their non-core activities, providing momentum for managed services and data management solutions.

Reduced Spend and Hiring

- The number of six-figure expansion and new logo wins in Q3 remained the same as the previous year, but the average size was 4% lower.

- Expansion through hiring has slowed down.

- While new business is impacted, the number of deals falling out remains consistent.

- Middle-office solutions with performance and risk have shown strength.

Overall, the market softening and reduced guidance, along with timing and budget constraints, are expected to have a significant impact on the stock’s movement. The reduced spend and hiring may also affect the company’s financial performance. However, there are positive signs of diversification in banking spend and strong client interactions in terms of value discussions and the pipeline.

Q & A sessions,

Optimism about the future

- Resolving the debt ceiling uncertainty

- Evolving product mix to take advantage of generative AI

- Investments in deep sector and private markets to help with retention and expansion

The value of FactSet’s data and content refinery

- Decades of data and clean stitching of data

- Creating data solutions and re-architecting data collection

- Focus on creating wow factor for clients, improving content collection, and supporting clients

Balance between data from third parties and self-reliance

- Collecting data ourselves and the value in that

- Potential opportunity to collect data historically relied on third parties

- Third parties needing to pipe their data through platforms like FactSet

Positive outlook for the buy side business

- Growth in institutional asset management, asset owners, and hedge funds

- Best-in-class middle-office solutions and improvements in front-office experience

- Increase in users for every firm type

Potential for acquisitions and focus on wealth and private markets

- Feeling well-poised for potential acquisitions

- Interest in wealth and private markets as areas that make sense for FactSet

- Focusing on timing and price that makes sense for the company

Reorganization and de-prioritization of product lines

- Realigning by firm type and workflow

- Combining content and CTS teams

- De-prioritizing some product lines and evaluating roles