First Solar, Inc.

CEO : Mr. Mark R. Widmar

Quarterly earnings growth(YoY,%)

| Period | Revenue | Operating Income | EPS | Release Date |

|---|---|---|---|---|

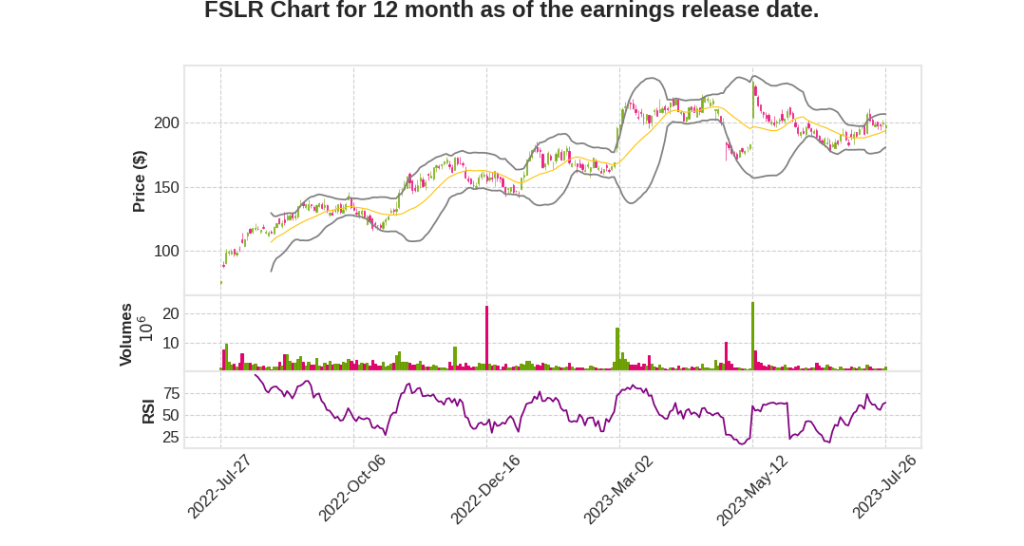

| 2023 Q2 | 30.6% YoY | 16.4% | 207.7% | 2023-07-27 |

Mark Widmar says,

Key Highlights from Q2 2023 Earnings Call:

- Continued strength in commercial, operational, and financial foundations

- Ramped up production and delivery of next-generation Series 7 modules

- Acquisition of Evolar to accelerate development of next-generation PV technology

- Investment of up to $1.1 billion in building a new manufacturing facility in the US

- Expected manufacturing footprint growth to 14 gigawatts in the US and 25 gigawatts globally by 2026

- Net bookings of 8.9 gigawatts in Q2, bringing year-to-date net bookings to 21.1 gigawatts

- Total backlog of future bookings at 78.3 gigawatts, including 48.5 gigawatts of mid- to late-stage opportunities

- Produced 2.4 gigawatts of Series 6 modules in Q2 with a manufacturing yield of 98%

- Q2 sales of 215 megawatts of Series 7 modules

- Announcement of limited production run of bifacial module panels

- Construction of Indian factory complete, expected to begin production by end of August 2023

- Expansion and upgrade of Ohio Series 6 factory on track, additional capacity expected in 2024

- New Alabama facility on schedule for completion by end of 2024

- Announcement of fifth US manufacturing facility, location decision expected soon

- Investment of over $2.8 billion in capital investments into the US

- Appreciation for Biden administration’s guidance on IRA-related policies

- Awaiting Department of Commerce’s final determination on Chinese manufacturers investigation

- Engagement with EU’s path to energy self-sufficiency and Germany’s interest in solar manufacturing

Alex Bradley says,

Financial Results for Q2 2023

- Net sales in Q2 were $811 million, a $262 million increase compared to Q1.

- The increase in net sales was driven by strong market demand, higher volumes sold, next-generation Series 7 module sales, and an increase in module ASP.

- Gross margin was 38% in Q2, compared to 20% in Q1, primarily due to higher module ASPs, lower sales freight costs, and higher volumes sold.

- Ramp costs for the new Series 7 factory in Ohio were $29 million in Q2.

- SG&A and R&D expenses totaled $83 million in Q2, primarily due to additional investments in R&D and higher professional fees.

- Operating income was $169 million in Q2, including ramp costs, production start-up expense, and a litigation loss.

- Tax expense was $18 million in Q2, driven by higher pre-tax income and lower tax benefits associated with share-based compensation.

- Diluted earnings per share in Q2 were $1.59, compared to $0.40 in Q1.

Balance Sheet and Cash Flow

- Cash, cash equivalents, restricted cash, restricted cash equivalents, and marketable securities at the end of Q2 were $1.9 billion.

- Cash decreased due to capital expenditures, acquisition payments, and drawdown by the India credit facility.

- Cash deposits as deferred revenue totaled approximately $1.5 billion at the end of Q2, providing financial resources for expansion.

- Total debt at the end of Q2 was $437 million, an increase of $117 million from Q1.

- Net cash position decreased by approximately $0.5 billion to $1.5 billion.

- Cash flows used in operations were $89 million in Q2, primarily due to expansion-related activities.

- Capital expenditures were $383 million in Q2.

- A five-year revolving credit facility for $1 billion was secured during Q2.

Full Year 2023 Guidance

- Legacy systems business-related revenue and gross profit impact so far in 2023 was $20 million and $14 million, respectively.

- Module business expects a $40 million improvement in gross profit.

- Revenue and gross margin guidance ranges remain unchanged.

- Section 45X tax benefits forecast remains unchanged at $660 million to $710 million.

- Operating expenses guidance increased to $450 million to $475 million due to litigation losses.

- Operating income and earnings per share guidance remain unchanged.

- Expected earnings cadence: approximately 40% in Q3 and 60% in Q4.

- Capital expenditures forecast reduced to $1.7 billion to $1.9 billion.

- Expected $0.3 billion increase in year-end net cash balance to $1.5 billion to $1.8 billion.

Key Messages from the Earning Call

- Robust demand with 21.1 gigawatts of net bookings year-to-date and record contracted backlog of 77.8 gigawatts.

- India, Ohio, and Alabama expansions on schedule.

- Investing an additional $1.1 billion in a new U.S. factory expected to begin production in H1 2026.

- Investments in advanced technology and acquisition of Evolar expected to accelerate development of next-generation PV technology.

- Ended Q2 with $1.9 billion gross cash balance, $1.5 billion net of debt, and additional debt capacity of $1 billion.

- Maintaining revenue and EPS guidance, including forecasted full-year earnings per diluted share of $7 to $8.

Q & A sessions,

Supply for 2024-2025

- Using India for U.S. shipments to meet strong demand and restructure deals

- Ramping up Perrysburg Series 7 factory and pulling forward Ohio upgrades to create additional capacity

Bookings ASP

- Bookings average ASP was $0.293

- Including sales rates for half of the volume would increase ASP to the low 30s

- Over $300 million of conversions of existing volumes to deliver Series 7 and meet domestic content requirements

Domestic content rules

- Series 7 modules will be 100% compliant with all domestic content requirements

- First Solar is the best-positioned module to ensure the domestic content bonus

- Working closely with customers to ensure qualification for the bonus and provide cost-level information

Perovskites and new technologies

- Evolar’s capabilities in perovskites are complementary to First Solar’s capabilities in CIGS6

- Looking at tandem technology (cadmium telluride top cell, CIGS bottom cell) for higher-efficiency product

- Still early to determine when this technology can get to market

Impact of domestic content on agreements

- Existing agreements for 2023, 2024, and 2025 are not affected by callbacks or provisions

- New agreements have provisions for adjustments if domestic content requirements are not met

- No recovery or clawback from First Solar as long as requirements are met

Sourcing for Europe

- Currently not envisioning sourcing anything from the U.S. to Europe

- Intent is to support Europe out of international factories