Fortinet, Inc.

CEO : Mr. Ken Xie

Quarterly earnings growth(YoY,%)

| Period | Revenue | Operating Income | EPS | Release Date |

|---|---|---|---|---|

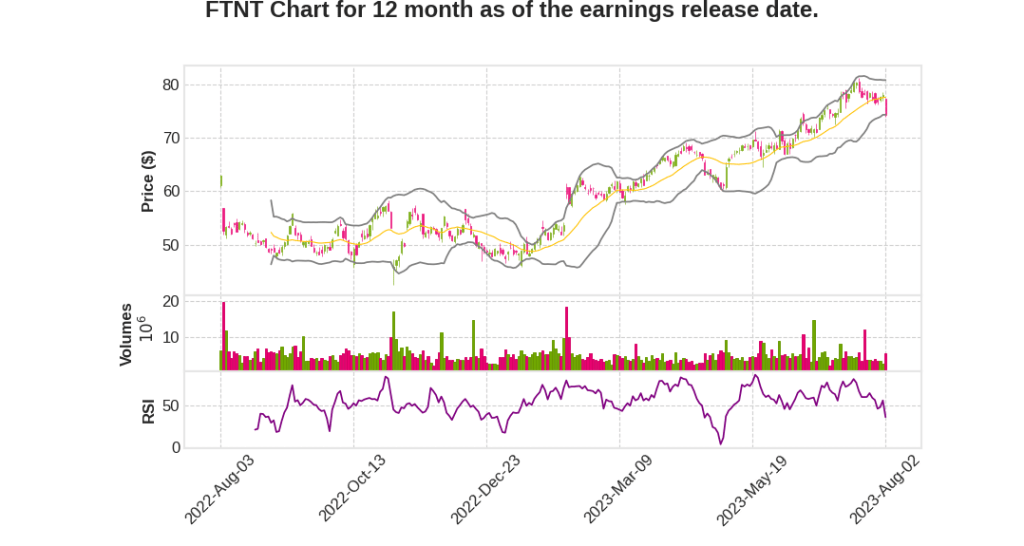

| 2023 Q2 | 25.5% YoY | 42.9% | 54.5% | 2023-08-03 |

Keith Jensen says,

Key Highlights from Q2 2023 Earning Call Transcript

- Billings growth of 18% and total revenue growth of 26%

- Product revenue growth of 18% and service revenue growth of 30%

- OT and SD-WAN revenue up 60% and 40% respectively

- Record 6,500 new logos added, indicating strength in small and midsized customer segments

- Operating margins of 26.9%, exceeding guidance range by 140 basis points

- Free cash flow of $438 million, representing a margin of 34%

- Non-FortiGate billings growth driven by networking FortiGate VM, NAC, and cloud

- Manufacturing and government were the top industry verticals in terms of billings

- International emerging GIOS led in billings growth

- Total revenue grew 26% to $1.29 billion, driven by non-FortiGate growth of over 45%

- Total gross margin of 77.9%, up 140 basis points

- Security subscriptions represent over 55% of service revenue

- Significant wins include deals with a global pharmaceutical leader, a large U.S. school district, and a large bank

- Investment and innovation in AI and machine learning technologies to enhance cybersecurity

Guidance for Q3 2023

- Billings in the range of $1,560 million to $1,620 million, representing 13% growth

- Revenue in the range of $1,315 million to $1,375 million, representing 17% growth

- Non-GAAP gross margin of 75.5% to 76.5%

- Non-GAAP operating margin of 24.5% to 25.5%

- Non-GAAP earnings per share of $0.35 to $0.37

Guidance for Full Year 2023

- Billings in the range of $6,490 million to $6,590 million, representing 17% growth

- Revenue in the range of $5,350 million to $5,450 million, representing 22.3% growth

- Service revenue in the range of $3,350 million to $3,410 million, with product revenue growth at 13.5%

- Non-GAAP gross margin of 75.25% to 76.25%

- Non-GAAP operating margin of 25.25% to 26.25%

- Non-GAAP earnings per share of $1.49 to $1.53

Ken Xie says,

Total Revenue Growth

- Total revenue in Q2 2023 increased by 26%.

- Service revenue grew by 30% for the second consecutive quarter.

- Growth in existing subscriptions and non-FortiGate product subscriptions was 34%.

- Product revenue growth was 18%.

Market Share Leadership

- Fortinet is the market share leader in both unit and revenue in the firewall category, with over 50% market share.

- Fortinet was named the ITOT network protection platform leader by Westland Advisory on Security and Cybersecurity.

Future Growth Opportunities

- Fortinet is one of the top and fastest-growing OT security vendors in the market, expected to grow to $33 billion by 2030.

- Increased go-to-market investment in IoT security, cloud security, and security operations.

- New FortiGate 90G next-generation firewall with industry-leading security features and performance.

- New SD-WAN services to enhance digital experience and facilitate rapid deployment.

Cost Savings and Benefits

- FortiGate next-gen firewall and FortiGuard AI-powered security services offer over 300% ROI over three years and payback in six months.

- Fortinet Security operation solutions reduce time to detect and respond to incidents from three weeks to one hour.

AI and Future Developments

- AI technologies, such as generative engines, show promise in areas like malware detection, threat hunting, event correlation, and automation.

- AI can significantly improve productivity and be scaled to a large customer base.

Q & A sessions,

Impact of Manufacturing and Government Sectors

- Manufacturing sector performed well in Q2 and continued to spend heavily due to the perceived threat environment.

- Government sector also showed strength and had budgets despite a slowing economy.

Impact of Retail Sector

- Retail sector experienced negative growth in Q2 due to a digestion period and a slowdown in the economy.

Guidance for Q3 and Q4

- Q3 is expected to have low-single digit growth sequentially, similar to historical trends.

- Q4 is expected to have lower growth compared to previous periods, cautioning about the tough comparison to the strong Q4 of the previous year.

Impact of Duration and SASE

- Duration slowdown has affected year-over-year growth, resulting in a decrease in growth by 4-5 points.

- SASE product is not impacted by duration, only services are partially affected.

CISO Spending and Budgets

- CISOs are facing budget constraints but cannot neglect their infrastructure and security needs.

- There may be new use cases for firewalls, opportunities for on-prem and cloud security, and increased focus on infrastructure security in a hybrid work environment.

Long-Term Growth and Market Share

- The company aims to keep gaining market share and believes in the long-term convergence of network and network security.

- Product revenue growth remains strong compared to competitors.

- Some timing-related issues and inventory levels have affected product revenue growth.