Huntington Ingalls Industries, Inc.

CEO : Mr. Christopher D. Kastner

Quarterly earnings growth(YoY,%)

| Period | Revenue | Operating Income | EPS | Release Date |

|---|---|---|---|---|

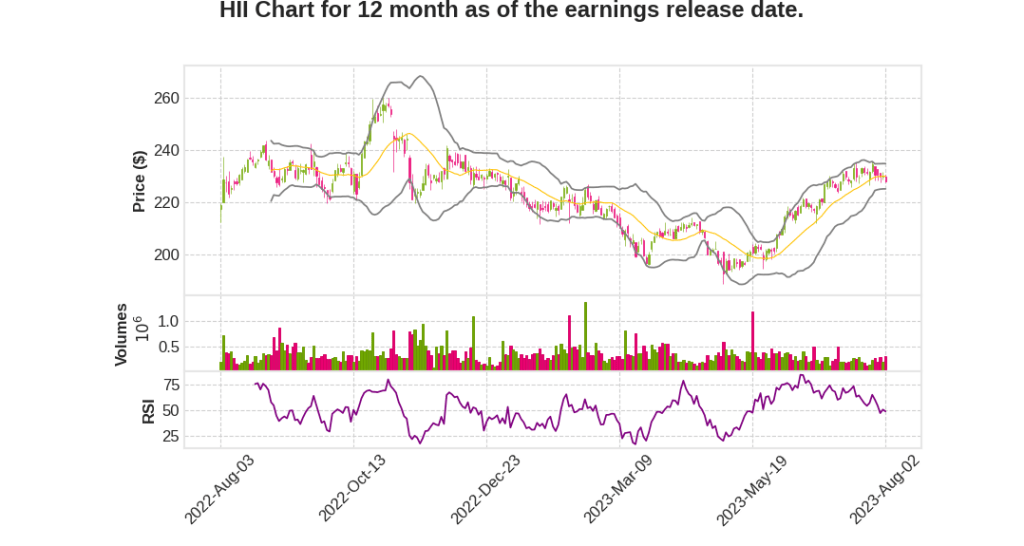

| 2023 Q2 | 4.7% YoY | -18.3% | -26.4% | 2023-08-03 |

Chris Kastner says,

Top Line Growth and Operational Performance

- Second quarter revenue was $2.8 billion, representing a 4.7% increase from the same period last year.

- Diluted earnings per share for the quarter was $3.27, down from $4.44 in Q2 2022.

Shipbuilding Milestones

- In the second quarter, the company laid the keel for LPD 31 Pittsburgh and completed builder’s trials for NSC 10 Calhoun.

- The first Flight III Arleigh Burke destroyer DDG 125 Jack H. Lucas was successfully accepted and delivered.

- Expected launches and deliveries later this year include DDG 128 Ted Stevens, LHA 8 Bougainville, NSC 10, and LPD 29 Richard M. McCool, Jr.

Mission Technologies

- Mission Technologies achieved record high revenue of $645 million in the second quarter, with a growth rate of 7.5% compared to Q2 2022.

- Notable wins in the quarter include a $1.4 billion contract at J-NEEO, which enables the transition of innovation from the lab to the battlespace.

Government Support

- The President’s budget request for fiscal year 2024 is under consideration by Congress, with bipartisan support for shipbuilding programs.

- The Armed Services Committees have authorized funding for LPD 33, multi-year procurement for Virginia class submarines, Columbia class ballistic missile submarines, and DDG 51 Early Bird destroyers.

- The Senate Appropriations Bill provides advanced procurements funding for LPD 33 in FY24 and a third DDG 51 in FY25.

- The House Appropriations Bill supports stable procurement rates for amphibious warfare ships.

- Final outcomes will depend on conference negotiations between the Appropriations and Authorization Committees.

Labor Challenges

- The company hired over 3,200 craftsmen and women in the second quarter, on track to meet the full year plan of approximately 5,000.

- Attrition remains high, posing a risk to meeting the hiring targets.

- Efforts are focused on recruiting, robust training, and retention in the challenging labor environment.

Overall, HII’s solid quarter with top line growth, progress on shipbuilding backlog, and strong performance in Mission Technologies indicate a positive outlook. However, labor challenges and the outcome of government support negotiations will be important factors to monitor.

Tom Stiehle says,

Extension of Navy contract repayment

- An extension was granted for the repayment of the Navy contract, which was originally due by the end of June.

- The extension allows for more time to negotiate the transition of the contract back from the advanced prog pay.

- The details of the negotiated settlement and the impact on the company are yet to be determined.

Impact on guidance and financials

- The extension of the Navy contract repayment does not affect the guidance range of 400 to 450.

- The company advises sticking to the provided guidance at this time.

- Further details and impact will be assessed after another 60 days of negotiations.

Significant milestones in the back half of the year

- There are three deliveries, two launches, and one float off scheduled in the latter half of the year.

- Each delivery results in the liquidation of the contract, providing opportunities for margin and cash from retentions for incomplete work.

Delay in LTE 29 milestone

- The LTE 29 milestone is not expected to be achieved this year or next year.

- The milestone is still anticipated as a 2023 event.

- Projected cash flow for the next 17 months remains on target to meet the goals outlined in the provided five-year milestone chart.

- The company expects 1.2 billion in cash flow during this period.

Q & A sessions,

Q4 Performance and Guidance

- The company anticipates a strong Q4 performance, similar to last year, with over $0.5 billion in revenue.

- The guidance for Q3 assumes a repayment for COVID, and any changes will be provided in the November call.

Mission Technologies

- Mission Technologies grew by 4% and is expected to grow over 5% sequentially.

- The business unit has a strong pipeline and is working to fill funded seats.

- Book to bill is currently low, but is expected to improve in the second half of the year.

Impact on Projects

- 801 had some late-breaking rework that pushed up module delivery to the beginning of next year, but it does not have a material impact.

- There was a fire on LHA-8, but there was no significant damage or impact on cost or schedule.

- A corrective action plan has been implemented to prevent similar issues in the future.