Invitation Homes Inc.

CEO : Mr. Dallas B. Tanner

Quarterly earnings growth(YoY,%)

| Period | Revenue | Operating Income | EPS | Release Date |

|---|---|---|---|---|

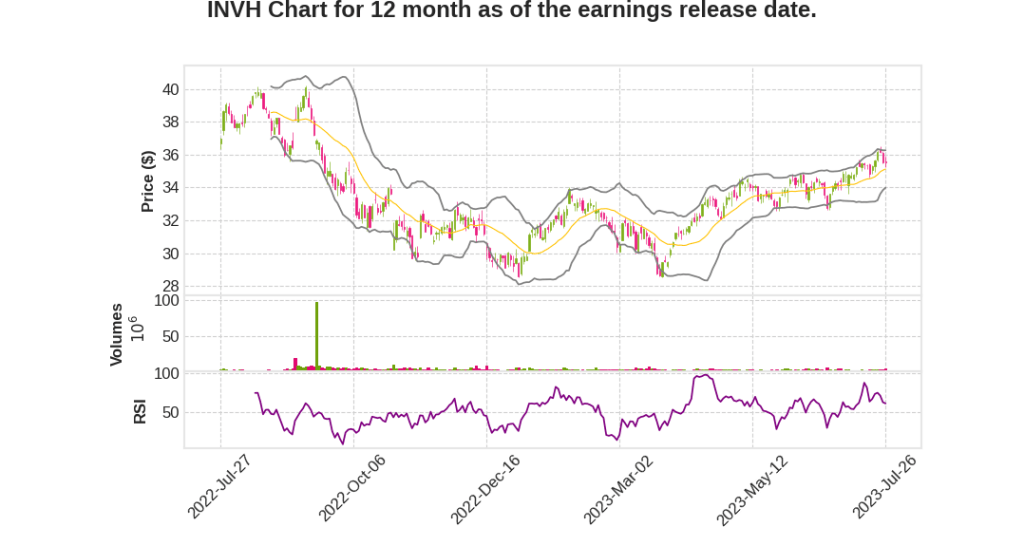

| 2023 Q2 | 7.7% YoY | 128.7% | 27.8% | 2023-07-27 |

Dallas Tanner says,

Value Creation through Recent Purchase

- Invitation Homes purchased nearly 1,900 single-family rental homes for approximately $650 million

- The portfolio consists of well-located homes bought at an attractive price

- The purchase price represents a meaningful discount to end-user market values

- Immediate benefits of scale and expected enhanced returns

- Homes within desirable infill neighborhoods that provide strong rent growth and value appreciation

Smart External Growth and Partnerships

- Continued collaboration with homebuilder partners, with 157 new homes delivered in the second quarter

- Added 173 homes to the new product pipeline, with expected future deliveries of just under $900 million

- Appointment of Scott Eisen as Chief Investment Officer to explore disciplined growth opportunities

- Focus on multi-channel acquisition strategy, including bulk purchasing and expansion of homebuilder pipeline

- Partnership with Esusu to help residents build good credit and remove barriers to housing choice

Fundamental Tailwinds for Business

- Strong future demand indicated by the large population between 23 and 35 years old

- Rising cost and burden of homeownership contribute to demand for single-family homes for lease

- Leasing a home is nearly $1,000 cheaper per month on average than buying a home in Invitation Homes markets

- Lack of new housing supply and low for-sale inventory support home prices and asset sales

- Accretive capital recycling through sale of non-core or underperforming assets

Improving Resident Experience

- Partnership with Esusu enables positive credit reporting to help residents improve their credit profiles

- Commitment to resident choice and flexibility in housing options

- Focus on growing ancillary services business and developing new ways to engage with customers

Growth and Value Creation Outlook

- Increasing demand for single-family rentals, favorable demographic trends, and resident flexibility position Invitation Homes for sustained growth and value creation

- Thankful for dedicated associates’ hard work and commitment

Charles Young says,

1. Same-store NOI and Revenue Growth

- Same-store NOI grew by 3.6% year-over-year.

- Same-store core revenue grew by 5.9%, driven by a 7.4% increase in average monthly rental rate and a 7.3% increase in other income.

2. Lease Compliance and Bad Debt

- The company made progress in working through its lease compliance backlog.

- Same-store bad debt in the second quarter was 150 basis points of gross rental revenue, a sequential improvement of about 50 basis points since the first quarter.

- The company expects further improvement in bad debt as more markets return to pre-COVID performance.

3. Expense Growth and Cost Controls

- Same-store core expense growth was primarily driven by expected increases in property taxes, higher turnover, and property administration costs.

- This expense growth was partially offset by a 6% decrease in R&M expenses due to cost controls and lower inflation.

4. Lease Rates and Occupancy

- Lease rates on renewals grew by 6.9% year-over-year, while new lease rates grew by 7.3% year-over-year.

- This drove second quarter blended rent growth of 7% year-over-year.

- Average occupancy remained strong at 97.6% during the biggest move-out season for the business.

- While there may be some expected moderation in occupancy through the back end of peak season, demand for the company’s homes and the quality of new applicants remain strong.

5. Financials and Focus for the Future

- The company’s average household income for new residents over the past 12 months exceeds $138,000 per year, resulting in an average income-to-rent ratio of 5.1x.

- The focus for the second half of the year is to maintain momentum, control costs, and provide outstanding service to residents.

Q & A sessions,

Lease Compliance Backlog and Turnover

- The lease compliance backlog was expected to be heavier in the first part of the year but started to pick up in Q2.

- Progress has been made, with numbers going down 50 basis points quarter-on-quarter.

- Major markets like Southern California, Atlanta, Vegas, and NorCal have shown positive signs of progress.

- There has been a spike in turnover, impacting occupancy towards the back half of peak season.

New Lease and Renewal Rates

- New lease rates have been historically strong, with markets like Orlando, Tampa, South Florida, Southern California, Atlanta, and Carolina leading the way.

- Renewals are holding steady at high 6s, with potential for improvement as seen in low 8s in September and October.

- Turnover impact is specific to markets with a backlog, such as Atlanta, Vegas, and SoCal.

- Demand is strong overall, with the exception of slight softness in Vegas due to competition and market slowdown.

Partnerships and Growth

- The company’s strategy of partnering with professional management companies to build homes is proving successful.

- The partnership allows for influence on portfolio composition, design, and neighborhood fit.

- The customer’s move-in experience with new product is expected to create a stickier customer over time.

- The company’s G&A light approach and alignment of interests with partners contribute to the success of this strategy.

Insurance Expenses and Risk Mitigation

- The company’s insurance bill increased year-over-year, but the increase was lower compared to other REITs.

- The company’s favorable loss history, geographic dispersion, and lack of coastal exposure contribute to risk mitigation.

- For the third and fourth quarter, quarterly year-over-year increases of around 20% are expected, with the full-year expense up a little over 16%.

- The company is evaluating different alternatives, including captives, for next year’s insurance renewal.

Opportunities for Margin Expansion

- Smaller mid-scale operators are considering their options, and Invitation Homes sees opportunities for margin expansion.

- The company’s scale, platform, and operating efficiencies can create a more efficient margin profile.

- The newly acquired portfolio offers potential for additional margin expansion through improved operations.