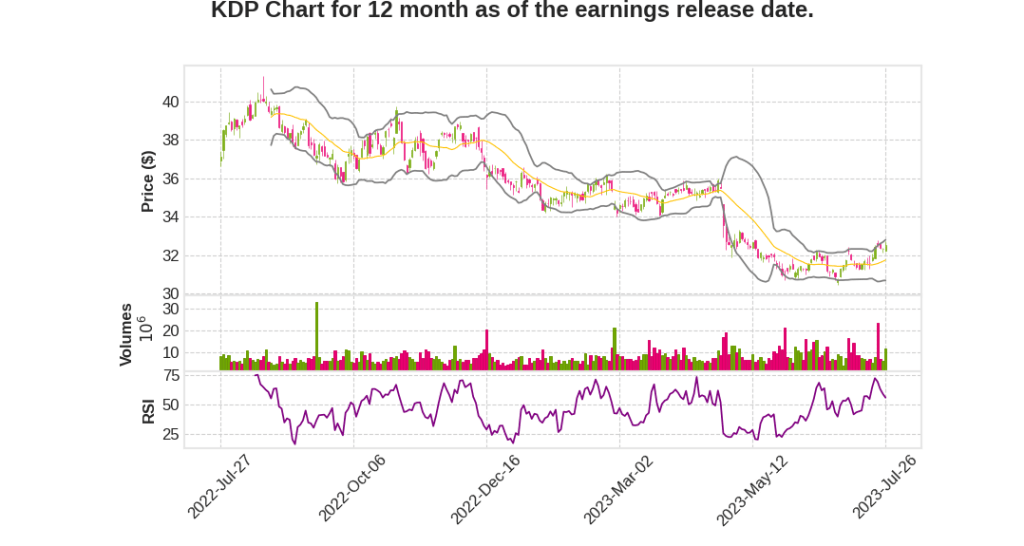

Keurig Dr Pepper Inc.

CEO : Mr. Robert J. Gamgort

Quarterly earnings growth(YoY,%)

| Period | Revenue | Operating Income | EPS | Release Date |

|---|---|---|---|---|

| 2023 Q2 | 6.6% YoY | 34.4% | 140.0% | 2023-07-27 |

Robert Gamgort says,

Strong Q2 Performance and Outlook

- Consolidated Q2 results showed strong revenue momentum and accelerating operating income and EPS growth.

- Net sales advanced more than 6% supported by net price realization, modest category elasticities, and good share performance.

- Gross margins expanded for the first time since Q3 2021.

- 2023 net sales growth outlook raised to 5% to 6%.

- EPS outlook remains unchanged but represents greater than originally anticipated underlying growth.

U.S. Refreshment Beverages

- Outstanding double-digit revenue growth and strong operating margin expansion in Q2.

- Market share gains in CSDs, sparkling water, coconut water, and juice portfolios.

- Focus on driving growth in core brands through marketing and brand renovation.

- Partnerships with Polar and La Colombe contributing to share gains and growth potential.

- Driving growth through innovation, filling portfolio white spaces, and enhancing omnichannel selling and distribution.

U.S. Coffee

- Expectation of at-home coffee category momentum recovery in the back half.

- Adding approximately two million new households to Keurig’s ecosystem in 2023.

- Segment operating margins expected to improve in the back half.

- Pricing catch-up to inflation and exit of low-margin private-label contracts impacting results.

- Growth strategy includes expanding presence in cold coffee, partnering with La Colombe, and driving incremental household penetration.

International Segment

- Strong performance in Canada with volume momentum in non-alcoholic and low alcohol beverages.

- Canadian coffee business gaining market share.

- Mexican DSD network strengthening and partnership with Red Bull rolling out.

- Pen UCL and CSD brands performing well.

Overall Business Development

- Continued focus on long-term investments in innovation, partnerships, and capabilities.

- Deploying cash to create value for shareholders.

- Margin recovery expected to become more visible in the back half.

- Positive category trends and market share momentum driving confidence in future growth.

Robert Gamgort says,

Impact of Mobility Changes and Supply Chain Recovery

- The decline in at-home coffee category and profitability was primarily due to mobility changes post-COVID.

- The negative impact of mobility changes is expected to be largely played out by the end of the third quarter.

- Supply chain recovery after COVID also contributed to the challenges faced by the coffee business.

- Issues such as a service-at-all-cost mindset and lack of focus on productivity added to the challenges.

- Inflation and the lag in pricing realization further impacted the coffee business.

Rebound in Category and Pricing Recovery

- The category is rebounding, driven by normalized mobility and changes in coffee consumption at home.

- Pricing, which was lagged, is now flowing through the Profit and Loss (P&L) statement.

- Inflation is moderating, which is a positive factor going forward.

- Single-serve coffee has gained share of all coffee forms during this period.

Shipments and Category Consumption

- The focus is on category growth, with shipments aiming to approximate category consumption over time.

- The company has an approximate 80% share of all Pods that go through the system.

- The mix of shipments can change over time, but the emphasis remains on category growth.

Short-term Factors Affecting Shipments

- Shipments may not fully align with consumption due to factors such as supply chain disruptions and the exit of low-margin private-label contracts.

- Pricing adjustments on owned and licensed products have been made to prioritize margin recovery in a recovering category.

- This temporary separation between consumption and shipments is not expected to persist in the long term.

Q & A sessions,

Coffee Category Trends

- The coffee category has shown long-term growth, with mid-single-digit CAGR for both pods and brewers.

- The category is driven by the shift from brewing by the pot to brewing by the cup, a trend led by Keurig.

- Keurig participates in 80% of the transactions in this growing category.

Visibility and Predictions

- Consumer mobility has been challenging to predict, but this issue is largely behind Keurig.

- Normalization in category growth and consumer behavior is expected in the back half of the year.

- Keurig has good visibility to margin improvement and expects a slow and gradual recovery in the category.

Refreshment Beverages

- Keurig has been gaining share in the growing refreshment beverages category through marketing, innovation, and retail execution.

- Pricing and productivity have caught up with inflation, and consumer resilience has supported the category.

- There are some greater elasticities in certain segments of the category that Keurig is monitoring and adjusting to.

Shipment and Consumption Trends

- Keurig expects a slow and gradual recovery in the total at-home coffee category and continued single-serve share growth.

- Factors impacting shipments include recovery timing, license pricing, private-label contracts, and intentional strategies to rebuild margin.

- Margins are expected to improve in the second half due to pricing, inflation, productivity, and mix.

Pricing Strategy and Ecosystem Management

- Keurig focuses on managing its own brands separately from partner brands and private-label brands.

- The company sees opportunities for more pricing within its brands to drive category growth.

- Keurig aims to improve margins in a growing category and is not overly concerned about share differences.

- No destocking of pods is expected at retail.