Las Vegas Sands Corp.

CEO : Mr. Robert Glen Goldstein

Quarterly earnings growth(YoY,%)

| Period | Revenue | Operating Income | EPS | Release Date |

|---|---|---|---|---|

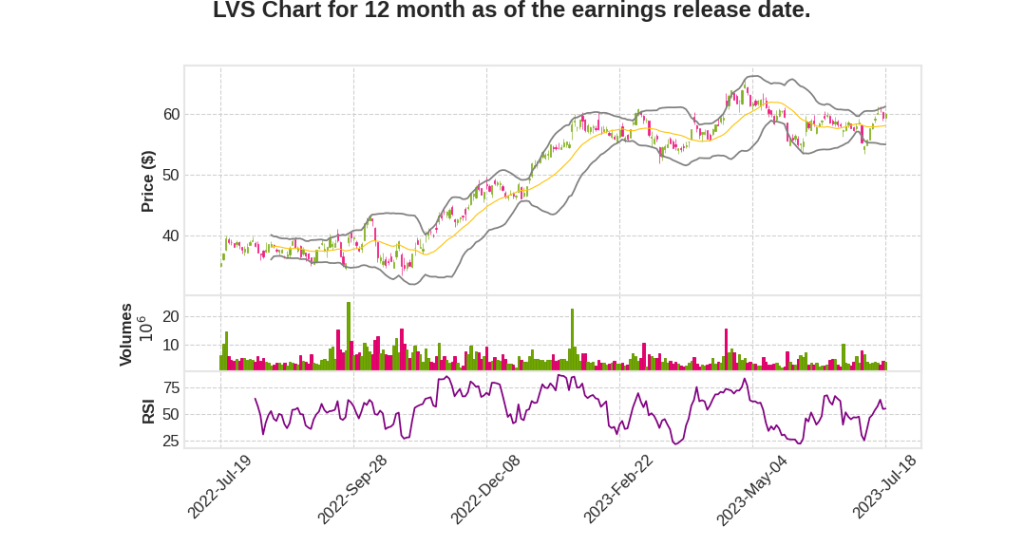

| 2023 Q2 | 143.3% YoY | -478.2% | -175.9% | 2023-07-19 |

Grant Chum says,

Improved Margins and Business Mix

- Normalized margins increased by 240 basis points quarter-on-quarter

- LVS has a more profitable business mix compared to 2019, with a greater proportion of mass gaming relative to VIP gaming

- 87% of GGR (Gross Gaming Revenue) in Q2 2023 is from mass gaming, compared to 71% in Q2 2019

- Nongaming revenue is rising as a percentage of total revenues, increasing from 17% in 2019 to 22% in Q2 2023

- Both mix shifts in gaming and nongaming segments are positive for margins

Reinvestment and Increased Capacity

- LVS is reinvesting its revenues to increase its capability to handle more visitors

- Increased headcount to service more hotel rooms

- Room operating capacity was back to 10,700 rooms on average for the quarter

- Heading back to 12,000 operable hotel room capacity for the summer

- Labor shortage issue has dissipated as an impediment

June Recovery and Strong Performance

- June was a standout month for LVS

- Mass revenues almost fully recovered to June 2019 levels

- Visitation recovery in Macao reached almost 70% of 2019 levels

- Key volume metrics showed significant improvement compared to April and May

- Non-rolling drop increased by 15%

- Slot handle was up 9%

- Rolling volume was up 10%

Patrick Dumont says,

Capital Allocation and Growth Opportunities

- The company sees significant growth opportunities in both Macao and Singapore, which will drive the expansion of non-gaming amenities and cash flow.

- Capital will be allocated towards these growth opportunities to expand the asset base and cash flow capacity.

Return of Capital to Shareholders

- The company aims to be shareholder-friendly and is focused on return on capital.

- There will be a balance between share repurchases and dividends in the future, with a focus on shrinking the share count.

- Management intends to be more programmatic about share repurchases and allocate more capital towards it over time.

Dividend and Share Repurchases

- The current dividend size provides flexibility for future investments and allows for future share repurchases.

- Having a balanced capital return program is important for the company.

- Management intends to shrink the share count over time.

Q & A sessions,

Singapore Expansion and Marina Bay Sands

- The company has a strong belief in the future success of Singapore and the positive outlook for the country’s economy.

- Discussions are ongoing with the government regarding the expansion plans for Marina Bay Sands.

- The final form of the project is being adjusted based on market potential, government goals, and the company’s growth strategy.

- Non-gaming programs and lifestyle offerings have been successful in attracting high-value tourists and driving customer visitation.

Macau Market and Visitations

- Air traffic to Macau and Hong Kong is still at around 50% of pre-pandemic levels.

- Visitation and play from China have been increasing each month across the quarter.

- The company expects a return of higher-value customers and an increase in premium mass as air travel from China improves.

- Investments in non-gaming activities are expected to draw more customers to concerts and events, further driving visitation in Macau.

Marina Bay Sands Expansion and Capital Allocation

- The renovation of Marina Bay Sands is ongoing and creating a better product with strong customer response.

- The full earnings potential of the renovated towers will not be reached until the 200 multi-day suites come online.

- The company aims to address cost increases through higher-value customers, pricing, and volumes.

- The return of capital program has been restarted, showing confidence in the long-term performance of the business.

- The company plans to grow the dividend over time and considers share repurchases as part of its capital allocation strategy.

Londoner Expansion and Return Targets

- The Londoner project has been well-received and validated by the market, and the second phase is expected to tap into its earning power.

- Return targets are not directly discussed, but the company sees potential growth in the mass and premium mass segments.

- Investments in hotel rooms and suites are expected to help address the market and improve profitability.

- Rumors about a new hotel tower are not familiar to the company, which is focused on delivering against concession renewal requirements and investing in non-gaming amenities.

Visitation and Spending in Macau

- Premium mass recovered faster than base mass, but both segments showed strong growth in visitation.

- The spend per head is rising in both premium mass and base mass, indicating high-quality and high-value tourism in Macau.

- The company is attracting high-value foreign tourists in addition to domestic visitation.