Lamb Weston Holdings, Inc.

CEO : Mr. Thomas P. Werner

Quarterly earnings growth(YoY,%)

| Period | Revenue | Operating Income | EPS | Release Date |

|---|---|---|---|---|

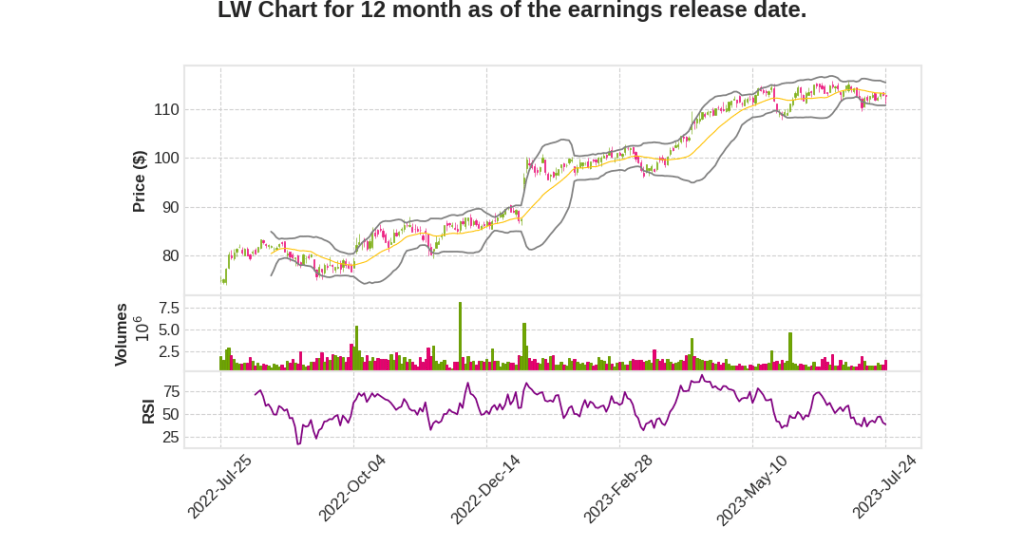

| 2023 Q4 | 47.0% YoY | 116.7% | 1468.2% | 2023-07-25 |

Bernadette Madarieta says,

Q4 2023 Earnings Summary

- Sales increased by $540 million or 47% to a quarterly record of just under $1.7 billion

- About $380 million of the increase was due to the consolidation of EMEA and Argentina operations

- Net sales grew 14% excluding incremental sales from acquisitions

- Price/mix increased by 24% due to pricing actions taken in fiscal 2023

- Overall sales volumes declined by 10%

- Gross profit increased by $170 million to nearly $425 million

- Gross margin increased by over 300 basis points to 25.1%

- SG&A expenses increased by $65 million to $183 million

- Adjusted EBITDA increased by $117 million or 59% to $318 million

- Sales in the Global segment were up 85%, driven by the EMEA and Argentina acquisitions

- Sales in the Foodservice segment grew 4%, a deceleration from previous quarters

- Sales in the Retail segment increased by 25%

- Liquidity position remained solid with $305 million of cash and no borrowings under the revolving credit facility

- Net debt was nearly $3.2 billion, resulting in a leverage ratio of 2.6 times

Fiscal 2024 Outlook

- Operating environment expected to remain challenging with inflation and macro factors impacting costs, restaurant traffic, and consumer demand

- Capacity constraints in producing coated fries, specialty cuts, and chopped in form varieties until new facilities become available

- Targeting sales of $6.7 billion to $6.9 billion, including incremental sales from the EMEA transaction

- Net sales growth, excluding acquisitions, expected to be 6.5% to 8.5%

- Volume to be pressured by strategic product mix management and cautious consumer demand

- Pricing actions to counter input cost inflation expected, but at a more modest rate than in fiscal 2023

- Transportation rates charged to customers may serve as a price headwind

Tom Werner says,

Fiscal 2023 Financial Results

- Record sales of nearly $5.4 billion

- Strong profit growth in each core business segment

- Achieved through pricing actions, mix improvement, and supply chain productivity

Strategic Transactions and Business Expansion

- Acquired remaining interest in European joint venture, adding processing facilities and capacity

- Acquired controlling interest in joint venture in Argentina, with capacity expansion underway

- Progress on major capital expansion projects in China, Idaho, and The Netherlands

- Opened innovation center in The Netherlands to develop and test new products

Product Innovation and Market Expansion

- Launched new products addressing non-traditional frozen potato channels

- Expanded total addressable market, particularly in pizza outlets

Operational Infrastructure and Capabilities

- Stabilized supply chain through staffing and productivity initiatives

- Upgrading capabilities at processing facilities

- Completing design work for new enterprise resource planning system

Financial Highlights and Shareholder Returns

- Returned over $190 million to shareholders

- Increased dividend for the sixth straight year

- Continued execution against share repurchase plan

Operating Environment and Demand Outlook

- Frozen potato category remains healthy globally

- Fry attachment rate in the US remains steady and above pre-pandemic levels

- Restaurant traffic growth decelerated but picked up in June

- Near-term demand may be choppy due to variability in restaurant traffic trends and macro pressures on consumers

Costs, Pricing, and Inflation

- Expect input cost inflation to moderate but still have a meaningful impact

- Higher contract prices for potatoes in North America (20% increase) and Europe (35-40% increase)

- Price actions to offset inflation expected to be more modest than fiscal 2023

Potato Crop Outlook

- Early potato varieties consistent with historical averages

- Main crop in North America and Europe appear to be in line with historical averages

- Wet and cold spring in Europe may delay harvest timing in some regions

Q & A sessions,

Potato crop management

- The company closely monitors and manages the yields on the potato crop annually.

- Current progress of the crop looks promising.

- The company tracks contracted amounts versus forecast and market conditions globally.

- Adjustments can be made in the next 90 to 120 days to six months to balance overall potato supply.

- The agricultural team is skilled at managing these adjustments.

Capacity expansion

- The company plans to bring on additional capacity in the next 18 months.

- This investment demonstrates confidence in the market category’s future.

- Although there is some near-term softness in certain areas, the company believes the category will remain resilient in the long-term.

- Competition is also increasing capacity, but the overall category is expected to handle the additional supply well.

- The company is well-positioned in terms of both near-term and long-term supply and demand balance.