Live Nation Entertainment, Inc.

CEO : Mr. Michael Rapino

Quarterly earnings growth(YoY,%)

| Period | Revenue | Operating Income | EPS | Release Date |

|---|---|---|---|---|

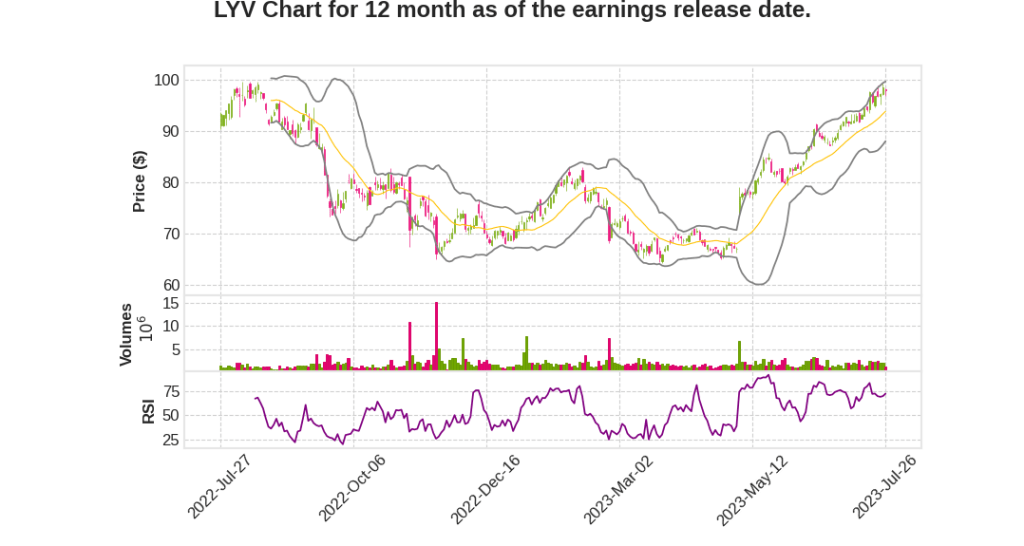

| 2023 Q2 | 27.0% YoY | 21.2% | 2.0% | 2023-07-27 |

Joe Berchtold says,

Confirmed shows and show count

- The number of confirmed shows and shows with offers in arenas, amphitheaters, and stadiums is higher compared to the same period last year.

- This indicates continued growth in show count, which is expected to lead to increased attendance.

Growth in international markets

- International markets have experienced significant growth, with a 46% increase in fan count year-to-date.

- Latin America has seen a 35% increase in fan count, with approximately 10 million fans.

- Expansion opportunities in South America are still in the early stages, with impressive ticket sales for the inaugural Town festival.

Growth in North America

- North America has also had a successful year, with an 8% increase in fan count year-to-date and expectations of double-digit growth in Q3.

- Theaters, clubs, amphitheaters, and high-end stadiums have all experienced strong growth in attendance.

- Even the middle and low end demand remains robust across these venues.

Strategy for growth

- The company’s strategy revolves around driving attendance growth and subsequently increasing AOI levels through higher per fan profitability, sponsorship, and ticketing.

- Long-lead-time global shows are expected to contribute significantly to overall growth.

- The expansion of promoting, sponsorship, and ticketing businesses in Latin America is projected to further drive growth in the region.

Outlook

- The company anticipates continued strong growth in 2024 across all segments.

Michael Rapino says,

Pipe for Next Year

- The company expects the live entertainment industry to have a growth surge on a global basis for the next multiple years.

- They believe this growth is not just a COVID catch-up but a long-term trend fueled by factors such as international expansion, global artists, and increased consumer demand.

Strong Outlook

- Management anticipates a very strong year in 2024 and beyond, with a combination of market growth, consumer demand, and ongoing acquisitions and expansions.

- The company foresees a continuous 1-2 punch of growth through organic growth and strategic additions to their portfolio.

Top Artists and Venue Types

- The company has a robust pipeline of artists lined up for next year, covering various venue types and markets worldwide.

- They expect to fill different types of venues with top-tier artists, ensuring a diverse range of live entertainment experiences.

Q & A sessions,

Positive Impact of Experiences on Consumer Spend

- Analysis shows that the tailwind impact from getting experiences back as a portion of discretionary spend is about 10x the impact of any potential headwind coming from student loan payments.

- This indicates that the return of experiences as a preferred spending category is expected to have a significant positive impact on consumer spending.

Tremendous Tailwind Business

- The company sees the globalization of demand as a tremendous tailwind for their business.

- They expect continued growth in international markets, with a strong focus on Latin America, Asia, and Europe.

- Latin America is showing strong growth, with the launch of the Town festival selling 400,000 tickets in its first year.

Growth in Attendance and Fan Spending

- The company is experiencing high single-digit increases in attendance per show, driven by more lawn tickets being sold.

- Even price-conscious fans are continuing to spend strongly, with per caps growing.

- The company is not seeing any indicators of a slowdown in fan spending.

Investments in Venue Improvements

- The company is investing in tactical improvements across its amphitheaters, theaters, and clubs to enhance revenue-generating opportunities.

- A CapEx refresh cycle is also being implemented when renewing venues, ensuring strong returns on investments.

- New builds are another area of focus, with a emphasis on international markets.

Utilization of Digital Ticketing and Data

- Digital ticketing is now largely ubiquitous globally, with an expected adoption rate in the 90s.

- Data from digital ticketing is being used for marketing, understanding fans, upselling, and machine learning purposes.

- The company is leveraging data to assist clients in pricing and marketing their shows, as well as understanding demand in specific markets.