Molina Healthcare, Inc.

CEO : Mr. Joseph Michael Zubretsky

Quarterly earnings growth(YoY,%)

| Period | Revenue | Operating Income | EPS | Release Date |

|---|---|---|---|---|

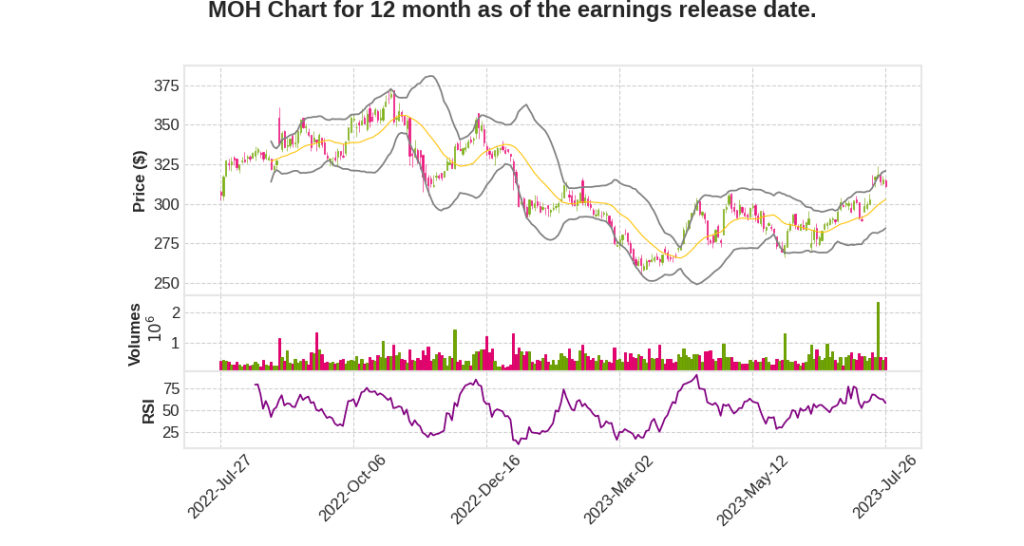

| 2023 Q2 | 3.4% YoY | 22.7% | 23.5% | 2023-07-27 |

Mark Keim says,

Consolidated MCR and Medical Cost Management

- Consolidated MCR for Q2 2023 was 87.5%, reflecting strong medical cost management.

- Medicaid reported MCR was 88.3%, in line with expectations and target range.

- COVID-related costs have largely subsided.

Medicare Performance

- Medicare reported MCR was 89.2%, above long-term target range.

- Increased utilization of outpatient and professional services.

- Strong growth in D-SNP and MAPD products impacting new member margins.

Marketplace Performance

- Marketplace reported MCR was 73.7%, reflecting pricing strategy and seasonal patterns.

- Pricing strategy increased premium yield by approximately 9%.

- Well positioned to achieve mid-single-digit target margins for the year.

Balance Sheet and Financial Position

- Parent company cash balance was approximately $0.5 billion.

- Debt remained unchanged at 1.6 times trailing 12 month EBITDA.

- Low leverage position and ample cash and capital capacity for growth.

2023 Guidance

- Increased adjusted earnings guidance by $0.50 to at least $20.75 per share.

- Driven by Q2 operating and investment income performance and higher expected investment income in the second half of the year.

Redeterminations and Membership

- Medicaid membership down 93,000 from Q1 due to expected initial impact of redeterminations.

- Successful outreach protocols to help eligible members remain in the Medicaid program.

- Two-thirds of disenrollees potentially remain fully Medicaid eligible.

Joe Zubretsky says,

Second Quarter Highlights

- Adjusted earnings per diluted share for Q2 2023 was $5.65, a 24% year-over-year growth

- Premium revenue for Q2 was $8 billion

- Consolidated MCR for Q2 was 87.5%, at the low end of the long-term target range

- Adjusted pre-tax margin for Q2 was 5.3%, above the high end of the long-term target range

- Medicaid business had an MCR of 88.3% in Q2, in line with full-year guidance and long-term target range

- Medicare MCR for Q2 was 89.2%, above the high end of the long-term target range

- Marketplace MCR for Q2 was 73.7%, reflecting successful strategies to restore business to mid-single-digit target margins

2023 Guidance

- Adjusted earnings per share guidance for 2023 increased to at least $20.75, a 16% growth year-over-year

- Pre-tax margins are exceeding expectations

- Medicaid MCR is on target, Medicare slightly behind target, and Marketplace substantially better

Medicaid Redeterminations

- All but four states began disenrolling members in Q2

- Medicaid membership declined by 93,000 members in Q2, within expectations

- Impact on overall Medicaid MCR was negligible and within expectations

- States are willing to adjust rates to account for any changes in acuity or trend

Growth Strategy

- Premium revenue target for 2026 is $46 billion

- Recent state RFP wins drive over $5 billion in incremental premium revenue

- Acquisition of Bright HealthCare’s California Medicare Business, expected to add $1.8 billion of premium revenue

- Line of sight to approximately $38 billion of premium revenue in 2024 or 19% growth before additional strategic initiatives

- Long-term earnings per share growth rate target of 15% to 18% reaffirmed

Q & A sessions,

Impact of Risk Adjustment Liabilities

- Analysts projected a potential benefit of $66 million in positive development of risk adjustment liabilities.

- About half of this benefit is tied up in margins, reducing the overall impact.

- The retention of margins that don’t fall to the bottom line further reduces the potential benefit to less than half of the initial projection.

- The recognition of these risk adjustment liabilities is expected to occur largely in the first quarter with a little bit in the second quarter.

- This development is considered normal, similar to IBNR, and is anticipated to have a slightly favorable impact as it rolls off.

Power of Ex Parte and Reconnects

- Ex parte review, conducted in advance of any loss of membership, helps avoid eligibility loss.

- It is estimated that 40% of members lose their eligibility during the verification process, while 60% retain it.

- Of the 60% that retain eligibility, it is estimated that 50% do so through ex parte.

- CMS is encouraging states to increase ex parte efforts.

- Reconnects, which allow individuals to regain eligibility within 90 to 120 days, are crucial for members who lose their eligibility due to procedural reasons.

- Reconnects have the potential to retroactively cover claims and premiums back to the day of eligibility loss.

Outlook and Impact on Medicaid MLR

- The company’s outlook for redetermination process includes 800,000 members up, 400,000 members down, $1.6 billion in premium, and an 88.5% Medicaid MCR for the year.

- The company’s acuity determination and Medicaid MLR outlook remain unchanged.

- The Medicaid MLR outlook takes into account the slightly more favorable MCRs of levers compared to the portfolio average.

- Most states have minimum MLR or corridor programs, which the company operates efficiently and historically pays into.

- Any impact on medical margins from trends or yield would first be absorbed by significant liabilities already recorded for these conventions.

- The company reiterates confidence in the 88.5% Medicaid MCR estimate for the year.