Match Group, Inc.

CEO : Mr. Bernard J. Kim

Quarterly earnings growth(YoY,%)

| Period | Revenue | Operating Income | EPS | Release Date |

|---|---|---|---|---|

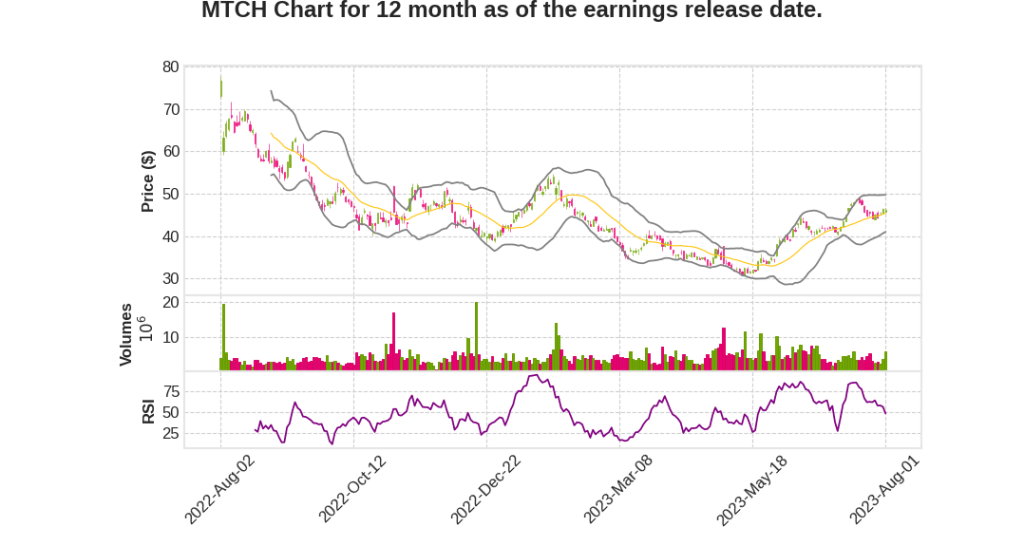

| 2023 Q2 | 4.4% YoY | -9.5% | -545.5% | 2023-08-02 |

Gary Swidler says,

Match Group Q2 2023 Earnings Summary

- Total revenue for Q2 was $830 million, up 4% YoY

- Q2 direct revenue was $816 million, up 5% YoY

- Tinder direct revenue was up 6% YoY at $475 million

- Hinge direct revenue grew 35% YoY

- MG Asia direct revenue declined 4% YoY

- Azar direct revenue grew 24% YoY

- Operating income was $215 million, representing a margin of 26%

- Adjusted operating income (AOI) was $301 million, up 5% YoY, representing a margin of 36%

- Cost of revenue represented 30% of total revenue, flat YoY

- Selling and marketing costs increased 9% YoY

- G&A costs declined 3% YoY

- Product development costs grew 9% YoY

- Interest expense increased 12% YoY

- Match Group ended Q2 with $741 million of cash, cash equivalents, and short-term investments

Guidance and Outlook

- Q3 2023 total revenue guidance of $875 million to $885 million, up 8% to 9% YoY

- Expecting significant acceleration of YoY RPP growth in Q3, particularly at Tinder

- Tinder direct revenue expected to be up close to 10% YoY in Q3

- Expecting mid-single digit YoY decline in Tinder payers in Q3

- Expecting Hinge to deliver meaningfully accelerating YoY direct revenue growth in Q3

- Match Group Asia direct revenue expected to be close to flat YoY in Q3

- Expecting slight improvement in YoY direct revenue growth for Hyperconnect in Q3

- Expecting low-single digit YoY decline in direct revenue for Evergreen & Emerging brands in Q3

- Expecting modest YoY improvement in indirect revenue in Q3

- AOI guidance for Q3 is $320 million to $325 million, up 13% to 14% YoY

- Overall marketing spend expected to increase YoY in Q3

- Full-year 2023 expected to achieve 6% to 7% top-line growth and better AOI margins compared to 2022

Bernard Kim says,

Record Quarter and Turnaround

- The first half of the year has shown significant progress, leading to a record quarter.

- The efforts undertaken to lead to this record quarter have been successful.

- The teams have undergone changes and have become stronger together.

- The teams are executing on their product roadmaps and marketing initiatives.

Tinder Momentum and Refresh

- The energy in the L.A. office, where Tinder team members are located, is completely different compared to a year ago.

- The new “It Starts with a Swipe” marketing campaign is delivering impressive results, increasing new user signups and reactivations.

- The Tinder roadmap is being refreshed to make the app more relevant, fun, and relatable to a younger demographic.

Hinge Growth and Learnings

- Hinge continues to experience exceptional user and revenue growth and is now a top three most downloaded dating app in 14 countries.

- The learnings from other brands are being applied at Hinge to maximize growth.

Asia Businesses Course Correction

- Azar’s revenue momentum has been driven by their new AI-enabled matching algorithm.

- Hakuna is pivoting to deliver a better experience for content creators and audiences, leading to increased user engagement.

- In Japan, the rollout of TV ads for the first time is expected to improve user trends for the category.

Efficiency and Innovation

- The Evergreen & Emerging brands have unified their teams to share key learnings more effectively.

- Innovations and products are being developed on the same platform, leading to improved efficiency, innovation, speed to market, and cost savings.

Generative AI and Innovation

- Match Group recognizes the need for innovation to stay relevant and is exploring the use of generative AI.

- Generative AI will be used to enhance trust, authenticity, and respect, leading to better matches and dates.

- By the end of the year, Match Group expects to launch initiatives that use generative AI to eliminate awkwardness and make the dating journey more enjoyable.

Note: The given speech does not provide specific guidance or numbers related to financial performance, so the summary focuses on the impact of various initiatives and developments on the company’s operations and growth potential.

Q & A sessions,

Impact of Price Optimization and Weekly Subscription Packages

- The introduction of price optimization and weekly subscription packages has introduced variability in the numbers and has had a significant impact on the payers.

- The decision not to roll out price changes in the international markets has resulted in better numbers than expected.

- The slower rollout of pricing changes in the U.S. market is affecting Q2 payers numbers and will continue to have lingering effects in Q3 and potentially Q4.

Expectations for Q3 and Q4

- Overall, Q3 sequential trends are expected to be meaningfully better than Q2, which saw a decline in payers.

- The rest of 2023 is largely focused on increasing revenue per payer (RPP), with a greater increase expected in Q3 and continued acceleration into Q4 due to the introduction of weekly subscription packages and price optimizations.

- Year-over-year declines in payers in the mid-single digits are expected to continue for the next couple of quarters, influenced by pricing changes and new user growth.

- 2024 is expected to have a more balanced impact from payer and RPP increases, with the introduction of a new premium tier driving revenue per payer growth.

Growth and Revenue Outlook

- The Match Group is expecting 6% to 7% year-over-year total revenue growth for the full year, with Q3 revenue growth expected to be 8% to 9% year-over-year.

- Tinder is expected to deliver approximately 10% year-over-year direct revenue growth in Q3 and solidly double-digit growth in Q4.

- Hinge is expected to achieve approximately 40% year-over-year direct revenue growth for 2023, reaching around $400 million of revenue.

- Other businesses are expected to see mid-single digit declines in Q3, with a potential for some improvement.

- The growth of Tinder and other businesses will impact the overall company’s AOI margin, with at least 50 basis points of margin improvement expected on a year-over-year basis.

Variables and Marketing Spend

- The level of growth at Tinder and marketing spend are the biggest variables that will impact the company’s performance.

- The revenue initiatives at Tinder have been more successful than anticipated, leading to a dramatic acceleration in growth.

- Marketing spend will be calibrated to drive additional growth in 2024, and the company will make decisions on marketing investments towards the end of the year.

Learning from Weekly Subscription Packages

- Weekly subscription packages are new to the company, and they are still learning from the trends, especially around renewals.

- Data on weekly subscriptions is limited compared to monthly subscriptions and long-term trends.