Nordson Corporation

CEO : Mr. Sundaram Nagarajan

Quarterly earnings growth(YoY,%)

| Period | Revenue | Operating Income | EPS | Release Date |

|---|---|---|---|---|

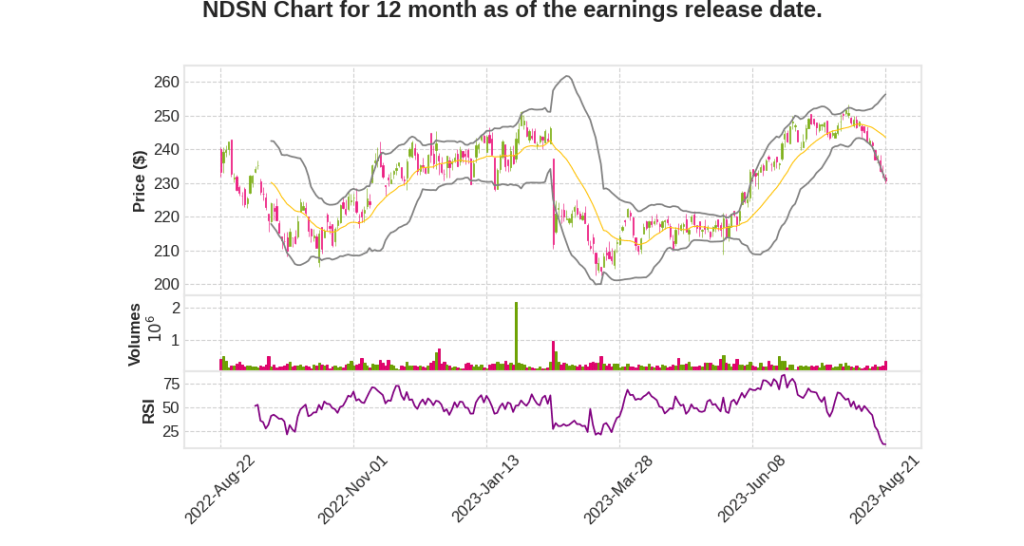

| 2023 Q3 | -2.0% YoY | -7.5% | -9.3% | 2023-08-22 |

Joseph Kelley says,

Q3 2023 Sales and Profitability

- Sales for Q3 2023 were $649 million, a decrease of 2% compared to the prior year’s Q3 sales of $662 million.

- Organic sales decreased by 5%.

- Gross profit totaled $360 million, or 56% of sales, comparable to the prior year.

- Operating profit, excluding non-recurring items, was $181 million, or 28% of sales, 4% below the prior year.

- EBITDA for Q3 was $208 million, or 32% of sales, $5 million below the prior year.

- Net income for Q3 was $128 million, or $2.22 per share.

- Adjusted earnings per share, excluding non-recurring costs, were $2.35 per share, a 6% decrease from the prior year.

Segment Performance

- Industrial Precision Solutions (IPS) sales of $338 million decreased 1% compared to the prior year, driven by softness in product assembly and nonwovens product lines in Asia.

- EBITDA for IPS was $122 million, or 36% of sales, a decrease of 3% compared to the prior year.

- Medical and Fluid Solutions sales of $171 million decreased 4% compared to the prior year, driven by softness in medical fluid components and fluid solutions product lines in Asia Pacific.

- EBITDA for Medical and Fluid Solutions was $68 million, or 40% of sales, a decrease of $8 million compared to the prior year.

- Advanced Technology Solutions sales were $140 million, a 3% decrease compared to the prior year, with organic sales volume down 13%.

- EBITDA for Advanced Technology Solutions was $33 million, or 24% of sales, an improvement compared to the prior year.

Balance Sheet and Cash Flow

- Generated $181 million in free cash flow in Q3.

- Cash ended the quarter at $143 million and net debt was $695 million, resulting in a 0.9 times leverage ratio based on the trailing 12 months EBITDA.

- Repaid $111 million of debt, paid $37 million in dividends, and spent $23 million on stock repurchasing.

Upcoming Acquisition of ARAG

- Expect to close the ARAG acquisition by the end of August.

- Projected net debt to EBITDA leverage ratio of approximately 2 times by the end of the year.

- Assume approximately $20 million to $30 million in revenue from ARAG in fiscal ’23, with EBITDA margins expected in the high-30% range.

- ARAG acquisition initially financed with a short-term loan and revolver borrowings, with a bond issuance in the public markets planned later this year.

Sundaram Nagarajan says,

Financial Results

- Sales were at the low-end of expected guidance range for the quarter.

- Adjusted earnings per share (EPS) for the quarter were $2.35, which was at the high-end of third quarter EPS guidance.

- Cost control measures were implemented in divisions where necessary, resulting in strong growth in divisions with strong market demand.

Electronics and Biopharma Product Lines

- Weakness in the electronics and biopharma product lines affected sales.

- Asia Pacific results were significantly impacted, with a 20% decline, particularly in the semiconductor and electronics assembly segments.

- These markets are cyclical, and a turnaround is expected in the middle of 2024.

Diversification of Business

- The company experienced double-digit organic growth in medical interventional solutions and polymer processing product lines.

- The test and inspection business also saw high-single-digit growth.

- Customers in the Americas and Europe are rebalancing their supply chains, leading to mid-single-digit organic growth in these regions.

Upcoming Enterprise Updates

- An acquisition of ARAG has been made, which will be discussed in more detail later.

Q & A sessions,

Medical Fluid Components Division:

- Expecting to anniversaries the supply chain destocking pressure in Q1 2024

- Cautiously expecting the division to return to its historical mid to high single-digit growth rate over time

Electronics End Markets:

- Expecting the CapEx spend cycle to turn in the second half of calendar 2024

- Expecting to benefit from customer investments in automation, memory, AI, and electronics new product innovation

- Successfully managing costs and staying invested in profitable growth opportunities

Asia Pacific Region:

- Monitoring sales weakness in China, largely related to the electronics exposure

- Not seeing significant moves out of China, but some rebalancing of supply chain to other regions of Asia, Americas, and Europe

- Well-positioned to support customers in diversifying their supply chains

Acquisitions and Revenue Guidance:

- Acquired revenue target of $500 million set for 2025 is nearly 80% achieved

- Acquired ARAG, a market leader in precision spraying technology for precision agriculture

- Expecting revenue growth of 0% to 2% over fiscal 2022 and adjusted earnings of $8.90 to $9.05 per share for 2023

End Market Expectations:

- Expecting electronics cycle to rebound in mid-calendar 2024, benefiting both T&I and EPS divisions

- Medical division seeing strong double-digit growth due to backlog and elective surgery returning to normal, expecting to settle into historical mid to high single-digit growth rate

- Biopharma division believed to have bottomed out and settling at current levels, cautious about the speed of returning to high-single-digit growth rate