NXP Semiconductors N.V.

CEO : Mr. Kurt Sievers

Quarterly earnings growth(YoY,%)

| Period | Revenue | Operating Income | EPS | Release Date |

|---|---|---|---|---|

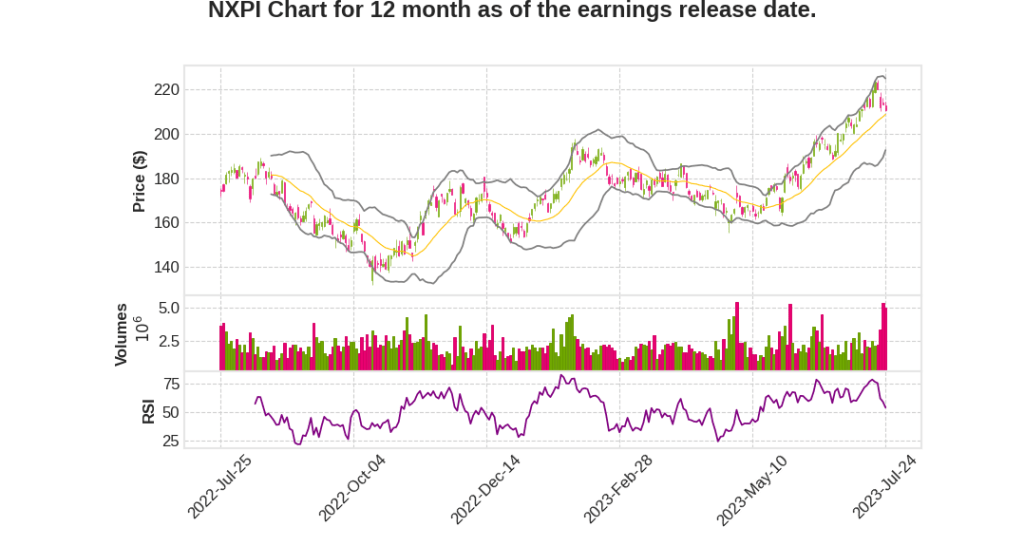

| 2023 Q2 | -0.4% YoY | -0.6% | 5.5% | 2023-07-25 |

Kurt Sievers says,

Quarter Two Results

- Revenue of $3.3 billion, essentially flat year-on-year

- Distribution channel inventory maintained at 1.6-month level

- Non-GAAP operating margin of 35%, 100 basis points below the year ago period

- Stronger gross margin, offset by higher R&D investments

Focus End Market Trends

- Automotive revenue of $1.87 billion, up 9% year-on-year

- Industrial and IoT revenue of $578 million, down 19% year-on-year

- Mobile revenue of $284 million, down 27% year-on-year

- Communication, Infrastructure, and Other revenue of $571 million, up 15% year-on-year

Guidance for Quarter Three 2023

- Expected revenue of $3.4 billion, down 1% year-on-year

- Anticipated trends in different segments:

- Automotive: up in mid-single-digit percent range year-on-year, up in low single-digit range sequentially

- Industrial and IoT: down in mid-teens percent range year-on-year, up in low-single-digit percent range sequentially

- Mobile: down in mid-teens percentage range year-on-year, up in mid-20% range sequentially

- Communication, Infrastructure, and Other: up about 10% year-on-year, flat sequentially

Strategic Initiatives

- Focus on working with suppliers and customers to enhance long-term supply and demand assurance programs

- Pursue consistent pricing policy to pass along input cost increases to customers

- Confidence in returning to predictable year-over-year growth in 2023

Software-Defined Vehicle

- NXP has achieved a significant milestone with the industry’s first fully automotive specified safe and secure 5-nanometer computer

- The software-defined vehicle enables easy upgrades and new features throughout the vehicle’s lifetime

- NXP’s S32 platform offers a complete portfolio to address processing requirements in the software-defined vehicle

- Received significant OEM awards, including the new 5-nanometer vehicle computer, which will drive automotive growth beyond 2024

Bill Betz says,

Financial Highlights

- Total revenue for Q2 was $3.3 billion, at the high-end of the guidance range.

- Non-GAAP gross profit was $1.93 billion with a gross margin of 58%, up 60 basis points year-on-year.

- Total non-GAAP operating expenses were $771 million, at the high-end of the guidance range.

- Non-GAAP operating profit was $1.16 billion with an operating margin of 35%.

- Non-GAAP earnings per share was $3.43, near the high-end of the guidance range.

Cash and Debt

- Total debt at the end of Q1 was $11.17 billion, with an ending cash position of $3.86 billion.

- Net debt was $7.31 billion with a trailing 12-month adjusted EBITDA of $5.44 billion.

- During Q2, $302 million of shares were repurchased and $264 million was paid in cash dividends.

Working Capital Metrics

- Days of inventory was 137 days, an increase of two days sequentially.

- Distribution channel inventory was 1.6 months or approximately 49 days.

- Days receivable were 29 days, down two days sequentially.

- Days payable were 63 days, a sequential decrease of five days.

- The cash conversion cycle was 103 days, an increase of five days versus the prior quarter.

Q3 Outlook

- Q3 revenue is expected to be $3.4 billion, down about 1% year-on-year.

- Non-GAAP gross margin is expected to be flat sequentially at 58.4%.

- Operating expenses are expected to be $785 million.

- Non-GAAP operating margin is expected to be 35.3%.

- Non-GAAP financial expense is expected to be $67 million.

- Non-GAAP tax rate is expected to be 16.6%.

- Non-GAAP earnings per share is expected to be $3.60.

Q & A sessions,

Supply Chain Normalization and Inventory Challenges

- The supply chain situation in the automotive industry has largely normalized after 2.5 years of turmoil from supply challenges.

- Lead times have largely normalized, resulting in a more normal order pattern.

- There is a bit of a tension between OEMs and Tier 1 suppliers regarding inventory targets.

- This uneven situation, along with golden screw leftovers, has led to some challenges.

Automotive Industry Outlook

- The automotive industry is showing surprisingly good performance, with a solid SAAR forecast and consistent year-on-year growth in electric and hybrid vehicles.

- SAAR is expected to reach 5% growth this year, with around one-third of global sales being electric or hybrid vehicles.

- This growth in electric and hybrid vehicles presents a fantastic opportunity for the semiconductor business.

Increased Input Costs and Pricing Strategy

- Input costs have been increasing, and NXP expects pricing to follow suit, including in the automotive sector.

- NXP has long-term agreements with customers for demand and supply assurance, ensuring stability in pricing and avoiding short-term fluctuations.

- While input costs are expected to rise next year, the mix of manufacturing and input costs is uncertain.

Backlog and Demand

- NXP does not work on a backlog concept but focuses on true demand and long-term agreements with customers.

- The backlog has already normalized, and there is no negative or positive impact from working down a backlog.

- The macro environment may be uncertain, but the auto consumption market is not in bad shape, with consistent growth in SAAR and lower dealer inventories.

Market Rebound and Growth Opportunities

- There is no significant rebound in the Android space, but NXP’s exposure to Android phones is such that an increase in consumer demand will reflect in their numbers.

- In the automotive sector, NXP benefits from the success of electric car companies, particularly in China, which have a tendency to adopt newer products at higher ASPs.

- China’s electric automotive market is developing well, and NXP’s exposure to it is positive.

- Consumer IoT in China is gradually increasing but has not yet experienced a rebound.