Old Dominion Freight Line, Inc.

CEO : Mr. Kevin M. Freeman

Quarterly earnings growth(YoY,%)

| Period | Revenue | Operating Income | EPS | Release Date |

|---|---|---|---|---|

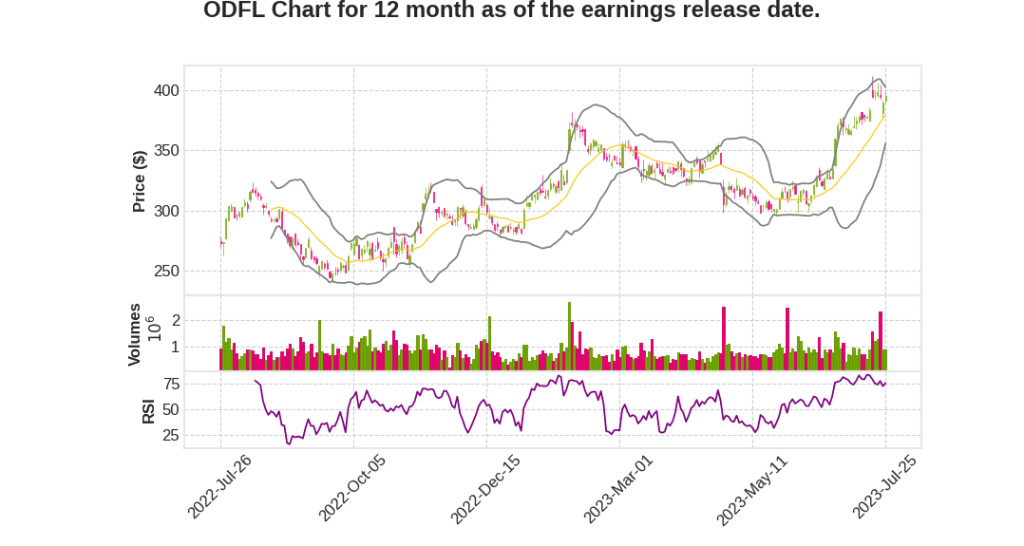

| 2023 Q2 | -15.2% YoY | -23.0% | -19.8% | 2023-07-26 |

Kevin Freeman says,

Revenue and Financial Results

- ODFL experienced a 15.2% decrease in revenue during the second quarter.

- Despite the decrease in revenue, the company achieved a 72.3% operating ratio and earnings per diluted share of $2.65.

Superior Service and Value Proposition

- ODFL focuses on delivering superior service at a fair price, with on-time service performance of 99% and a cargo claims ratio of 0.1% in the second quarter.

- This commitment to superior service strengthens customer relationships and supports ongoing yield management initiatives.

Market Share and Operating Density

- ODFL’s market share remained relatively consistent in the second quarter, despite subdued freight demand.

- The year-over-year decrease in volumes resulted in a loss of operating density.

- Improvement in operating ratio requires consistent increases in both density and yield, which depend on a favorable macroeconomic environment.

Cost Management

- ODFL maintained direct operating costs as a percent of revenue by managing costs and improving productivity.

- Overhead costs increased as a percent of revenue, mainly due to fixed cost categories.

- Aggregate depreciation expense increased due to the execution of the capital expenditure plan.

Capacity and Investments

- ODFL currently has approximately 30% excess capacity within its service center network.

- The company remains confident in its ability to win market share and invests in service center capacity to stay ahead of its growth curve.

- Regular investments are made in fleet, technology, training, education, and benefits for employees.

Long-term Growth and Profitability

- ODFL’s disciplined execution of its long-term strategic plan has resulted in strong records for long-term growth and profitability in the LTL industry.

- The company is committed to providing superior service, maintaining necessary capacity for growth, and increasing shareholder value.

Adam Satterfield says,

Revenue and Volume Metrics

- LTL tons per day decreased by 14.1% in the second quarter, and LTL revenue per hundredweight decreased by 1.1%.

- Yield metrics were impacted by the decrease in diesel fuel prices, resulting in a 7.6% increase in LTL revenue per hundredweight, excluding fuel surcharges.

- Sequentially, revenue per day for the second quarter decreased by 2.0% compared to the first quarter, with LTL tons per day and shipments per day also decreasing.

- Shipments per day have been relatively consistent since December of the previous year.

- In July, there has been an incremental increase in revenue, bringing it more in line with the 10-year average sequential change.

Revenue and Cost Comparison

- Revenue per day in July 2023 has decreased by approximately 15% to 16% compared to July 2022.

- The price of diesel fuel and purchase transportation costs improved by 60 basis points.

- These improvements offset the increase in salaries, wages, and benefits for drivers, platform employees, and fleet technicians.

Cash Flow and Share Repurchase

- Cash flow from operations totaled $287.8 million for the second quarter and $703.2 million for the first half of 2023.

- Capital expenditures were $244.7 million for the second quarter and $479.4 million for the first half of 2023.

- Old Dominion utilized $160.5 million and $302.2 million of cash for their share repurchase program during the second quarter and first half of 2023, respectively.

- Cash dividends totaled $43.8 million and $87.8 million for the same period.

- A new share repurchase program of up to $3 billion has been approved by the Board, which will commence after the completion of the existing $2 billion repurchase program announced in July 2021.

Effective Tax Rate

- The effective tax rate was 25.4% for the second quarter of 2023 and 26.0% for the second quarter of 2022.

- The annual effective tax rate is expected to be 25.6% for the third quarter of 2023.

Q & A sessions,

Increasing Business Trends

- The company has seen an uptick in business over the past few days, indicating a better trend in recent weeks.

- Old Dominion has been having conversations with shippers about reusing their services within the supply chain.

- Shipments per day have increased from 47,000 to closer to 50,000, potentially indicating a stronger performance than initially forecasted.

- The company expects business levels to start returning at the end of the year and into early 2024, indicating a positive outlook for the future.

Operating Ratio and Overhead Expenses

- The company expects a 50 basis point increase in the operating ratio from the second to the third quarter.

- Overhead expenses are expected to be higher, particularly due to depreciation and higher miscellaneous and general supplies expenses.

- The company aims to manage direct operating costs consistently as a percent of revenue.

- The ultimate impact on the operating ratio will depend on the top line and how overhead costs as a percent of revenue fluctuate.

Impact of Customer Relationships and Demand Environment

- Old Dominion has maintained good customer relationships and long-term contracts, even during supply chain challenges.

- While there has been a decrease in revenue, the company has seen stable trends and anticipates stabilization and potential growth in the future.

- The overall demand for LTL transportation is expected to improve, potentially leading to increased market share for Old Dominion.

Consistent Pricing Strategy

- The company emphasizes having a consistent cost-based process and discussing cost inflation and price increases with customers.

- Managing cost inflation and keeping it in check has been a priority, and cost per shipment numbers have shown moderation.

- If other carriers close the pricing gap and aim for bigger increases, it could benefit Old Dominion’s market share opportunities.

- The focus is on demonstrating the value Old Dominion can provide and continuing to drive cash flow and strengthen the balance sheet.

Shipment Mix and Trends

- The weight per shipment has dropped slightly, with an average of around 1,525 pounds.

- Old Dominion has seen an increase in smaller tariff-based customers, potentially impacting the average weight per shipment.

- If the recent trends hold steady, there could be a further increase in shipments per day, potentially carrying into August.