Packaging Corporation of America

CEO : Mr. Mark W. Kowlzan

Quarterly earnings growth(YoY,%)

| Period | Revenue | Operating Income | EPS | Release Date |

|---|---|---|---|---|

| 2023 Q2 | -12.7% YoY | -6.8% | -30.1% | 2023-07-25 |

Tom Hassfurther says,

Impact of Packaging Segment Prices and Mix

- Total prices and mix in the Packaging segment were below expectations, with domestic containerboard and corrugated products prices and mix $0.32 per share below Q2 2022 and also $0.32 per share below Q1 2023.

- Export containerboard prices were down $0.15 per share compared to last year’s Q2 and down $0.07 per share compared to Q1 2023.

Impact of Packaging Segment Volume

- Corrugated product shipments were down 9.8% in total and per workday compared to last year’s Q2.

- Outside sales volume of containerboard was 62,000 tons below last year’s Q2 and 33,000 tons above Q1 2023.

Factors Impacting Demand

- Consumer buying preferences have shifted towards service-oriented spending, impacting the purchases of both durable and nondurable goods.

- Persistent inflation and higher interest rates are also negatively impacting consumer purchases.

- Inventory destocking, both in boxes and at customers’ products, is occurring across customer bases.

- The manufacturing index has remained in contraction territory for eight consecutive months.

Improvements Expected in Q3

- Despite the tough comparison period, second-quarter shipments improved almost 3% compared to Q1.

- Some improvement is expected in inventory destocking of both customer products and boxes.

- Positive momentum is expected in the current quarter, although there is one less work day compared to Q2.

Bob Mundy says,

Capital Spending

- In 2023, the company plans to wind down its capital spending on heavy projects that have been ongoing for the past ten years.

- Last year, capital spending was $824 million, but this year it is expected to be around $400 million.

- The company anticipates finishing the year with capital spending around the $400 million mark.

- For 2024, the company is already discussing the capital spending plan and expects it to be in the $400 million range, unless an outstanding opportunity arises.

- The company believes that maintaining capital spending in the $400 million range is beneficial for running the business and supports improvement opportunities and maintenance in mills and box plants.

Q & A sessions,

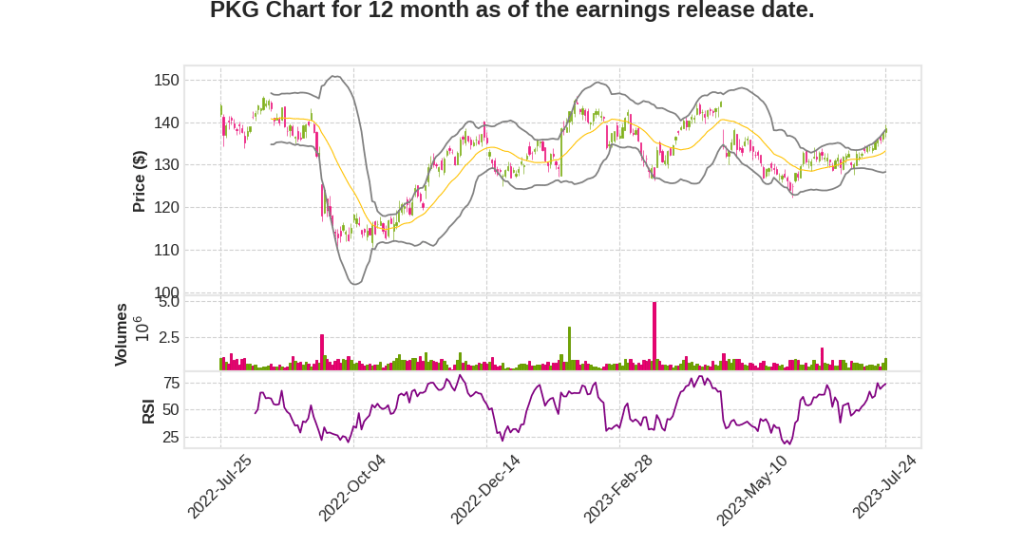

Impact on Stock’s Movement

- Strong July bookings, up 15% quarter-to-date, indicating a good start to the quarter

- Customers reporting that destocking is now over, suggesting more predictable volume going forward

- Challenging segments impacting volume: ag business, building product segment, single-use plastic products manufacturers

- Ag segment expected to recover, while e-commerce and food and beverage segments holding up better

- July trends showing more predictability and order patterns returning to pre-COVID levels

- Inventories are in a comfortable position, with the ability to flex depending on demand curves

- Cost improvement achieved through process efficiencies and practices, not capital investments

- Focused assessment of equipment running and project effectiveness leading to optimization and fine tuning