Pool Corporation

CEO : Mr. Peter D. Arvan

Quarterly earnings growth(YoY,%)

| Period | Revenue | Operating Income | EPS | Release Date |

|---|---|---|---|---|

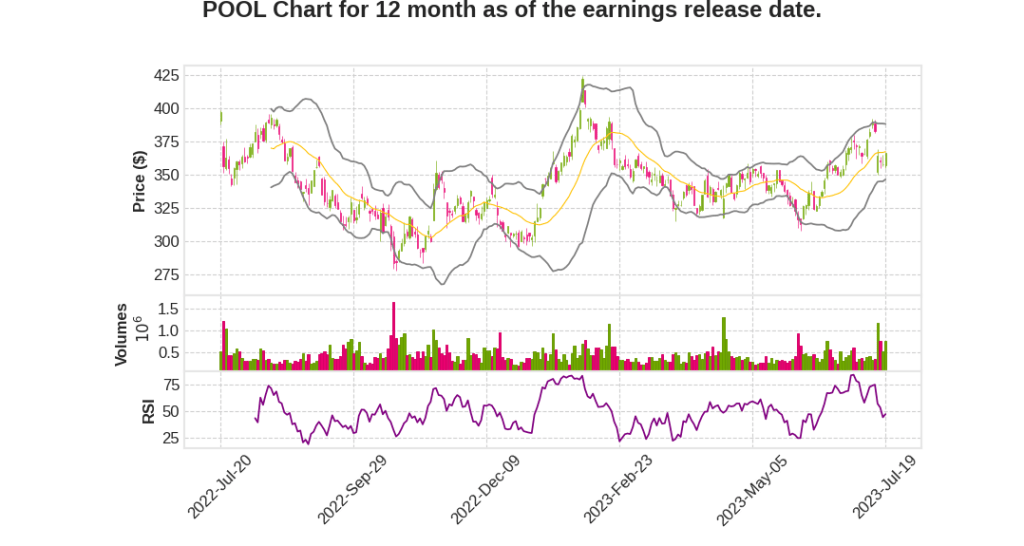

| 2023 Q2 | -9.7% YoY | -21.9% | -22.8% | 2023-07-20 |

Peter Arvan says,

Weather and Construction Challenges

- Challenging start to the year due to weather and construction pressures

- Delayed start to the pool season and shortened season due to cooler weather

- New pool construction under pressure, particularly at the lower end of the market

- Resiliency in the remodel market, with renovation outpacing new construction

Company Performance and Growth

- Recorded a strong quarter despite market conditions

- Investing in growth and focusing on customer experience

- Opened eight new sales centers and added nine new franchise stores in Japan

- Managing operating expenses in a declining demand environment

- POOL360 adoption growing and launching POOL360 water test application

Regional Sales Performance

- California sales declined 8% in Q2, but improved from Q1

- Arizona sales declined 7% in Q2, but improved from Q1

- Texas sales decreased 13% in Q2, affected by cooler temperatures and precipitation

- Florida sales decreased 7% in Q2, experiencing a slowdown in new construction

- Seasonal markets sales declined 11% in Q2, but improved from Q1

Product Sales Performance

- Equipment sales down 8% in Q2

- Chemical sales down 3% in Q2

- Building material sales down 8% in Q2

- Commercial swimming pool sales increased 8% in Q2

- Pinch A Penny franchisees reported relatively flat sales

Financials and Outlook

- Operating expenses were 13% of net sales in Q2

- Operating income for Q2 was $327 million, down compared to last year but a significant increase over 2019

- Expecting new pool construction to be down 30% in 2023

- Long-term outlook for the industry remains strong with a growing install base

Melanie Hart says,

Net Sales and Pricing

- Net sales for Q2 2023 were $1.9 billion, the second best top line in history.

- Inflation in the quarter was approximately 3% to 4%, with slightly higher inflation for equipment products.

- Overall pricing benefited from marginal price increases in chemicals.

- Trichlor prices experienced pressure, resulting in a 1% drag on net sales for the quarter.

Gross Margin and Operating Expenses

- Gross margin of 30.6% in Q2 2023 saw a 180 basis point decline compared to Q2 2022.

- Gross margin was somewhat negatively impacted by sales concession activity in response to slower season start.

- Operating expenses declined by 3% year-over-year in Q2 2023.

- SG&A cost as a percentage of net sales was 13% for the quarter, significantly better than Q1 2023.

Operating Margin and EPS

- Operating margin for Q2 2023 was 17.6%, a decrease from 20.4% in Q2 2022.

- Full year operating margin in 2023 is expected to be well above pre-pandemic levels.

- Diluted EPS, excluding ASU, was $5.89 in Q2 2023, comparable to 2021 Q2 EPS.

Inventory and Cash Flow

- Inventory reductions have been made by $186 million year-over-year.

- Cash flow from operating activities was $377 million, an increase of $348 million compared to last year.

Outlook and Future Spending

- Full year sales for 2023 are expected to be down in the range of negative 10% compared to 2022.

- Gross margin is expected to return to seasonally normalized levels in the second half of the year.

- Operating expenses will be well managed to limit full year base business expense growth to 1%.

- Anticipated spending includes acquisitions, capital expenditures, dividends, debt reductions, and share buybacks.

Q & A sessions,

New Pool Construction

- Expect new pool construction to be up around 30%, with a focus on lower-priced pools performing better than higher-priced ones

- Ability to gain share in new pool sales is consistent with previous expectations

Weather

- Poor weather in the second quarter, including a late start to the season, impacted sales

- Expectation of normal weather for the rest of the year

Consumer Buying Patterns

- Non-discretionary spend is strong, particularly in chemical sales due to hotter weather

- Consumers are deferring semi-discretionary purchases, such as pool repairs or new cleaners, due to current economic conditions and higher financing costs

Renovation and Remodel Market

- Renovation and remodel market is performing better than new construction

- Backlog of renovation projects expected to moderate

- Tile sales down 9% and pool finish sales down 2% for the year

Competition and Market Position

- Competition in the market is not new and not a concern

- Confident in maintaining and growing market share due to investments in expanding locations, value proposition, and network resources

- Vertical integration in chemical packaging and private label capabilities provide flexibility and competitive advantage

- Investments in digital tools, customer experience, and marketing to enhance service and attract customers