ResMed Inc.

CEO : Mr. Michael J. Farrell BE, MBA, SM

Quarterly earnings growth(YoY,%)

| Period | Revenue | Operating Income | EPS | Release Date |

|---|---|---|---|---|

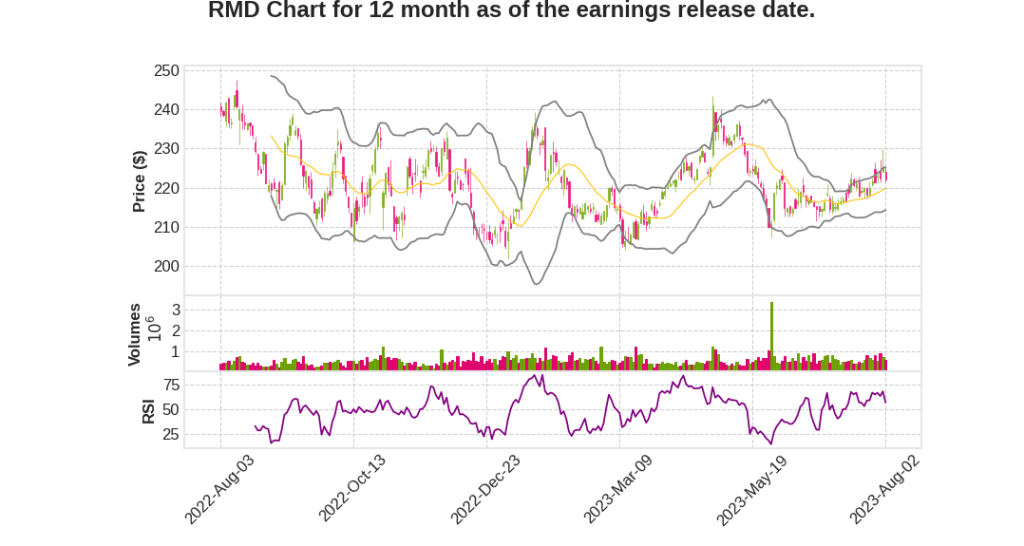

| 2023 Q4 | 22.7% YoY | 7.8% | 17.3% | 2023-08-03 |

Mick Farrell says,

Strong Growth in Devices, Masks, and Software Businesses

- Double-digit growth in devices, masks, and software businesses

- Unconstrained availability of AirSense 10 flow generated devices

- Increasing supply of AirSense 11 platform throughout fiscal year 2024 and beyond

Significant Adoption of Patient-Facing Digital Health Platforms

- Strong adoption of myAir patient app, with double the adoption rate compared to AirSense 10 platform

- High engagement with myAir app linked to higher therapy adherence and better patient outcomes

- Acquisition of Somnoware to streamline end-to-end pathway for patients and improve customer experience

Growth in Respiratory Care Business

- Strong growth in non-invasive ventilators and life support ventilator solutions

- Focus on addressing COPD as a global health epidemic

- Development of home-based high-flow therapy for treating respiratory insufficiency in the home

High Growth in SaaS Business

- Year-over-year growth of 34% in SaaS business

- Strong organic growth in Brightree and MatrixCare portfolio

- Pent-up demand for technology investments in residential medicine verticals

Improvements in Margins and Bottom Line Profitability

- Improvements in business margins with geography mix and product mix

- Transition to AirSense 11 platform and increased software solutions growth

- Higher inventory costs and freight costs expected to work their way through the supply chain

Brett Sandercock says,

Revenue and Sales

- Q4 revenue was $1.12 billion, a 23% increase compared to the prior year quarter.

- Revenue growth was driven by strong demand for cloud connected sleep devices and solid growth across the product portfolio.

- Device sales globally increased by 24% in constant currency terms, while masks and other sales increased by 18%.

- In the U.S., Canada, and Latin America, device sales increased by 30%, benefiting from strong demand and the availability of cloud connected devices.

- In Europe, Asia, and other markets, device sales increased by 15% in constant currency terms, reflecting strong demand and improved availability of cloud connected devices.

Software-as-a-Service (SaaS) Revenue

- SaaS revenue increased by 34% in the June quarter, driven by the contribution from the MEDIFOX DAN acquisition and strong performance from the HME vertical.

- Excluding the MEDIFOX DAN acquisition, SaaS revenue grew by 8%.

Gross Margin

- Gross margin declined by 200 basis points to 55.8% in the June quarter.

- This decrease was primarily due to component cost increases, warranty and manufacturing related cost increases, and product mix shifts.

- Unfavorable foreign currency movements and a lower than expected product mix benefit also impacted gross margin.

Operating Expenses

- Sales, General, and Administrative (SG&A) expenses increased by 25% (26% in constant currency terms), mainly driven by increased employee-related costs, marketing expenses, travel expenses, and the incremental expenses associated with the MEDIFOX DAN acquisition.

- SG&A expenses as a percentage of revenue was 21.5% compared to 21.1% in the prior year period.

- R&D expenses increased by 21% (23% in constant currency terms), consistent with the prior year quarter.

- R&D expenses as a percentage of revenue was 7%.

Net Income and Diluted Earnings Per Share

- Net income for the June quarter increased by 7%, and non-GAAP diluted earnings per share also increased by 7%.

- Non-GAAP adjustments included acquisition expenses, restructuring costs, and a gain from a business interruption insurance claim.

Debt and Cash Flow

- At June 30, the company had $1.4 billion in gross debt and $1.2 billion in net debt, mainly due to the funding of the MEDIFOX DAN acquisition.

- Cash flow from operations for the quarter was $237 million.

- Capital expenditure for the quarter was $34 million, and depreciation and amortization totaled $47 million.

- The company ended the quarter with a cash balance of $228 million.

- During the quarter, debt was reduced by $145 million, and the company had approximately $745 million available for drawdown under its revolver facility.

Dividend and Growth Strategy

- The Board of Directors declared a quarterly dividend of $0.48 per share, representing a 9% increase over the previous dividend.

- The company plans to reinvest in growth through R&D and deploy capital for tuck-in acquisitions.

- The recent acquisition of Somnoware, a company providing an upstream diagnostic management platform, is aligned with the company’s growth strategy.

Q & A sessions,

Global Devices Sales

- $602 million in global devices sales in Q4 2023

- 30% growth in U.S., Canada, Latin America

- 15% growth in Europe, Asia, and rest of the world

Competitor Recall

- Uncertainty around the impact of a competitor recall

- No definitive date for the end of the recall

- Potential for ResMed to experience stronger growth and take additional market share

Regional Competition

- Competition with regional competitors in Europe, Asia, and Americas

- Continued success in beating competitors and maintaining/growing market share

- Launching AI-driven products to stay ahead in the digital space

Resupply and Sustainability

- Strong growth in resupply setups globally

- Sustainability of resupply growth driven by respiratory health trends and consumer demand

- ResMed’s market share driven by excellent mask products and patient outreach programs

Gross Margin Factors

- Foreign exchange impact on inventory, resulting in a 30 basis points decrease in gross margin

- Potential for gross margin improvement through geographic and product mix, software solutions, and lower inventory costs

- Potential for gross margin improvement with the launch of AirSense 11