Steel Dynamics, Inc.

CEO : Mr. Mark D. Millett

Quarterly earnings growth(YoY,%)

| Period | Revenue | Operating Income | EPS | Release Date |

|---|---|---|---|---|

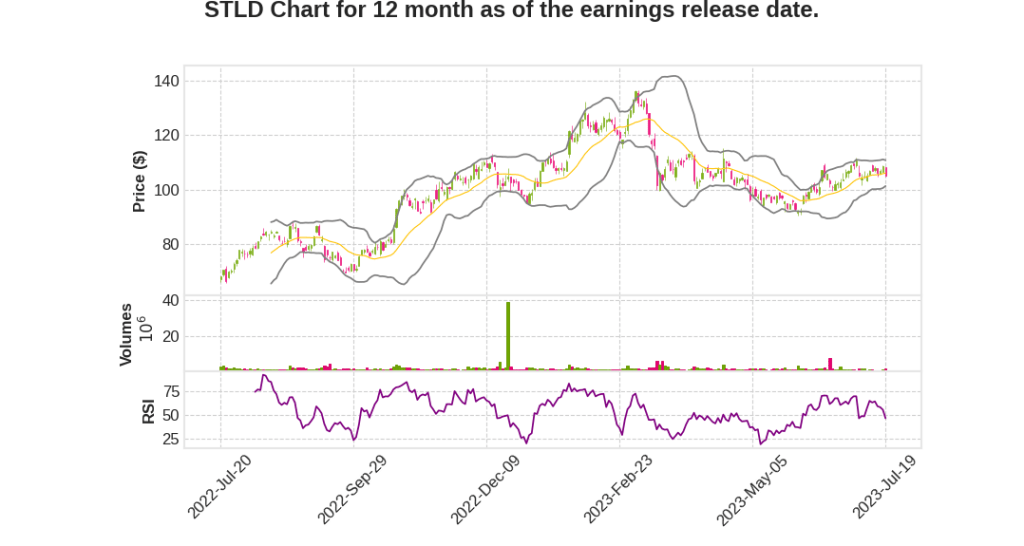

| 2023 Q2 | -18.2% YoY | -34.3% | -25.6% | 2023-07-20 |

Theresa Wagler says,

Financial Performance

- Net income for Q2 2023 was $812 million or $4.81 per diluted share.

- EBITDA for Q2 2023 was $1.1 billion.

- Revenues for Q2 2023 were $5.1 billion, driven by increased realized steel selling values.

- Operating income for Q2 2023 was $1.1 billion, 27% higher than Q1 2023.

Steel Operations

- Steel operations generated strong operating income of $706 million in Q2 2023 due to metal spread expansion and near-record shipments of 3.2 million tons.

- Realized increased pricing and metal spread across both flat-rolled and long product steel operations.

Metals Recycling Operations

- Operating income from metals recycling operations was $40 million, consistent with Q1 2023 results.

- Increased shipments offset by lower metal spreads.

- Mexico recycling operations provide a competitive advantage for reliable supply and future increased scrap aluminum collection.

Steel Fabrication Operations

- Operating income for steel fabrication operations was $462 million in Q2 2023.

- Average pricing decreased 13% and volumes were steady.

- Steel joist and deck order backlog extends into Q1 2024.

- Backlog pricing remains strong and spot pricing remains resilient.

Capital Allocation and Cash Flow

- Liquidity as of June 30 was $3.5 billion.

- Cash flow from operations for the first half of 2023 was $1.5 billion.

- Capital investments for the second half of the year are expected to be in the range of $1 billion, primarily for aluminum flat-rolled investments and completion of four flat-rolled steel coating lines.

- Cash dividend was increased by 25% in February 2023.

- $606 million remained authorized for share repurchases under existing program.

Sustainability and Carbon Reduction

- Company is committed to carbon neutrality and has an actionable path towards achieving it.

- Sustainability and carbon reduction strategy is an ongoing journey.

Mark Millett says,

Financial Performance

- Cash from operations: $808 million

- EBITDA generation: $1.2 billion

- Improved investment-grade credit ratings

Aluminum Flat-Rolled Investments

- Making significant progress on investments

- Excitement within prospective customer base for supply chain solutions

- New and innovative offerings from a differentiated supplier

Safety Performance

- Continued safety improvement

- 81% of facilities incident-free in the quarter

- Focus on providing the best health, safety, and welfare for employees

- Team’s safety performance ahead of industry averages

- Goal of achieving zero injuries

Q & A sessions,

Steel Fabrication Business

- Continued strong performance with high expectations for the business

- Non-residential construction markets expected to remain strong

- Order backlog remains strong, extending into January 2024

- Expect second half 2023 volumes to be comparable to first half shipments

- Average pricing expected to remain elevated but possibly decrease 10-15% from the first half of the year

Metals Recycling Business

- Achieved a strong second quarter despite price declines

- Expect scrap pricing to fluctuate modestly in the second half of the year

- Mexican volumes provide a competitive advantage for raw materials

- Partnering with steel and aluminum teams to expand scrap segregation capabilities

- Increased recycled content of aluminum sheet products for margin enhancement

Steel Operations

- Record shipments of 3.2 million tons in the second quarter

- Steel production utilization rate of 93% compared to domestic industry rate of 76%

- Value-added diversified product offerings and supply chain solutions driving customer preference

- Strong backlog and good customer order entry

- Expectations of higher auto production output in 2023

Sinton Mill

- Achieved positive EBITDA for the second quarter

- Experienced equipment issues with the cast, but repairs underway

- Expect to restart and progressively ramp up to 80% run rate by the end of the year

- Market acceptance of the mill and strong customer interest

- Expected to add $650 million to $700 million of through-cycle annual EBITDA to the company

Expansion into Aluminum

- Developing a 650,000 metric ton aluminum flat roll facility in Columbus, Mississippi

- Serving sustainable beverage and packaging markets, including body and automotive sectors

- Targeting 300,000 tons of can, 200,000 tons of auto, and 150,000 tons of industrial product

- Maximizing aluminum recycled content and expanding scrap processing capabilities

- Expected rolling mill start-up around mid ’25 with total project cost of $2.5 billion