Teledyne Technologies Incorporated

CEO : Dr. Robert Mehrabian

Quarterly earnings growth(YoY,%)

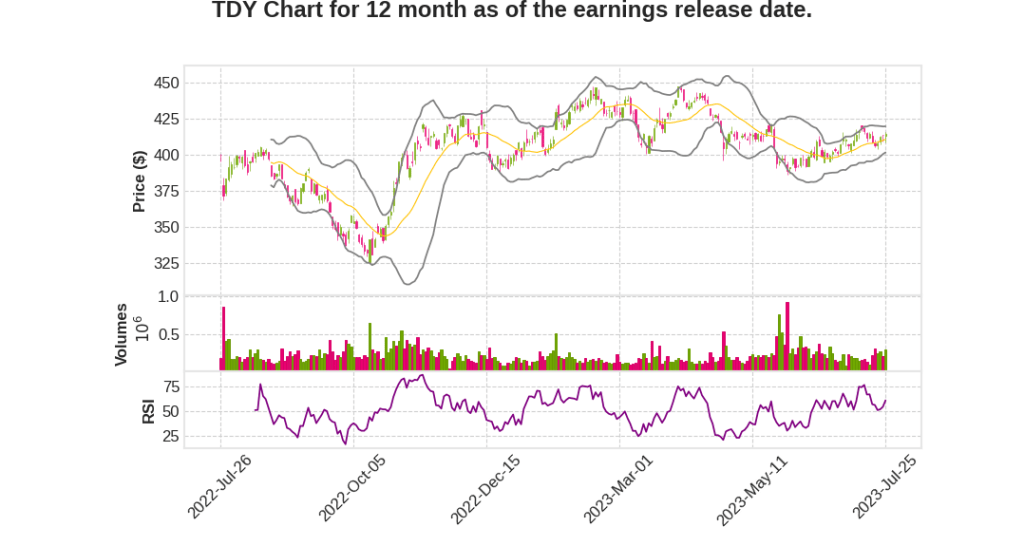

| Period | Revenue | Operating Income | EPS | Release Date |

|---|---|---|---|---|

| 2023 Q2 | 5.1% YoY | 11.6% | 7.7% | 2023-07-26 |

Robert Mehrabian says,

Record Breaking Performance in Q2 2023

- All-time record quarterly sales, increasing by 5.1%

- Year-over-year increase in sales, GAAP and non-GAAP operating profit, and operating margin in every segment

- GAAP operating margin of 18% and non-GAAP operating margin of 21.4%, both second quarter records

- GAAP earnings per share of $3.87 and non-GAAP earnings per share of $4.67, both second quarter records

- Consolidated leverage ratio declined to 2.1x

Performance of Teledyne FLIR

- Significant improvement in order book and backlog

- Order-to-sales ratio of 1.18x for FLIR and 1.5x for FLIR Defense

- Large orders include Black Hornet Nano UAV for U.S. Military, additional UAVs for European customers, counter UAV systems, missile systems, and surveillance imaging systems

- Charges announced for further reduction in FLIR operating footprint and related headcount

2023 Sales and Earnings Outlook

- Reaffirming prior 2023 full year sales and non-GAAP earnings outlook

- Excluding $10 million to $12 million charges

- Total 2023 growth of approximately 5% or sales of approximately $5.73 billion

- Third quarter sales estimated at roughly $1.4 billion

- Non-GAAP earnings of $19.10 at the midpoint of guidance

Segment Performance

- Digital Imaging segment: 2.3% increase in sales, higher sales of X-ray products, commercial infrared imaging components and solutions, and industrial scientific cameras

- Instrumentation segment: 5.1% increase in sales, growth in marine instruments, electronic test and measurement systems, and flat sales in environmental instruments

- Aerospace and Defense Electronics segment: 10.2% increase in sales, driven by growth in Defense Electronics and Commercial Aerospace products

- Engineering Systems segment: 18.5% increase in revenue, with operating profit increasing by 33.7%

Sue Main says,

Cash Flow and Capital Expenditures

- Cash flow from operating activities was $190.5 million in Q2 2023.

- Free cash flow was $163.2 million in Q2 2023, compared to $176.1 million in 2022.

- Capital expenditures were $27.3 million in Q2 2023, compared to $20.8 million in 2022.

Net Debt and Stock-based Compensation Expense

- The company ended Q2 2023 with approximately $2.99 billion of net debt.

- Stock-based compensation expense was $8.4 million in Q2 2023, compared to $6.4 million in 2022.

Outlook for Q3 2023

- Management expects GAAP earnings per share in the range of $3.76 to $3.90.

- Non-GAAP earnings per share are expected to be in the range of $4.70 to $4.80.

Outlook for Full Year 2023

- The company’s GAAP earnings per share outlook for the full year 2023 is $15.60 to $15.88.

- Non-GAAP earnings per share outlook is maintained at $19 to $19.20.

- The full year 2023 estimated tax rate, excluding discrete items, is expected to be 22.3%.

Q & A sessions,

Impact on Digital Imaging Segment

- Organic growth declined by 1.5% year-over-year, mainly due to government programs in digital imaging, particularly in FLIR.

- Successful orders for products in Europe and the US stabilized the business.

- Expansion in healthcare and medical sectors offset the decline in certain parts of digital imaging.

Margin Outlook

- Second quarter Digital Imaging margin increased by 28 basis points year-over-year.

- Full-year margin is expected to be relatively flat, possibly down 10-15 basis points.

- Aerospace and Defense segment projected to have 80 basis points expansion in margin for the year.

Impact on Healthcare Business

- Significant expansion in the healthcare sector, particularly in X-ray products and components.

- Some slowdown observed in China, but less than 10% of the portfolio is sold to China.

- Balance portfolio helps mitigate any potential negative impact from China’s contraction.

Debt Repayment and Acquisition Strategy

- Net debt-to-EBITDA ratio currently at 2.1%, with $60 million remaining in variable debt.

- Interest payments expected to be 2.1% in future years.

- Bullish on acquisitions, with potential for larger acquisitions in the general instrumentation area.

Q2 2023 Earnings Performance

- All-time record quarterly sales, with overall sales increasing by 5.1%.

- GAAP and non-GAAP operating margins increased year-over-year in every segment.

- GAAP operating margin of 18% and non-GAAP operating margin of 21.4%.

- GAAP earnings per share of $3.87 and non-GAAP earnings of $4.67.

- Continued debt repayment, leading to a decline in consolidated leverage ratio to 2.1x.