Targa Resources Corp.

CEO : Mr. Matthew J. Meloy

Quarterly earnings growth(YoY,%)

| Period | Revenue | Operating Income | EPS | Release Date |

|---|---|---|---|---|

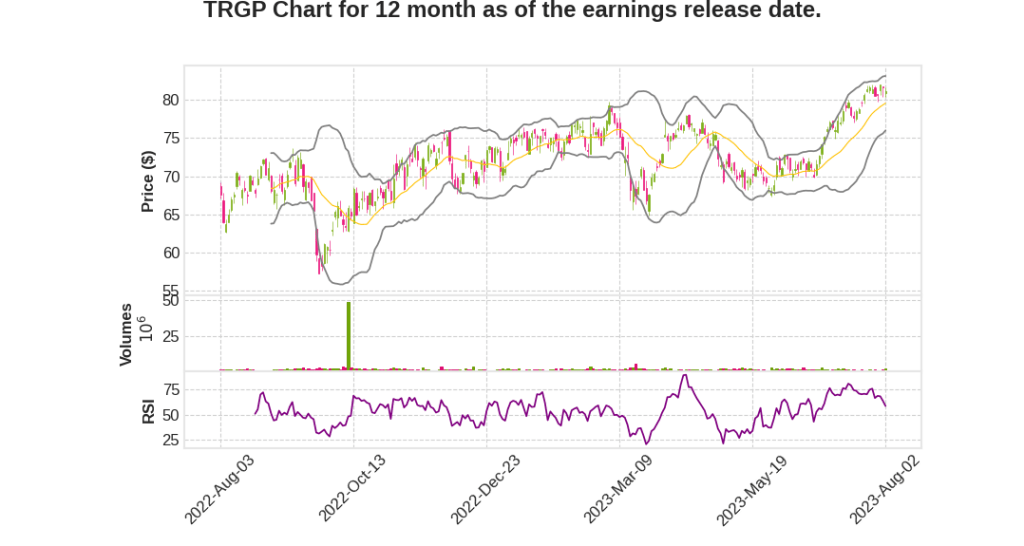

| 2023 Q2 | -43.8% YoY | 43.6% | -12.2% | 2023-08-03 |

Matt Meloy says,

Record volumes and consistent performance

- Second quarter results were consistent with expectations, driven by the strength of the business.

- Record volumes in the Permian region, leading to record NGL transportation and fractionation volumes downstream.

- Adjusted EBITDA expected to ramp over the rest of the year, with a full-year estimate of $3.5 billion to $3.7 billion.

New plant announcements

- Official announcement of new plants in Permian Midland and Permian Delaware to support infrastructure needs of producer customers.

- Continued growth CapEx spending estimated at between $2 billion and $2.2 billion for 2023.

- Projects remain on track and on budget.

Permian operations and activity

- Average reported inlet volumes across Midland and Delaware basins reached a record 5.1 billion cubic feet per day.

- Legacy II Plant in Permian Midland fully operational, with next Midland plant (Greenwood) on track to begin operations in late Q4 2023.

- Midway plant in Permian Delaware commenced operations and is expected to increase processing capacity.

Logistics and Transportation segment

- Record NGL pipeline transportation volumes and fractionation volumes during the second quarter.

- Expected restart of GCF and commencement of Train 9 fractionator in Mont Belvieu in 2024.

- Train 10 fractionator expected to be operational in 2025.

Long-term outlook and strategic priorities

- Focus on growing EBITDA, growing the dividend, and reducing share count while maintaining leverage within target range.

- Positive outlook for Targa, with a unique value proposition for shareholders and potential shareholders.

Scott Pryor says,

Demand and Spot Opportunities

- In the second quarter, the company experienced less spot opportunities due to a decrease in arbitrage opportunities in the marketplace.

- Headwinds in freight economics have tightened things up and impacted overall demand.

Third Quarter Outlook

- The company expects to extend existing contracts and add new contracts to their portfolio in the third quarter.

- The expansion project coming online in the third quarter is expected to provide additional benefits.

- Despite downtime for mandatory inspections, third quarter volumes are expected to be similar or better than the second quarter.

Fourth Quarter Outlook

- With the expansion project online and a ramp-up in demand, the company anticipates a positive outlook for the fourth quarter.

- Seasonal demand typically seen in the fourth quarter and first quarter further supports the positive outlook.

- Volumes through the company’s systems are expected to continue ramping up.

Q & A sessions,

Capital Spending on Daytona Project

- Most of the spending on the Daytona project will occur next year.

- The spending includes two fractionators, Train 9 and Train 10, as well as investments in GCS this year.

- This higher-than-normal spending on fractionation and NGL pipeline will taper off once Train 9 and Train 10 are online by the end of 2024.

Return of Capital and Dividend Growth

- Targa’s focus is on investing in its core business to generate good returns.

- The company plans to invest in both the G&P side and the downstream side to ensure volume to customers and drive EBITDA growth.

- This strategy will enable Targa to continue returning capital to shareholders through dividends and share repurchases.

- Targa repurchased a significant amount of shares in the second quarter.

Return on Invested Capital (ROIC)

- Targa has achieved a 26% ROIC on its investments in its core business.

- The company expects the returns on its future projects to be well in excess of its cost of capital.

- Organic growth is typically described as a 5 to 7 times multiple, but Targa aims to achieve a lower-end multiple of 4 to 5 times.

- The overall multiple may be influenced by commodity prices during the investment period, but Targa is becoming less commodity price sensitive.

Impact of Ethane Market and Pricing

- Targa benefited from the volatile ethane market in July, as it was able to utilize its storage position to take advantage of price spikes.

- The market has since balanced out, with prices returning to more moderate levels.

Propane Market and Inventory

- Propane pricing is currently down compared to recent levels, partly due to higher inventories.

- Global demand for propane is increasing, particularly in China with its PDH plant.

- The industry has adequate inventory levels, and the addition of more vessels for LPGs indicates market demand for increased propane exports.