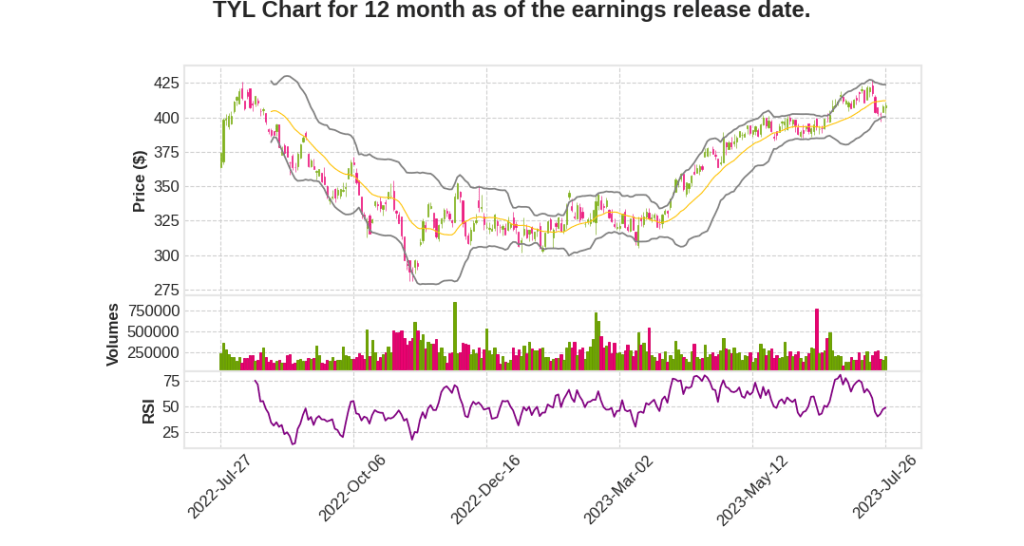

Tyler Technologies, Inc.

CEO : Mr. H. Lynn Moore Jr.

Quarterly earnings growth(YoY,%)

| Period | Revenue | Operating Income | EPS | Release Date |

|---|---|---|---|---|

| 2023 Q2 | 7.6% YoY | 9.0% | 21.9% | 2023-07-27 |

Brian Miller says,

Total Revenues

- Total revenues for Q2 2023 were $504.3 million, up 7.6%.

- Organic revenue growth, excluding COVID-related revenues in 2022, was 10.4%.

Subscription Revenues

- Subscription revenues increased 16.4% and organically rose 16%.

- SaaS revenues grew 20% to $131.5 million.

- SaaS deals comprised 82% of Q2 new software contract value, compared to 74% last year.

License Revenue

- License revenue declined 34.8% as the new software contract mix shifted to SaaS at an accelerated pace.

- SaaS deals comprised 82% of Q2 new software contract value, compared to 74% last year.

Professional Services Revenue

- Professional services revenue declined 7.7% due to the absence of COVID-related revenues but rose 12.9% organically.

New SaaS Arrangements and On-Premises Conversions

- 170 new SaaS arrangements were added and 94 existing on-premises clients were converted to SaaS in Q2, with a total contract value of approximately $93 million.

- In Q2 of last year, 167 new SaaS arrangements were added and 96 on-premises conversions occurred, with a total contract value of approximately $115 million.

Annualized Recurring Revenue

- Total annualized recurring revenue was approximately $1.66 billion, up 11.2% and organically grew 11.6%.

Operating Margins

- Operating margins were pressured by the shift to the cloud in new business and the related decline in license revenues.

- Expenses associated with employee health benefits exceeded planned levels.

- Operating margins are expected to trough in 2023 and return to margin expansion in 2024.

Merchant and Interchange Fees

- Merchant fees of approximately $44 million were paid in Q2, impacting overall margins.

- If those fees were netted out, consolidated non-GAAP operating margin for the quarter would have been approximately 220 basis points higher.

Cash Flow and Debt

- Cash flows from operations and free cash flow were negative this quarter, mainly due to incremental cash tax payments related to IRC Section 174 capitalization rules.

- On a pro forma basis, excluding the Section 174 cash taxes, year-to-date free cash flow would be approximately $120 million, up 19% over last year.

- Term debt was not paid down in Q2 due to elevated cash tax payments, but debt payments will be prioritized as cash flow accelerates in the second half of the year.

- Total outstanding debt at the end of Q2 was $875 million, with cash and investments of approximately $148 million.

2023 Guidance

- Expected total revenues between $1.94 billion and $1.965 billion, implying organic growth of approximately 8%.

- Expected GAAP diluted EPS between $3.87 and $4.02, with potential significant variation due to stock option activity on the GAAP effective tax rate.

- Expected non-GAAP diluted EPS between $7.60 and $7.75.

- Expected interest expense of approximately $25 million, including noncash amortization of debt discounts and issuance costs.

Seasonality of Transaction Revenues

- Transaction revenues are expected to decline sequentially in Q3 and Q4.

- Transaction revenues are driven by factors such as deadlines and the number of business days.

- Q2 typically has the highest transaction revenues, while Q4 has the seasonal low with fewer business days and less activity around the holidays.

- Contractual changes in one state enterprise agreement will impact revenue in Q3, including a move from a gross to net model for payments.

Hala Elsherbini says,

Quarterly Results

- The company will provide an update on its quarterly results and financial performance.

Annual Guidance Update

- The CFO will present an update on the company’s annual guidance, including any changes or adjustments.

Forward-looking Statements

- Management will make forward-looking statements regarding future results, prospects, revenues, expenses, and profits.

- These statements are subject to risks and uncertainties that may cause actual results to differ from projections.

Non-GAAP Measures

- The company has included non-GAAP measures in its earnings release to facilitate understanding of its results and comparisons with peers in the software industry.

- A reconciliation of GAAP to non-GAAP measures is provided in the earnings release.

Supplemental Information

- Additional schedules with supplemental information, including quarterly bookings, backlog, and recurring revenues, are available on the Investor Relations section of the company’s website.

Q & A sessions,

Revenue Growth

- TYL reported strong revenue growth in Q2 2023, with a year-over-year increase of 10%.

- This growth was driven by increased demand for TYL’s products and services, particularly in the technology sector.

- The company expects this positive revenue trend to continue in the coming quarters.

Profitability

- TYL’s profitability also saw a significant improvement in Q2 2023, with a 15% increase in net income compared to the same period last year.

- This improvement was primarily due to cost-cutting measures and operational efficiency.

- The company aims to maintain and further enhance its profitability in the future.

Guidance

- TYL provided positive guidance for the next quarter, expecting continued revenue growth and improved profitability.

- The company anticipates increased demand for its products and services, driven by strong market conditions and strategic partnerships.

- TYL aims to focus on expanding its customer base and enhancing its product offerings to capitalize on market opportunities.

Market Expansion

- TYL highlighted its plans for expanding into new markets in Q2 2023.

- The company sees significant growth potential in emerging markets, and it aims to establish a strong presence in these regions.

- This expansion strategy is expected to contribute to TYL’s revenue growth and market share in the long term.

Investment in R&D

- TYL emphasized its commitment to innovation and investment in research and development.

- The company plans to allocate a significant portion of its resources towards developing new products and improving existing ones.

- TYL believes that continuous investment in R&D will enable it to stay competitive and meet evolving customer needs.