West Pharmaceutical Services, Inc.

CEO : Mr. Eric M. Green

Quarterly earnings growth(YoY,%)

| Period | Revenue | Operating Income | EPS | Release Date |

|---|---|---|---|---|

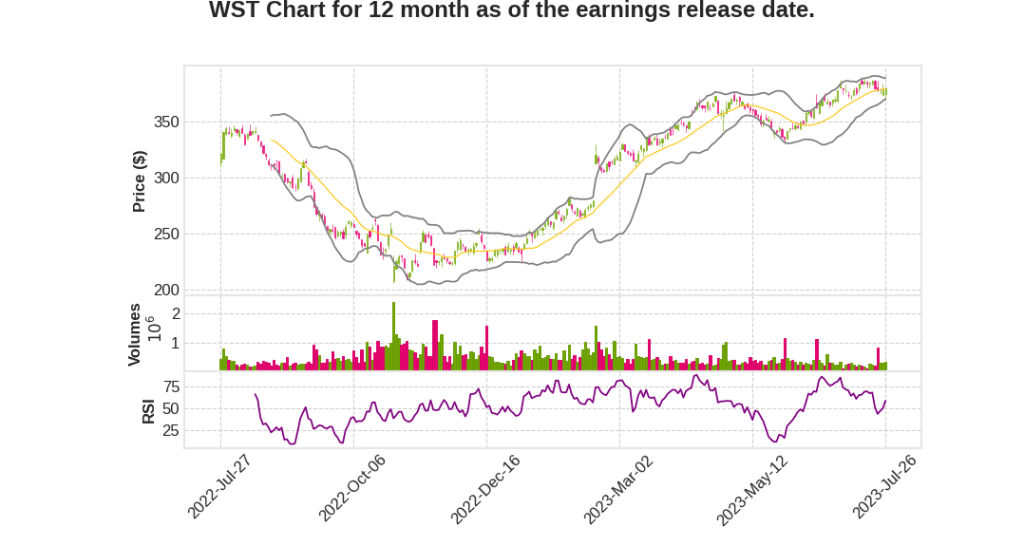

| 2023 Q2 | -2.3% YoY | -20.1% | -17.8% | 2023-07-27 |

Dave Ruud says,

Financial Results

- Operating earnings for Q2 2023 were $206 million, translating to $0.99 per share.

- DTE Electric earnings were $178 million, $8 million lower than Q2 2022, primarily due to cooler weather and lower residential sales.

- DTE Gas operating earnings were $24 million, $18 million higher than Q2 2022, driven by cost reductions and increased revenue from IRM.

- DTE Vantage operating earnings were $26 million, a decrease of $2 million from Q2 2022, mainly due to planned outage timings at renewables plants.

- Energy Trading earnings were $36 million, $29 million higher than Q2 2022, attributed to timing variability and contract premiums in the physical power portfolio for 2023.

- Corporate and Other earnings were unfavorably impacted by $2 million due to higher interest expense.

2023 Guidance

- Overall EPS guidance for 2023 remains on track to achieve the midpoint of the guidance range.

- DTE Electric is facing headwinds, including lower rate orders and unfavorable weather, which may cause it to fall below the guidance range.

- Favorability is expected in other business units, with DTE Gas benefiting from one-time cost reductions, DTE Vantage from stronger pricing and additional projects, and Energy Trading from contracted power portfolio and hedging.

- All business units have implemented one-time cost reductions.

- The company plans to achieve the midpoint of operating EPS guidance range for DTE and will update business unit guidance after summer weather plays out.

- Guidance assumes average weather for the remainder of the year without contingencies.

- The company remains focused on delivering long-term EPS growth and premium returns for shareholders.

Capital Plan and Outlook

- The company’s capital plan supports long-term operating EPS growth, cleaner generation, increased reliability, and customer affordability.

- The plan targets 6% to 8% operating EPS growth through 2027 and a dividend growing in line with operating EPS.

- Utility regulatory filings are advancing, and the company is pursuing a constructive settlement in the electric rate case.

Gerry Norcia says,

Continued surge of tree trim

- Expecting the surge to end in two years

- Transitioning to a maintenance cycle

Pull-top maintenance

- Replacing press arms, insulators, and equipment

- Significant part of the plan for the aging system

Automation

- Aiming for full automation of the grid in five years

- Increasing storms necessitate automation for outage restoration

Replacement of old grid

- 1/3 of the grid is outdated (4,800 volt system)

- Installed from the early 1900s through the ’60s

- Plan to replace approximately 16,000 miles over the next 15 or 20 years

Q & A sessions,

Transportation electrification

- The company sees transportation electrification as a valuable opportunity for several reasons.

- It believes that it is great for the environment, as the transportation sector is currently the largest emitter of carbon in the economy.

- The company expects transportation electrification to become a significant contribution to margin growth near the end of its 5-year plan.

Investment opportunity

- The company sees an investment opportunity in transportation electrification.

- As more load comes on, it creates headroom for investments and helps finance large investments being made to prepare for electrification and deal with inclement weather.

Supportive stakeholders

- The company is happy that its new commissioner, as well as the other two commissioners, are supportive of the electrification agenda.

- The administration is also supportive of electrification.

Impact on the 5-year plan

- Transportation electrification is expected to become more impactful in the company’s plan from a margin creation perspective later in the 5-year period.

Investments already being made

- The company is already investing against the opportunity presented by transportation electrification.