Zebra Technologies Corporation

CEO : Mr. William J. Burns

Quarterly earnings growth(YoY,%)

| Period | Revenue | Operating Income | EPS | Release Date |

|---|---|---|---|---|

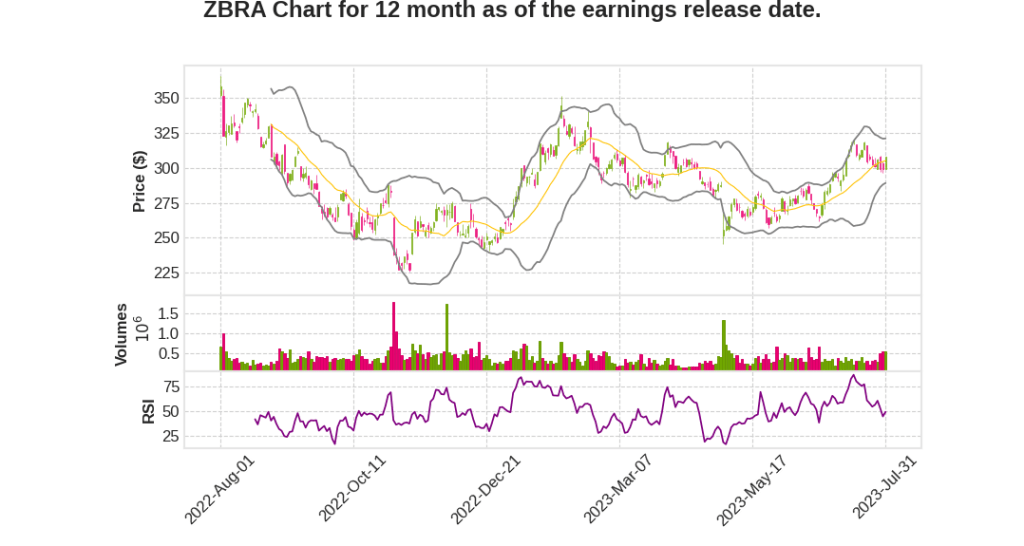

| 2023 Q2 | -17.3% YoY | -69.4% | -248.9% | 2023-08-01 |

Bill Burns says,

Weak Second Quarter Results

- Sales of $1.2 billion, a 16% decline from the prior year

- Adjusted EBITDA margin of 21.2%, a 70 basis point decrease

- Non-GAAP diluted earnings per share of $3.29, a 29% decrease from the prior year

Impact of Weakening Demand and Cautious Customer Spending

- Weakening demand and cautious customer spending across all end markets

- Retail and e-commerce and transportation logistics experienced the weakest demand

- Approximately 20% of Q2 sales decline attributed to distributors reducing inventory levels

- Global macro indicators resilient, but goods economy underperforming services economy

- Mobile computing sales declines accelerated following strong demand in previous years

Actions Taken to Address Challenges

- Reducing spending across the organization, including additional restructuring actions for $65 million in annualized savings

- Increasing focus on growth in underpenetrated markets

- Continuing to digitize and automate customer environments

Revised Full-Year Outlook

- Incorporates slowdown and deceleration across end markets

- Significant reduction in near-term demand in mobile computing market

- Destocking by distributors

- Partial year benefit of expanded restructuring actions

- Not expecting a recovery in 2023

Conclusion

- Taking agile approach to manage through uncertain near-term environment

- Expect reset of cost structure and shift of go-to market resources to drive sales growth and improved profitability as end markets recover

Joe Heel says,

Larger customers experiencing larger declines

- The declines in larger customers were larger than in mid-tier and small run-rate business.

- Deals worth hundreds of millions of dollars have been pushed out to the future or disappeared altogether.

Behavior acceleration in Q2

- The behavior of pushing out deals has accelerated in the second quarter.

- In North America, the amount of push-outs relative to the first quarter has tripled.

Examples of push-outs

- A grocer planned to buy $4 million worth of mobile computers in Q2 but decided to postpone the deal to Q3.

- Another grocer planned to buy over $5 million worth of mobile computers in Q2 but requested to spread the purchase over the next five quarters.

- A DIY retailer planned to buy $7 million worth of products in Q2 but had to cut budgets and postpone the project indefinitely.

Customers’ budget pressures

- The push-outs indicate that customers’ budgets are under pressure.

- Customers are trying to extend the timeline for purchasing, which negatively impacts revenue.

Q & A sessions,

Long-term Growth Drivers

- Zebra’s solutions are essential for customers to digitize and automate workflows.

- Secular trends such as automation, mobility, cloud computing, and artificial intelligence drive customer growth strategies.

- Zebra’s enterprise mobile computers are critical to the front line of business and offer significant value.

- Zebra’s RFID solutions are experiencing strong double-digit growth, with expanding use cases throughout the supply chain.

- Investments in machine vision business position Zebra for long-term growth, particularly in warehouse distribution and electric vehicle manufacturing.

- Workflow optimization software offerings, including workforce and task management, communication and collaboration tools, and demand planning, are expected to become EBITDA margin accretive in 2024.

Near-term Demand Challenges

- Sales are currently pressured due to the overall industrial economy slowdown in goods and not services.

- Customers are absorbing capacity bought during the pandemic, leading to reduced demand for Zebra’s solutions.

- Slowing consumer purchases and a reset of e-commerce activity contribute to the decline in transportation logistics and package delivery volume.

- In addition to large customers, mid-tier and smaller customers are also experiencing a slowdown in demand.

Guidance and Expectations

- Demand trends are expected to continue to deteriorate in Q3 and Q4.

- Significantly lower conversion of opportunities within the pipeline is anticipated due to push-outs of large orders by customers.

- Inventory destocking levels will contribute to softer demand in Q3, while Q4 is expected to see less destocking.

- An oversize effect of distributors’ destocking inventory levels is observed as end demand slows.

- An inflection point in demand is expected in 2024, with an exit from year-end at the appropriate inventory levels for distributors’ demand.