Palo Alto Networks, Inc.

CEO : Mr. Nikesh Arora C.F.A.

Quarterly earnings growth(YoY,%)

| Period | Revenue | Operating Income | EPS | Release Date |

|---|---|---|---|---|

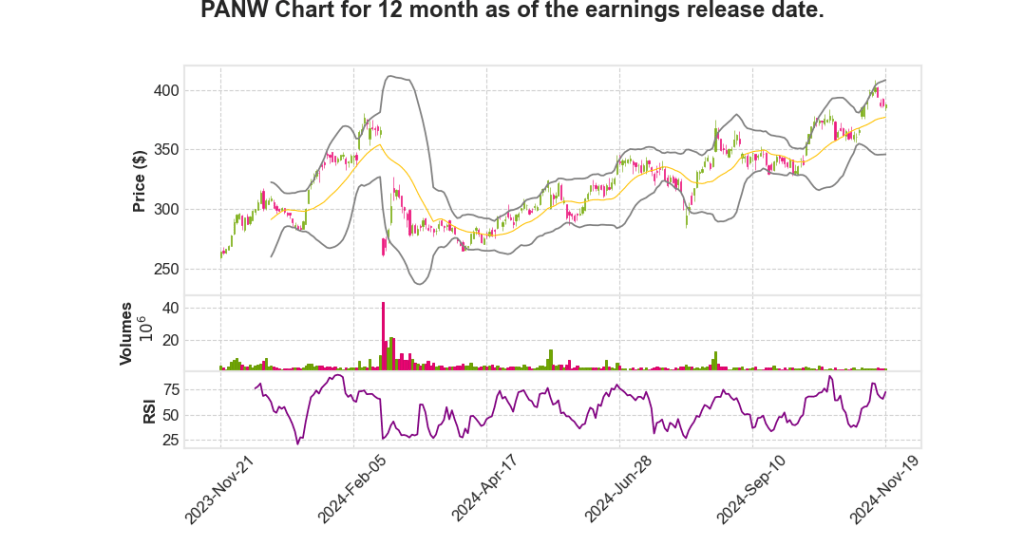

| 2025 Q1 | 13.9% YoY | 33.1% | 69.8% | 2024-11-20 |

Nikesh Arora says,

Financial Performance and Guidance

- Next-Generation Security (NGS) Annual Recurring Revenue (ARR) grew by 40% to over $4.5 billion, exceeding industry expectations.

- Operating margins expanded by 60 basis points year-over-year, reflecting improved efficiencies.

- Reported a 13% increase in Earnings Per Share (EPS) and strong cash generation, surpassing EPS guidance.

- Raised full-year fiscal 2025 guidance for NGS ARR, revenue, and EPS.

Platformization and Strategic Deals

- Achieved approximately 1,100 platformizations in Q1, with a third derived from the QRadar SaaS acquisition.

- Established significant deals, including a $50 million transaction with a large tech firm and a $15 million deal with a national hospital system.

- Reported 305 transactions over $1 million, up 13%, and 60 transactions over $5 million, up 30% this quarter.

- Projected 2,500 to 3,500 platformization deals by fiscal year 2030.

Innovation and Product Development

- Expanded Prisma Access with over 115 new customers and 1 million licenses since acquiring Talon Cybersecurity.

- Launched Strata Copilot leveraging AI to enhance customer support and decision-making processes.

- Released enhancements for operational technology (OT) environments, driving growth in AI-powered security solutions.

- Integrated Talon browser technology into the Prisma Access Browser, enhancing security for unmanaged devices.

Focus on AI and Automation

- AI-powered platforms for security operations, network, and cloud security, offering real-time security capabilities.

- Released more than 400 machine-learning detection modules for XSIAM, targeting autonomous security operations.

- Sold millions of cloud detection and response agents, driving a 15% increase in combined Prisma Cloud and Cortex customer base.

- Continued development in AI Copilots for Prisma Cloud and Cortex to facilitate machine-led security operations.

Strategic Outlook and Long-Term Vision

- Focus on platformization to drive sustainable and profitable growth, with investments in innovation and capability expansion.

- Expected convergence towards fewer platformization players in the cybersecurity industry over the next 5-10 years.

- Announced a two-for-one stock split to enhance stock accessibility for employees and investors.

- Dedicated to leading the cybersecurity market in integrating AI and platform solutions, positioning for long-term leadership.

| Metric | Performance |

|---|---|

| NGS ARR Growth | 40% to $4.5 billion |

| Operating Margin Expansion | 60 basis points |

| EPS Growth | 13% |

| Platformizations | 1,100 in Q1 |

| Large Transactions Over $1M | 305, up 13% |

| Large Transactions Over $5M | 60, up 30% |

Dipak Golechha says,

Q1 Earnings Highlights

- Total revenue for Q1 was $2.14 billion, representing a 14% growth, exceeding the high end of guidance.

- Product revenue increased by 4%, while services revenue grew by 16%, with subscription revenue up 21% and support revenue rising 8%.

- Revenue growth was strong across geographies: Americas grew 12%, EMEA increased by 21%, and JAPAC was up 13%.

- Gross margin was slightly down to 77.3% due to new SaaS offerings that haven’t yet fully scaled.

Key Financial Metrics and Changes

- NGS ARR surged 40% to $4.52 billion, with a $74 million contribution from QRadar SaaS acquisition.

- Total RPO increased by 20% to $12.6 billion, with $68 million added from QRadar SaaS.

- Current RPO grew 18% to $5.9 billion; average contract duration remains at about three years.

- Operating margin expanded by 60 basis points, contributing to increased earnings per share.

Guidance for Fiscal Year 2025

- NGS ARR expected to rise to $5.52 billion – $5.57 billion, a 31% to 32% increase.

- Revenue forecasted to be in the range of $9.12 billion to $9.17 billion, marking a 14% growth.

- Operating margins projected to be between 27.5% and 28%.

- Diluted non-GAAP EPS anticipated to increase by 10% to 13%, ranging from $6.26 to $6.39.

Q2 Fiscal Guidance

- NGS ARR projected between $4.70 billion and $4.75 billion, indicating a 35% to 36% increase.

- Revenue expected in the range of $2.22 billion to $2.25 billion, a 12% to 14% rise.

- Diluted non-GAAP EPS predicted to be $1.54 to $1.56, representing a 5% to 6% increase.

Important Stock and Strategic Developments

- A two-for-one stock split was announced, effective after trading on December 13, 2024.

- The stock split is aimed at making it more accessible to employees and a broader group of investors.

Q & A sessions,

Margin Expansion Strategies

- Cloud Cost Management: Leveraging deals with two major cloud providers to maintain margins similar to on-prem solutions.

- Reduction in Cost of Sales: The company’s strategy of securing large deals instead of multiple smaller ones reduces the incremental costs associated with sales efforts.

- Customer Support Automation: Implementation of support Copilots and training models improves the resolution time of support tickets, potentially reducing costs further.

Growth in Hardware and Market Share

- Steady Growth: The hardware segment is experiencing steady demand, particularly for ruggedized and IoT use cases.

- Market Share Increase: The company expects its market share in hardware firewalls to grow by 200 to 300 basis points annually.

- Evolutionary Strategy: Focus on gradual market share acquisition as opposed to revolutionary changes.

AI and Security Trends

- AI Utilization: AI is becoming a critical tool both for identifying infrastructure vulnerabilities and improving security posture.

- Increased Cybersecurity Spend: The evolving AI landscape prompts higher spending from CIOs to counter the growing sophistication of attacks.

- Top-Down Motion: Emphasis on higher-level engagement with CIOs and C-level executives to drive sales through consolidation.

SIEM Market and XSIAM Growth

- SIEM Opportunity: The company is positioned to capitalize on a $20 billion SIEM market undergoing a replacement cycle for legacy systems.

- Cortex Progress: Achieved $1 billion in Annual Recurring Revenue (ARR) with Cortex, marking it as the fastest-growing product in their history.

- Improved Security Posture: Offering more effective SIEM solutions that reduce the median time to remediate from days to hours.

SASE Market and Strategic Partnerships

- Fast-Growing SASE Space: The company is a top-three player in the SASE market, leveraging innovations and integrated solutions.

- Strategic Partnerships: Notable collaboration with IBM for migrating QRadar customers to Palo Alto solutions, aiming to enter the top three SIEM players.

- Future Prospects: Aiming to reach $1 billion in the SASE segment with continued innovations and customer engagement strategies.

| Strategy/Area | Key Metric/Trend |

|---|---|

| Hardware Market Share | 200-300 basis points annual increase |

| Cortex ARR | $1 billion |

| SIEM Market Opportunity | $20 billion TAM |