Baidu, Inc.

CEO : Mr. Yanhong Li

Quarterly earnings growth(YoY,%)

| Period | Revenue | Operating Income | EPS | Release Date |

|---|---|---|---|---|

| 2024 Q3 | -2.6% YoY | -5.6% | -100.0% | 2024-11-21 |

Robin Li says,

Revenue and Financial Performance

- Baidu Core total revenue for the third quarter was RMB26.5 billion, remaining flat year-over-year.

- AI Cloud revenue grew by 11%, reaching RMB4.9 billion, maintaining double-digit year-over-year growth.

- Gen AI-related revenue accounted for approximately 11% of the AI cloud revenue, up from 9% in the previous quarter.

- Non-GAAP operating profit and margin remained stable, affirming the resilience of the business amidst macroeconomic challenges.

AI Technology and Innovation

- ERNIE 4.0 Turbo saw a 48% improvement in inference efficiency due to an optimized four-layer AI infrastructure.

- Daily API calls for ERNIE increased significantly from 600 million in August to 1.5 billion in November, illustrating strong market adoption.

- Over 1.7 trillion tokens were generated daily, demonstrating robust usage and market acceptance of ERNIE.

Product Development and User Engagement

- AI-enhanced features in Baidu Wenku attracted over 50 million monthly active users, with subscription revenue growing 23% year-over-year.

- Over 20% of Baidu search result pages incorporated AI-generated content, improving user engagement and dwell time.

- ERNIE agents facilitated significant user interaction, averaging 15 million daily conversation rounds.

Strategic Partnerships and Collaborations

- Partnerships with companies like BYD and Samsung leveraged ERNIE agents to enhance brand engagement.

- Collaboration with Yum China and others demonstrated the effectiveness of ERNIE in improving customer service efficiency.

- AI Cloud services saw increased adoption by mid-tier enterprises, with revenue from these customers rising by 170% quarter-over-quarter.

Intelligent Driving and Autonomous Vehicles

- The sixth-generation autonomous vehicle, RT6, is now operational in multiple Chinese cities, expanding Baidu’s autonomous driving portfolio.

- Fully driverless operations achieved 100% in Chongqing, with national operations exceeding 80% in October.

- Apollo Go provided about 988,000 rides in the third quarter, marking a 20% year-over-year increase, with cumulative rides surpassing 8 million.

Junjie He says,

Q3 2024 Financial Overview

- Total revenues were RMB33.6 billion, a 3% decrease year-over-year.

- Baidu Core revenue was RMB26.5 billion, remaining flat from last year.

- Baidu Core’s online marketing revenue was RMB18.8 billion, decreasing 4% year-over-year.

- Baidu Core’s non-online marketing revenue increased 12% year-over-year to RMB7.7 billion, driven by AI Cloud business.

- Revenue from iQIYI was RMB7.2 billion, a 10% decrease year-over-year.

Cost and Operating Expenses

- Cost of revenues increased 1% year-over-year to RMB16.4 billion due to higher traffic acquisition costs and AI Cloud business expenses.

- Operating expenses decreased 5% year-over-year to RMB11.2 billion, mainly due to reduced personnel expenses.

- Baidu Core’s operating expenses were RMB9.9 billion, a 5% decrease from the previous year.

- SG&A expenses for Baidu Core rose 4% year-over-year to RMB5 billion.

- R&D expenses for Baidu Core dropped 13% year-over-year to RMB4.9 billion.

Income Metrics

- Operating income was RMB5.9 billion, with Baidu Core contributing RMB5.7 billion and achieving an operating margin of 21%.

- Non-GAAP operating income was RMB7 billion, and Baidu Core’s non-GAAP operating margin was 25%.

- Total other income net was RMB2.7 billion, increasing 40% year-over-year due to gains from long-term investments.

Net Income and Cash Flow

- Net income attributable to Baidu was RMB7.6 billion, with diluted earnings per ADS at RMB21.6.

- Non-GAAP net income attributable to Baidu was RMB5.9 billion, with non-GAAP diluted earnings per ADS at RMB16.6.

- Free cash flow was RMB2.6 billion, and RMB2.4 billion excluding iQIYI.

Balance Sheet Highlights

| Metric | Value (RMB) |

|---|---|

| Cash, cash equivalents, restricted cash, and short-term investments | 144.5 billion |

| Cash, cash equivalents, restricted cash, and short-term investments excluding iQIYI | 140.3 billion |

| Total number of Baidu Core employees | 31,000 |

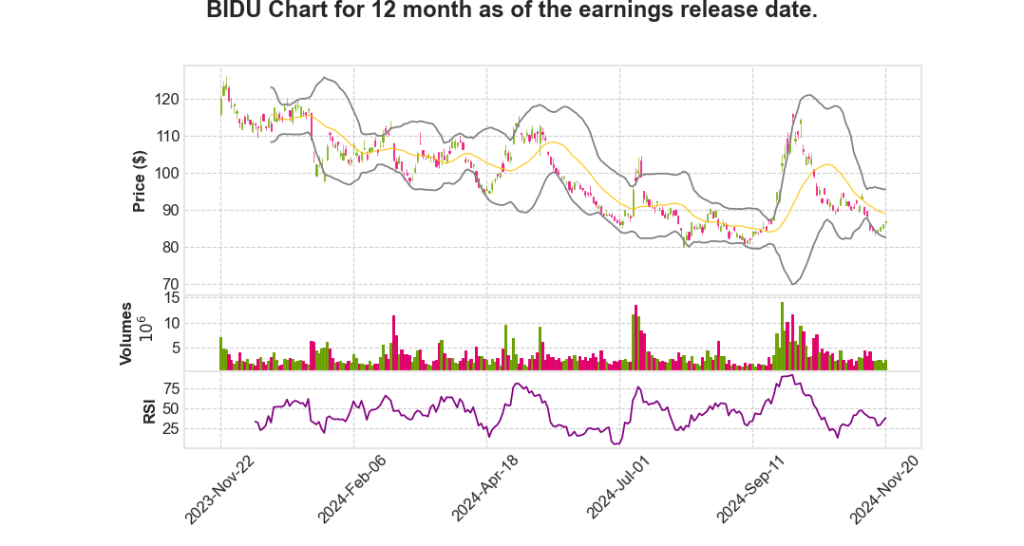

**Overall, the decrease in revenue, changes in operating margins, and strong cash position are pivotal factors that could influence stock movement significantly.**

Q & A sessions,

ERNIE AI Developments and Growth

- ERNIE API calls have grown significantly, with a remarkable 240% quarter-over-quarter increase in the last week of Q3.

- The growth is attributed to reduced hallucinations, lower inference costs, and customizable model applications.

- ERNIE’s integration across Baidu’s major consumer-facing products showcases its potential to revolutionize user experiences.

- External demand is strong, with adoption across sectors like online education, social media, healthcare, and more.

Baidu’s AI and Autonomous Driving Initiatives

- Apollo Go achieved a milestone of 8 million total rides, reinforcing Baidu’s leadership in autonomous driving technology.

- The RP6 model, priced under $30,000 for mass production, is positioned as the most competitive option in the market.

- Baidu is committed to international expansion, exploring cities that allow large-scale, driverless operations.

- Focus remains on an asset-light strategy to ensure flexibility and efficiency in operations.

Product and Model Enhancement

- Baidu launched ERNIE 4.0 Turbo in June, enhancing performance and capabilities.

- A new version of ERNIE is expected to launch early next year, strengthening Baidu’s position in foundation models.

- Continuous improvements are aimed at reducing costs and improving response speed for broader accessibility.

- Visual foundation model capabilities are being expanded into autonomous driving applications.

Strategic AI Focus and Long-term Vision

- Baidu remains committed to an AI-focused strategy, which may pressure near-term margins but promises long-term value.

- Efforts continue to advance AI capabilities in search while expanding autonomous driving initiatives for profitability.

- Resource allocation will focus on high-growth opportunities in alignment with long-term goals into 2025.

Share Buyback Program and Shareholder Value

- Baidu has consistently executed share buybacks, averaging about $1 billion annually, reducing the total number of shares outstanding.

- Share repurchase efforts are a key component of Baidu’s strategy to deliver shareholder value.

- Baidu remains committed to evaluating various options for returning value to shareholders while capitalizing on growth opportunities.

| Key Milestones | Date | Significance |

|---|---|---|

| Launch of ERNIE 4.0 Turbo | June 2023 | Enhanced AI performance and capabilities |

| Apollo Go 8 Million Rides | Q3 2024 | Reaffirms leadership in autonomous driving |