Deere & Company

CEO : Mr. John C. May II

Quarterly earnings growth(YoY,%)

| Period | Revenue | Operating Income | EPS | Release Date |

|---|---|---|---|---|

| 2024 Q3 | -17.3% YoY | -66.2% | -38.3% | 2024-11-21 |

Josh Jepsen says,

Overall Financial Performance

- Operating margins for equipment operations in Q4 2024 reached 13.1%, with full-year margins at 18.2%.

- Operating cash flow from equipment operations was just over $6.9 billion, despite lower shipment volumes.

- Net sales and revenues for fiscal year 2024 fell 16% to $51.7 billion, with equipment operations down 19% to $44.8 billion.

- Net income attributable to Deere and Company was $7.1 billion, or $25.62 per diluted share.

Fourth Quarter Highlights

- Q4 net sales and revenues dropped 28% to $11.1 billion, with equipment operations specifically down 33% to $9.3 billion.

- Net income for Q4 declined to $1.2 billion, equating to $4.55 per diluted share.

- Production and precision ag segment saw a 38% reduction in net sales, primarily due to lower shipment volumes.

2025 Market and Segment Outlook

- Global ag and turf equipment demand expected at or below trough levels; US and Canada large ag equipment sales projected to decrease by 30%.

- Production and precision ag segment sales forecasted to drop 15%, with a segment operating margin between 17%-18%.

- Small ag and turf segment expected to see a 10% decline in net sales, with operating margins projected between 13%-14%.

Construction and Forestry Segment Forecast

- Net sales in the construction and forestry segment are estimated to decline by 10%-15% in 2025.

- Operating margin for the segment is expected to be between 11.5%-12.5%.

- US and Canada earthmoving equipment sales expected to fall 10%, while compact construction equipment is forecasted to decline 5%.

Financial Services and Overall Guidance

- Financial services net income forecasted at $750 million for fiscal year 2025, with an improvement over 2024 due to lower provision for credit losses.

- Full-year net income expected in the range of $5 billion to $5.5 billion, with an effective tax rate between 23%-25%.

- Cash flow from equipment operations projected between $4.5 billion to $5.5 billion, showcasing improved structural financial resilience.

Cory Reed says,

Canadian Market Growth

- The Canadian market is experiencing significant competitive conversions following the smart industrial redesign.

- The redesign is tailored to support production specific to crop types and geography in Canada, especially in Western Canada.

- Canada’s primary production system focuses on small grains such as wheat, canola, and barley.

- The operations in these areas are typically large-scale, benefiting from system-level solutions.

Product Innovations and Offerings

- Recent product introductions include X9 combines, high horsepower 9RX tractors, and C series air carts.

- These products are specifically designed to address the challenges faced by Canadian small grains customers.

- The products integrate with John Deere’s technology solutions to enhance operational efficiency, profitability, and quality of life.

Dealer Network Commitment

- The Canadian dealer network is heavily invested in customer satisfaction and maximizing equipment utility.

- Dealers focus on delivering uptime and reliability, which enhances the value proposition for customers.

- This commitment is integral to providing exceptional system-level value in the market.

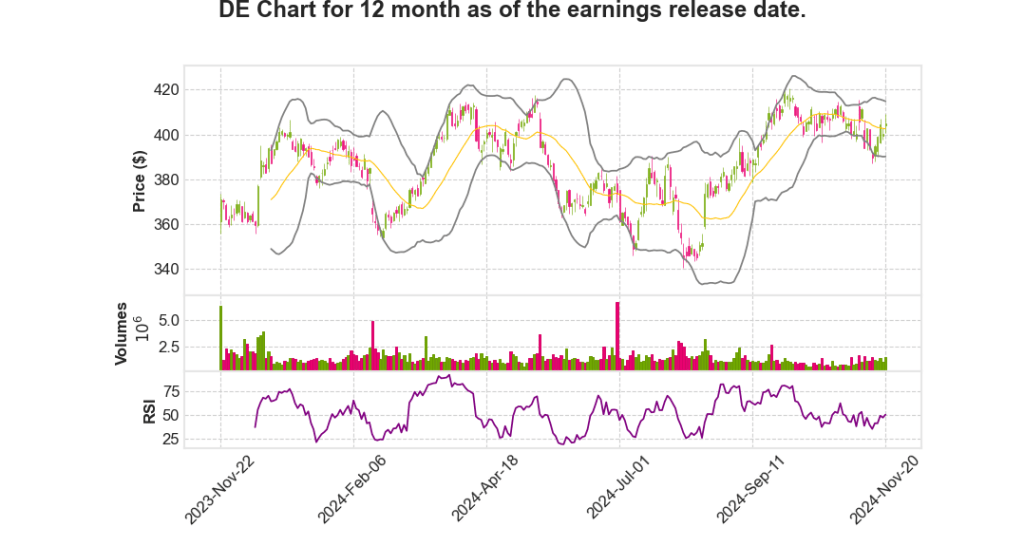

Impact on Stock Movement

- Increased market conversions and system-level solutions could lead to an uptick in sales and revenues, positively impacting stock performance.

- Continued innovation and tailored product offerings are likely to strengthen competitive positioning in key markets.

- The strong dealer network support ensures sustained customer loyalty and operational continuity, which could bolster long-term financial performance.

Q & A sessions,

Quarterly and Full-Year Financial Performance

- The quarter ended better than expected with significant inventory reductions in North American tractors and combines.

- Year-over-year improvements in production costs, SING, and R&D were noted, driving cash flow outperformance relative to the third-quarter guide.

- Full-year performance was marked by flexibility and adaptability in managing lower demand levels, resulting in favorable production costs.

- Despite muted sales, record levels of R&D spending were maintained to support future product introductions.

- Fiscal year 2024 ended with over $25 in EPS and $5.6 billion returned to shareholders via dividends and share buybacks.

Market Conditions and Projections for 2025

- Farm fundamentals globally are expected to remain depressed, impacting commodity prices and net incomes.

- Dairy and livestock margins remain strong, but machinery demand lags due to interest rates and slow herd expansion.

- Expectations for North American large ag machinery production to align with retail demand in 2025.

- European ag equipment demand faces challenges with further underproduction expected in 2025.

Inventory Management and Production Strategy

- 2024 underproduction was achieved, especially in North American large ag, with a focus on maintaining low inventory levels.

- For sprayers and planters, early order programs saw declines, dictating a production level below mid-cycle for 2025.

- Brazil reached targeted inventory levels in most product lines, allowing production to match retail in 2025, except for combines.

- Used equipment inventory levels are plateauing, with strategies in place to manage reductions effectively.

Technological Advancements and Adoption

- Strong growth in adoption of technologies like ExactApply, reaching an 80% take rate in early order programs.

- Significant growth in global engaged acres, with South America up nearly 30% year-over-year.

- Successful rollout of the See and Spray technology, with over one thousand orders for 2025 installations.

- Transition to a recurring license model for the Precision Ag Essentials Kit resulted in over eight thousand sales.

Outlook and Strategic Focus

- 2025 expected to be marked by discipline and proactive management in the face of challenging market conditions.

- Focus on structural improvements and investments in margin-accretive opportunities to support high margins despite volume declines.

- Continued efforts to reduce costs and enhance customer value through innovative technology solutions.

- Expectations of higher margins relative to previous peaks, despite anticipated sub-80% mid-cycle performance for equipment operations.