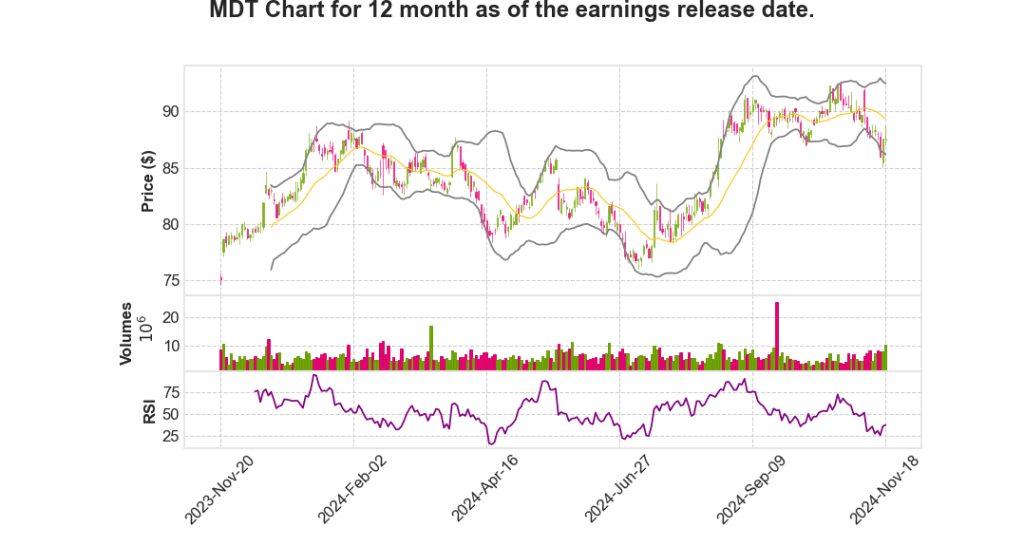

Medtronic plc

CEO : Mr. Geoffrey Straub Martha

Quarterly earnings growth(YoY,%)

| Period | Revenue | Operating Income | EPS | Release Date |

|---|---|---|---|---|

| 2025 Q2 | 5.2% YoY | -102.5% | 45.6% | 2024-11-19 |

GeoffMartha says,

Supply Chain Recovery and Expansion

- CAS ablation business faced a supply issue due to a third-party component supplier, which has now been resolved.

- The supplier has expanded capacity, enabling the company to ramp up the PulseSelect supply.

- **Resolution of supply issues is expected to drive future growth, specifically for the PulseSelect product.**

PulseSelect Performance

- The units of PulseSelect doubled in Q2, signaling a strong recovery and demand.

- The number of physicians using PulseSelect also nearly doubled, indicating wider adoption.

- The number of procedures and patients treated with PulseSelect more than doubled.

- **Company has confidence to open more accounts for PulseSelect, projecting continued growth.**

Cryo Business Update

- The cryo business saw a sequential improvement, contrary to previous declines.

- **Q2 showed better performance in cryo compared to Q1, negating earlier concerns.**

Growth Projections and New Developments

- Introduction of Sphere-9 is expected to complement PulseSelect demand and drive growth.

- Strong double-digit growth is anticipated in Q3, supported by the resolution of supply issues and increased demand.

- The company is the only player with both single shot and focal capabilities, enhancing its market position.

| Quarter | Key Product | Growth Metric |

|---|---|---|

| Q2 | PulseSelect | Double in units and procedures |

| Q3 (Projected) | PulseSelect and Sphere-9 | Strong double-digit growth |

Sean Salmon says,

Overview of Market Opportunity

- The base population for uncontrolled hypertension patients treated with drugs but still having elevated blood pressure is approximately 18 million.

- The Medicare population within this demographic is estimated at about 16 million patients.

- The addressable market, including both inpatients and outpatients, comprises roughly half of the Medicare population.

- Medicaid’s market potential varies state-by-state, similar to commercial insurance, indicating a significant but complex opportunity.

Insurance and Reimbursement Dynamics

- The PAIR mix is approximately 50% Medicare and Medicaid and 50% non-Medicare/Medicaid patients, highlighting the diversity of the patient base.

- The therapy specifically addresses the fee-for-service component of Medicare-eligible patients, excluding those on Medicare Advantage.

- Securing coverage is crucial, with a strong emphasis on establishing centers capable of performing the procedure.

Challenges and Considerations

- The minority of patients achieve control over hypertension despite drug availability, indicating an unmet need that this therapy could address.

- Demand is not the issue; the critical focus is on obtaining coverage and expanding procedural centers.

- State-by-state variability in Medicaid decisions adds a layer of complexity to market penetration and modeling.

Financial Implications

| Population | Number of Patients |

|---|---|

| Uncontrolled Hypertension | 18 million |

| Medicare Population | 16 million |

| Addressable Market | 50% of Medicare Population |

- The financial opportunity is significant, given the large untreated population and potential reimbursement pathways.

Q & A sessions,

Market Outlook and Growth Drivers

- The MedTech landscape is described as healthy, with steady procedure growth driven by innovation.

- Key areas of innovation include minimally invasive procedures, pacing technologies, and shifts from drug to MedTech solutions.

- Demographics also contribute significantly to market growth.

- Healthcare remains a priority under any administration, suggesting a stable outlook for the sector.

Impact of Political Changes and Trade Agreements

- Speculation about policies under President Elect Trump is considered premature, particularly regarding healthcare and tariffs.

- Less than 1% of revenue is exposed to imports from China, minimizing the impact of potential tariffs.

Key Product and Segment Performance

- Affera’s approval and integration into PulseSelect contributes to strong double-digit growth in Q3 and beyond.

- Uncertainty around CMS coverage timing despite FDA approval with a broad indication.

- High single-digit earnings growth expected for the back half of the year on a constant currency basis.

Mergers and Acquisitions Strategy

- M&A remains a crucial growth strategy, focusing on tuck-in acquisitions to support high-growth segments.

- Portfolio management is emphasized as an ongoing process aimed at durable mid-single-digit growth and shareholder return.

Product Trials and Pipeline Developments

- Expansion plans include the Intrepid valve trials for U.S. and European approval, targeting mitral and tricuspid positions.

- The new FX+ product, launched in the U.S. and Europe, aims to eliminate coronary access concerns.

- Future modifications of the Intrepid valve are underway to optimize it for tricuspid position.

| Key Segment | Growth Expectation | Key Products | Market Expansion Plans |

|---|---|---|---|

| Minimally Invasive Procedures | Steady Growth | TAVR, PFA | Global Expansion |

| PulseSelect & Affera | Double-Digit | PulseSelect System | Scalability & CMS Approval |

| Intrepid Valve | Approval Trials | Intrepid Valve | U.S. & European Markets |