NVIDIA Corporation

CEO : Mr. Jen-Hsun Huang

Quarterly earnings growth(YoY,%)

| Period | Revenue | Operating Income | EPS | Release Date |

|---|---|---|---|---|

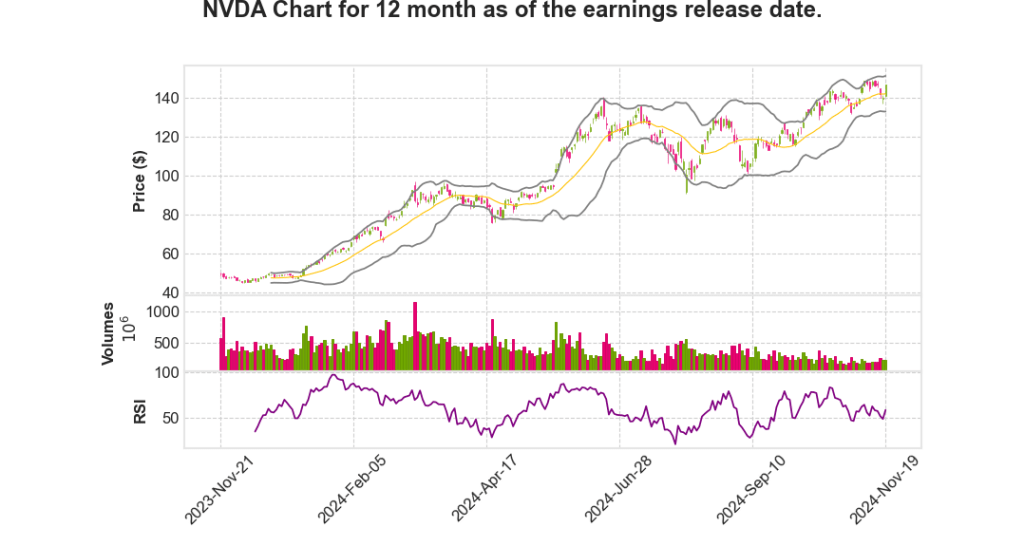

| 2025 Q3 | 93.6% YoY | 109.9% | 107.9% | 2024-11-20 |

Colette Kress says,

Overview of Q3 Performance

- Record-breaking revenue of $35.1 billion, marking a 17% sequential increase and a 94% year-over-year growth.

- Data Center revenue reached $30.8 billion, up 17% sequentially and 112% year-on-year.

- Demand for NVIDIA Hopper and H200 led to a significant increase, described as the fastest product ramp in company history.

- Consumer Internet and regional cloud revenue showed doubling trends year-on-year.

Significant Product Developments

- The NVIDIA Blackwell architecture is in full production, with demand quickly scaling.

- Blackwell debuted in MLPerf Training results, demonstrating a 2.2 times leap in performance over Hopper.

- NVIDIA NIM release is expected to enhance Hopper Inference performance by an additional 2.4 times.

- Blackwell systems have been deployed by major partners including Oracle and Microsoft.

Guidance for Q4 2025

- Expected revenue of $37.5 billion, plus or minus 2%, driven by continued Hopper demand and the Blackwell ramp-up.

- Gaming revenue anticipated to decline sequentially due to supply constraints.

- GAAP and non-GAAP gross margins projected at 73% and 73.5%, respectively.

- Operating expenses are expected to be approximately $4.8 billion GAAP and $3.4 billion non-GAAP.

Financial Highlights and Returns

- $11.2 billion returned to shareholders through share repurchases and dividends in Q3.

- GAAP gross margin was 74.6%, while non-GAAP was 75%, showing a slight decrease from previous quarters.

- Operating expenses increased by 9% sequentially.

- Expected other income and expenses to be around $400 million.

Strategic Investments and Partnerships

- NVIDIA AI Enterprise revenue expected to more than double year-over-year.

- Global expansion, including leading CSPs in India and Japan scaling up NVIDIA deployments.

- Strategic partnerships with major industry players like Accenture and Foxconn to accelerate AI adoption and efficiency.

- Collaborations with SoftBank and T-Mobile to enhance AI network capabilities in Japan and the US.

Jensen Huang says,

Scaling Innovations and Infrastructure Demand

- The speech highlighted the evolution from foundation model pre-training to new methods of post-training and inference time scaling.

- The introduction of “Strawberry, ChatGPT o1,” which utilizes inference time scaling, was emphasized as a groundbreaking development.

- These advancements have significantly increased demand for NVIDIA’s infrastructure, showcasing strong growth potential.

- The transition from 100,000 Hoppers to 100,000 Blackwells illustrates a shift in the industry’s hardware requirements.

Inference Platform Leadership

- NVIDIA currently holds the title of the largest inference platform globally, attributing this to its substantial installed base.

- Inference demand is notably rising, driven by the efficiency of Amperes and Hoppers hardware.

- The ongoing transition to Blackwells is expected to bolster the company’s infrastructure capacity for inference tasks.

AI Market and Enterprise Adoption

- An increase in AI-native companies has been observed, contributing to NVIDIA’s market expansion.

- Enterprise adoption of agentic AI is gaining momentum, further driving demand for NVIDIA’s offerings.

- These trends indicate a broadening market base, suggesting sustained growth for NVIDIA in AI-related sectors.

Industry Benchmarks and Future Projections

| Generation | Hardware | Starting Units |

|---|---|---|

| Last Generation | Hoppers | 100,000 |

| Next Generation | Blackwells | 100,000 |

- The shift from Hoppers to Blackwells marks a pivotal change in industry benchmarks.

- Future projections suggest that NVIDIA will continue to lead in AI infrastructure due to its innovative scaling strategies.

Conclusion

- The ongoing advancements in scaling methodologies present significant growth opportunities for NVIDIA.

- As demand for AI infrastructure intensifies, NVIDIA is well-positioned to capitalize on these developments, likely impacting its stock movement positively.

Q & A sessions,

Blackwell Production and Demand

- Blackwell production is exceeding previous estimates for this quarter, driven by high demand and effective supply chain management.

- The company plans to continue increasing Blackwell production through the next year, highlighting ongoing demand.

- The supply chain involves a complex network of partners, including TSMC, Amphenol, SK Hynix, and others, ensuring the scale of production targets.

Annual Roadmap and Performance

- NVIDIA is committed to an annual roadmap that increases platform performance while reducing the cost of training and inferencing.

- The focus on performance per watt is crucial, as it directly impacts revenue generation for partners operating power-limited data centers.

- The transition from CPU-based coding to machine learning on GPUs is a key transformative trend impacting the industry.

Market Expansion and Industry Trends

- The modernization of data centers and the emergence of AI factories are shaping a new multi-trillion dollar industry.

- Generative AI is driving demand for advanced computing solutions, with a significant rise in AI-native startups and inference services.

- NVIDIA is well-positioned to serve emerging opportunities across cloud, edge, and robotics sectors, leveraging its scale and expertise.

Financial Guidance and Projections

- Gross margins for the upcoming quarters are expected to be in the range of 71% to 72.5%, with potential improvements as yields increase.

- Hopper, another key product, is experiencing substantial growth and is expected to continue selling robustly into Q4 2025.

- Both Hopper and Blackwell products are poised for potential growth in the upcoming quarter.

Sovereign AI and Gaming Sector

- Sovereign AI remains a crucial growth area, with countries developing foundational models tailored to their languages and cultures.

- Growth opportunities are emerging in regional clouds and AI factories, particularly in Europe and Asia-Pacific regions.

- The gaming sector is experiencing strong demand, although supply constraints may pose short-term challenges.

| Quarter | Blackwell Production | Gross Margin |

|---|---|---|

| Q3 2025 | Exceeding estimates | 71% – 72.5% |

| Q4 2025 | Expected to increase | Potential advances to mid-70s |