Target Corporation

CEO : Mr. Brian C. Cornell

Quarterly earnings growth(YoY,%)

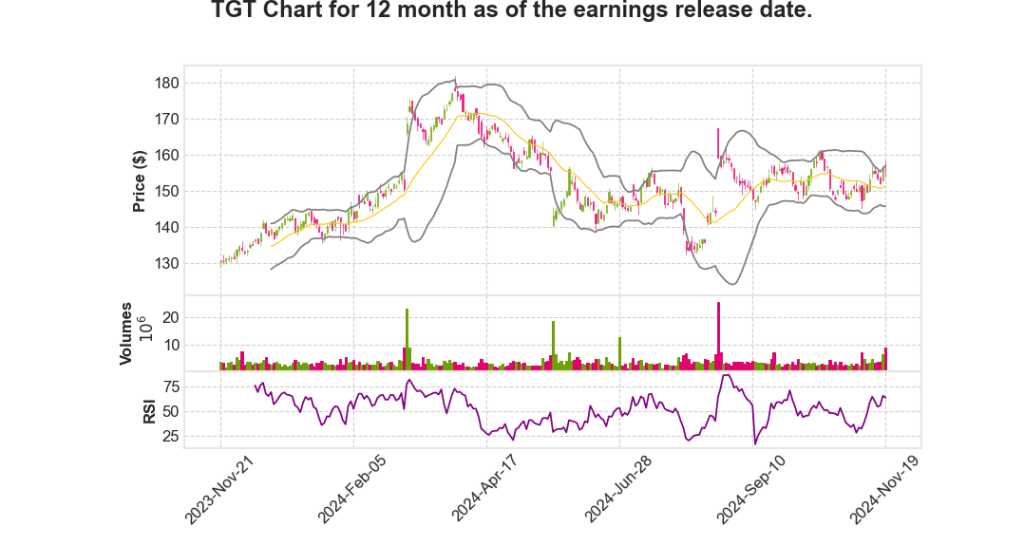

| Period | Revenue | Operating Income | EPS | Release Date |

|---|---|---|---|---|

| 2024 Q3 | 1.1% YoY | -11.3% | -11.9% | 2024-11-20 |

Michael Fiddelke says,

Inventory Management and Seasonal Preparedness

- The company’s inventory levels at the end of Q3 were 3% higher than a year ago.

- Gains in inventory management were made despite disruptions such as the East Coast port strikes and receipt timing volatility in Asian ports.

- Target implemented strategic routing to West Coast ports to protect key seasonal programs, ensuring readiness for the holiday season.

- Inventory comparisons to 2019 indicate sales growth slightly outpacing inventory increases, reflecting improved operational efficiency.

- Operational resilience was demonstrated by reopening nearly all facilities within 24 hours following hurricane closures.

Store Expansion and Performance

- Target has secured locations for 23 new stores this year, with 13 openings in the last quarter, responding to population and migration trends.

- New store performance is exceeding expectations, including locations in Miami, Florida, El Monte, California, and Waukee, Iowa.

- Investments in existing stores focus on enhancing front-store experiences and staffing with top talent.

- Net Promoter Scores show improvements in checkout wait times, product availability, team interactions, and store cleanliness.

Digital and Fulfillment Enhancements

- Average shipping times have improved by nearly a day year-over-year, with sortation centers handling 25% more packages than last year.

- Efforts to reduce split shipments have increased units fulfilled per package, lowering last-mile delivery costs.

- Target’s app integration with Apple CarPlay and Android Auto enhances ease for curbside orders.

- New options allow customers to opt out of plastic bags for pickup orders, saving costs and aligning with customer preferences.

Same-Day Delivery and Digital Innovations

- Target Circle 360 memberships have increased since the relaunch in April, supporting rapid growth in demand.

- Partnership with Shipt continues to maintain high Net Promoter Scores for delivery services.

- Sortation centers contribute to tens of millions of dollars in savings in last mile delivery costs compared to other options.

- Investments in same-day delivery capabilities bolster service efficiency and customer satisfaction.

Weather and External Influences

- External challenges include unusual weather patterns and port disruptions, adding complexity to operations.

- Despite these, the operations team demonstrated resilience, showcasing capability to handle peak volumes.

- Preparation and strategic actions position Target well for anticipated macro headwinds and a volatile external environment.

Brian Cornell says,

Executive Leadership Changes

- Introduction of Jim Lee as Target’s new CFO, bringing experience from PepsiCo.

- Recognition of Michael’s leadership during the CFO search, managing both finance and operations.

Financial Performance and Traffic Growth

- Operating income has grown by 6.7% through the first three quarters of the year.

- Third-quarter comparable sales increased by 0.3%, although near the lower end of expectations.

- Traffic growth of 2.4%, adding over 10 million transactions compared to last year.

- Digital channel sales grew nearly 11% in Q3, with same-day delivery and Drive Up services seeing significant double-digit increases.

Category Performance

- Beauty category saw a strong comparable sales increase of over 6%.

- Continued softness in home and hardlines categories due to cautious consumer spending.

- Despite challenges, apparel sales showed relative strength against the market.

Supply Chain and Cost Challenges

- East Coast and Gulf port strikes necessitated adjustments in shipment timings and port directions.

- These adjustments led to elevated inventory levels and higher-than-expected supply chain costs.

- Additional pressures in healthcare and general liability expenses.

Strategic Investments and Future Outlook

- Investments in store remodels, digital experience enhancements, and new store openings planned for 2025.

- Focus on AI and technology to improve guest service efficiency.

- Strengthening the Target Circle loyalty program with nearly 3 million new members in Q3.

- Target Circle Week and Roundel ad business contributed to profitability and guest engagement.

- While cautious about Q4 outlook, confidence remains in long-term strategy with continued capital investments.

Q & A sessions,

Financial Performance and Traffic Growth

- Target reported Q3 traffic growth of 2.4%, representing over 10 million additional transactions year-over-year.

- Digital sales saw a significant increase, with a growth rate of approximately 11%.

- The Target Circle 360 delivery program experienced nearly 20% growth.

- Drive Up service continued to show strong performance with double-digit growth.

Strategic Focus and Asset Utilization

- Target is focusing on leveraging its unique assets, including its own brand portfolio, national brand partnerships, and a strong advertising business.

- The company plans to continue investing in its digital channels and expanding its retail footprint.

- Target aims to deepen consumer engagement through its loyalty program, adding 3 million new members to its Circle program in Q3 alone.

Discretionary Category Performance

- Apparel and home categories saw a deceleration of about 4 percentage points from Q2, impacting profit margins.

- Despite the slowdown, Target managed to take market share, particularly in activewear and performance categories.

- Investment in inventory management, including pre-positioning for potential disruptions, ensured strong guest experience continuity.

Outlook and Guidance for Q4 2024

- Target is taking a cautious approach to guidance, particularly in high-margin discretionary categories due to recent deceleration.

- The company is committed to maintaining clean year-end inventory levels.

- Cost pressures are being managed through efficiency initiatives, although no drastic short-term measures will be taken.

Long-term Strategic Initiatives

- Target is focused on long-term consumer trends, emphasizing strength in essential goods, food, and beauty segments.

- The company is planning to leverage seasonal moments to drive sales and consumer engagement.

- Continuous investments in digital and physical assets aim to enhance the overall “Target experience” for consumers.