Williams-Sonoma, Inc.

CEO : Ms. Laura J. Alber

Quarterly earnings growth(YoY,%)

| Period | Revenue | Operating Income | EPS | Release Date |

|---|---|---|---|---|

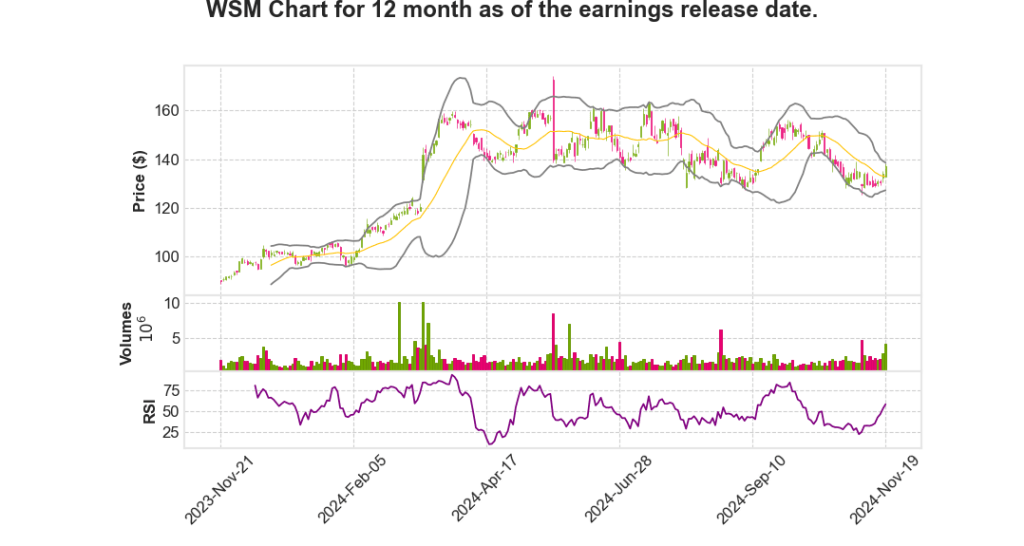

| 2024 Q3 | -2.9% YoY | 1.8% | 7.6% | 2024-11-20 |

Laura Alber says,

Financial Performance and Guidance

- Williams-Sonoma Inc. exceeded both top and bottom-line expectations in Q3 2024.

- Comparable sales were down 2.9%, yet operating margin stood robust at 17.8%.

- Earnings per share saw a 7% increase, reaching $1.96.

- Stock repurchase in Q3 amounted to $533 million, representing 4% of shares outstanding within the year.

- The full-year revenue guidance has been adjusted to a decline of 3% to 1.5%, with an increase of 40 basis points in operating margin guidance to a range of 17.8% to 18.2%.

Strategic Priorities and Initiatives

- Focus on three key priorities: returning to growth, elevating customer service, and driving earnings.

- Innovation in product design and e-commerce technology is contributing positively to the company’s growth strategy.

- Retail optimization is enhancing store experiences, improving inventory levels, and achieving good ROI from new store designs.

Brand Performance Review

- Pottery Barn had a negative 7.5% comp, but saw improved furniture performance and successful seasonal offerings.

- Pottery Barn children’s business maintained a positive trajectory with a 3.8% comp in Q3.

- West Elm achieved a negative 3.5% comp, improving from Q2, with successful fall and holiday product introductions.

- Williams-Sonoma brand was flat, focusing on high-ticket items and successful product collaborations.

Global Expansion and Emerging Brands

- Strong results in Canada, Mexico, and India, with new store openings planned for 2025.

- Global partnerships with John Lewis in the UK and retail presence at Fortnum & Mason are expanding brand awareness.

- Emerging brands like Rejuvenation, Mark and Graham, and GreenRow continue to show strong growth in their respective markets.

Outlook and Key Opportunities

- The Board approved an additional $1 billion stock repurchase authorization, indicating confidence in future performance.

- Business-to-business segment experienced its largest quarter ever, growing 9% in Q3.

- Emphasis on channel innovation and strategic growth opportunities is set to drive future growth into FY2025 and beyond.

| Key Financial Metrics | Q3 2024 Results | Full-Year Guidance |

|---|---|---|

| Comp Sales | -2.9% | -3% to -1.5% |

| Operating Margin | 17.8% | 17.8% to 18.2% |

| Earnings Per Share | $1.96 | N/A |

| Stock Repurchase | $533 million | Additional $1 billion authorized |

Laura Alber says,

Newness and Innovation Strategy

- West Elm has experienced double-digit positive comps in their new furniture introductions, emphasizing the success of their innovation strategy.

- The company is focusing on increasing the product offerings in holiday assortments, identifying it as an important growth opportunity.

- Non-furniture categories at West Elm present a significant area for expansion, with efforts directed towards introducing new products.

Performance by Brand

- Pottery Barn has seen positive consumer response in furniture, seasonal decorating, and kid’s categories, with a notable surge in baby and dorm segments.

- Collaborations, including those with LoveShackFancy, have contributed to increased consumer interest and sales.

- Williams-Sonoma is capitalizing on premium electrics, cookware, and exclusive seasonal products.

Quantifying Growth

- The company has witnessed double-digit increases across categories, highlighting the broad success of their recent strategies.

- Emphasis is placed on ensuring that new products are truly incremental and contribute to the company’s growth without oversaturating the market.

- This strategic approach is aimed at maintaining pricing power through unique product offerings.

Key Strategic Goals

- The company aims to leverage newness in product categories to drive growth in 2024 and beyond.

- They are focusing on creating a balance between innovation and market demand to avoid over-assorting.

- Williams-Sonoma aims to stay competitive by designing and introducing their own unique products to the market.

Q & A sessions,

Competitive Advantage and Holiday Strategy

- WSM’s unique position as a holiday headquarters offers a significant competitive edge, integrating a full holiday assortment with core products.

- This strategy is particularly relevant this year due to customers’ excitement about the holidays, which is expected to boost sales.

- The company’s ability to show customers how to integrate holiday items with existing home goods is a strategic focus.

Pricing Strategy

- WSM has moved away from promotional pricing to offer consistent and competitive pricing, enhancing customer trust.

- The company has reduced promotional activities each quarter, improving pricing transparency for customers.

- This approach has resulted in better regular-priced sales comps and overall profitability.

- Pricing consistency is expected to positively impact operating earnings moving forward.

Supply Chain and Operational Efficiencies

- WSM is optimizing supply chain efficiencies, having recently transitioned to a new Arizona Distribution Center.

- The company is improving occupancy by closing less profitable stores and relocating to more advantageous centers.

- New store performance is strong, with an emphasis on increasing revenue per square foot.

- Continued enhancements in operational efficiencies are anticipated to lead to better margins.

Marketing and Brand Engagement

- WSM’s marketing strategy leverages influencers and collaborators to boost brand visibility and traffic.

- Brand collaborations are considered effective for enhancing advertising efficiency and sales growth.

- Focus on marketing strategies that both drive short-term sales and foster long-term customer relationships.

Inventory Management and Future Outlook

- Inventory levels are well-managed, with clearance inventory in good condition, reducing the need for significant markdowns.

- WSM aims to maintain clean inventory operations, focusing on regular-priced sales for better margins.

- Strategic inventory management is expected to support sales growth without heavy promotional reliance.

| Focus Area | Key Strategy |

|---|---|

| Pricing | Consistent, non-promotional pricing |

| Supply Chain | Efficiency improvements and distribution center transitions |

| Marketing | Leveraging influencers and brand collaborations |

| Inventory | Clean inventory with focus on regular-priced sales |