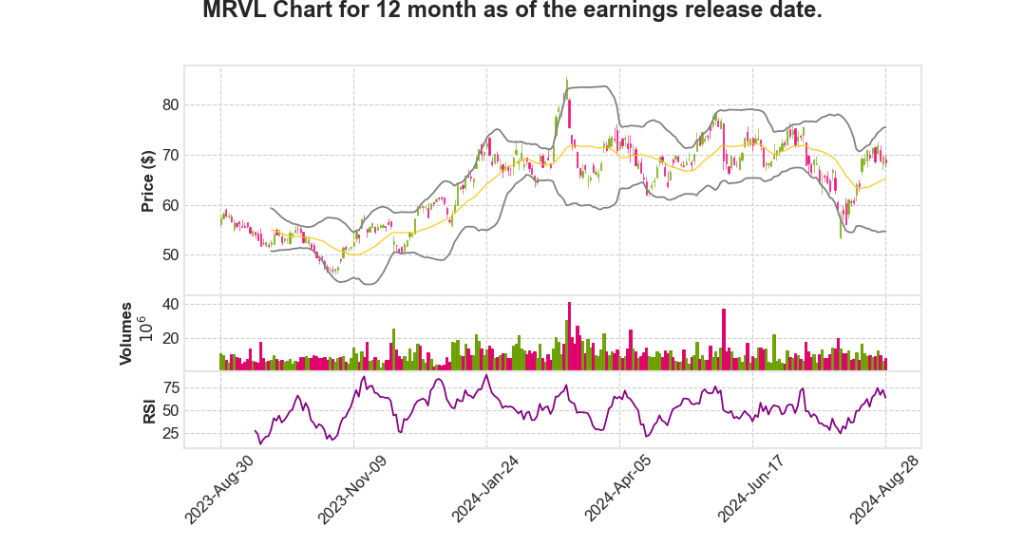

Marvell Technology, Inc.

CEO : Mr. Matthew J. Murphy

Quarterly earnings growth(YoY,%)

| Period | Revenue | Operating Income | EPS | Release Date |

|---|---|---|---|---|

| 2025 Q3 | 6.9% YoY | 385.9% | -347.4% | 2024-08-29 |

Matt Murphy says,

Financial Performance and Guidance

- Revenue for Q2 fiscal 2025 reached $1.27 billion, surpassing the midpoint of guidance due to strong data center demand.

- Non-GAAP earnings per share stood at $0.30, also exceeding the midpoint of guidance.

- Sequential revenue growth of 10% in Q2, with an expectation of significantly higher sequential growth in Q3.

- Anticipated return to year-over-year revenue growth by achieving the midpoint of Q3 guidance.

Data Center End Market

- Record revenue of $881 million for Q2, marking a 92% year-over-year and an 8% sequential growth.

- Strong bookings for 800 gig PAM products and 400ZR DCI products.

- Introduction of next-generation 200 gig per lane, 1.6 terabit DSPs in Q3.

- Anticipation of accelerated production ramp in the second half for 100 gig per lane, 800 gig DSPs.

- Forecasting revenue growth to accelerate into the high teens sequentially in Q3, majorly driven by AI custom silicon programs.

Enterprise Networking and Carrier Markets

- Enterprise networking revenue was $151 million; carrier revenue was $76 million in Q2.

- Flat sequential revenue in Q2 with expectations of mid-single-digits percentage growth in Q3.

- New orders received for 5 nanometer based OCTEON 10 DPUs.

Consumer End Market

- Q2 revenue was $89 million, showing a 112% sequential increase.

- Forecasted slight sequential growth in Q3 with expected normalization at about $300 million annually.

- Primary growth driver: custom SSD controller for a leading game console platform.

Automotive and Industrial End Market

- Q2 revenue was $76 million, reflecting a 31% year-over-year decline and a 2% sequential decline.

- Mid-single-digits sequential growth projected for Q3.

| Q2 Fiscal 2025 Revenue | Growth Expectations for Q3 |

|---|---|

| $1.27 billion | 14% sequential growth at the midpoint of guidance |

| Data Center: $881 million | High teens sequential growth |

| Enterprise Networking: $151 million | Mid-single-digits sequential growth |

| Consumer: $89 million | Slight sequential growth |

| Automotive and Industrial: $76 million | Mid-single-digits sequential growth |

**In summary, Marvell’s strong performance and strategic focus on high-growth areas, particularly in AI and data center markets, are expected to drive significant stock movements, with confidence in surpassing full-year AI revenue targets.**

Willem Meintjes says,

Financial Performance Overview

- Second quarter revenue was $1.273 billion, declining 5% year-over-year but growing 10% sequentially.

- Data center accounted for 69% of total revenue, with enterprise networking at 12%, consumer at 7%, carrier infrastructure at 6%, and auto/industrial at 6%.

- GAAP gross margin stood at 46.2%, while non-GAAP gross margin was significantly higher at 61.9%.

- GAAP operating margin was negative 7.9%, whereas non-GAAP operating margin was a healthy 26.1%.

- Non-GAAP EPS grew by 25% sequentially to $0.30, exceeding guidance by $0.01.

Cash Flow and Balance Sheet

- Cash flow from operations was robust at $306 million for the second quarter.

- Inventory levels were reduced by $198 million year-over-year, reflecting a near 20% decrease.

- Cash dividends returned to stockholders totaled $52 million, while stock repurchases amounted to $175 million, up $25 million from the previous quarter.

- Total debt was reported at $4.13 billion, with a gross debt to EBITDA ratio of 2.29 times and a net debt to EBITDA ratio of 1.84 times.

Third Quarter Fiscal 2025 Guidance

- Forecasted revenue for Q3 is $1.45 billion, with a growth range of plus or minus 5%.

- GAAP gross margin expected to be approximately 47.2%, with non-GAAP gross margin at about 61%.

- GAAP and non-GAAP operating expenses are projected to be $693 million and $465 million respectively.

- Non-GAAP EPS is projected between $0.35 and $0.45, with a sequential growth of 33% at the midpoint of guidance.

Stock Repurchase and Capital Returns

- Marvell plans to further increase stock repurchases in Q3, enhancing shareholder value.

- Ongoing stock repurchase program is expected to reduce the diluted weighted average shares outstanding to 875 million.

- The company remains focused on strong cash flow generation and returning increasing capital to investors.

Market Growth and Strategic Focus

- Revenue growth in the third quarter is driven significantly by ramping up custom AI products.

- All end markets are expected to see sequential growth, with AI data center revenue growing rapidly.

- The company anticipates substantial operating leverage as custom programs expand.

Q & A sessions,

Data Center and AI Impact

- Marvell’s data center revenue reached $881 million in Q2 2025, growing 92% year-over-year.

- Revenue growth in the data center is primarily driven by electro-optics products and custom silicon.

- AI custom silicon programs are expected to significantly boost revenue growth, forecasting acceleration in the high teens percentage for Q3.

- Marvell anticipates maintaining a leadership position in the interconnect market, which is projected to grow at a 27% CAGR to $14 billion by 2028.

Enterprise and Carrier Markets

- Both enterprise networking and carrier infrastructure revenues were flat in Q2 but are expected to grow sequentially in the mid-single-digits in Q3.

- Marvell projects enterprise and carrier markets to recover and potentially reach a $2.2 billion annual run rate collectively.

- Long-term growth in enterprise and carrier is expected to be in the low to mid-single digits with potential for share gains.

Custom Silicon and Competitive Position

- Custom silicon is a key growth driver, with Marvell securing multi-generational relationships with Tier 1 cloud providers.

- Marvell is positioned as a key partner for AI applications, leveraging a robust technology platform and advanced packaging capabilities.

- Continued success in custom silicon is expected to accelerate Marvell’s timeline to achieve target operating margins.

Financial Performance and Guidance

- Q2 revenue was $1.27 billion, surpassing the midpoint of guidance, with non-GAAP EPS of $0.30 also above expectations.

- Marvell forecasts a 14% sequential revenue growth for Q3, primarily driven by data center AI and a recovery in enterprise and carrier markets.

- The company expects to exceed its full-year AI revenue target and plans to invest R&D resources heavily in AI and accelerated infrastructure.

Strategic Initiatives and Long-term Outlook

- Marvell is focused on expanding its TAM in the data center and driving new product releases to capitalize on AI opportunities.

- The shift towards custom silicon is strategic in nature, providing lower gross margins but benefiting from reduced operating expenses.

- Marvell emphasizes the importance of being a long-term, reliable partner with multi-generational product commitments.

| Quarter | Data Center Revenue | Enterprise & Carrier Revenue | Overall Revenue Growth |

|---|---|---|---|

| Q2 2025 | $881M | Flat | 10% Sequential |

| Q3 2025 (Forecast) | High Teens % Growth | Mid-Single Digits Growth | 14% Sequential (Midpoint) |