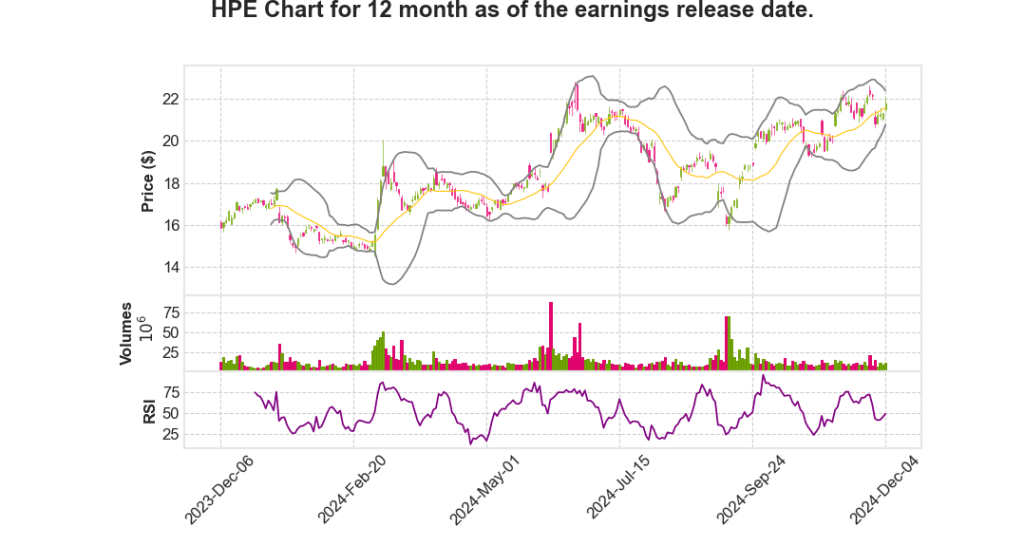

Hewlett Packard Enterprise Company

CEO : Mr. Antonio Fabio Neri

Quarterly earnings growth(YoY,%)

| Period | Revenue | Operating Income | EPS | Release Date |

|---|---|---|---|---|

| 2024 Q4 | 15.1% YoY | 36.7% | 104.0% | 2024-12-05 |

Marie Myers says,

Revenue and Profitability Highlights

- Achieved record quarterly revenue of $8.5 billion, representing a 15% year-over-year and 9% quarter-over-quarter growth.

- AI systems revenue increased over 150% to reach $4.1 billion.

- Fiscal 2024 total revenue grew by 3% to $30.1 billion, exceeding the high-end of the outlook range.

- Non-GAAP diluted net EPS was $1.99 for the full year, with Q4 non-GAAP diluted net EPS at $0.58, both above guidance.

- Free cash flow for Q4 was $1.5 billion, culminating in a record annual free cash flow of $2.3 billion.

Segment Performance and Trends

- Server segment reached an all-time high revenue of $4.7 billion, up 31% year-over-year.

- Hybrid Cloud revenue grew by 18% year-over-year to $1.6 billion, driven by Private Cloud and Alletra MP.

- Intelligent Edge revenue was $1.1 billion, experiencing a 20% year-over-year decline but steady quarter-over-quarter.

- Financial Services revenue rose to $893 million, a 2% year-over-year increase.

Operational Efficiency and Margin Improvements

- Non-GAAP operating margin increased to 11.1%, an improvement of 140 basis points year-over-year.

- Cost management led to a 9% year-over-year decrease in non-GAAP operating expenses.

- Intelligent Edge operating margin improved by 200 basis points quarter-over-quarter, reaching 24.4%.

Customer Growth and Product Adoption

- HPE GreenLake customer base expanded by approximately 2,000, ending with around 39,000 unique customers.

- AI systems backlog rose to over $3.5 billion post-Q4, indicating strong demand.

- Gen11 server products, accounting for more than two-thirds of core compute revenue, saw strong adoption in North America and Europe.

Outlook for Fiscal Q1 2025

- Anticipated year-over-year revenue growth in the mid-teens for Q1 2025.

- Expected Q1 GAAP diluted net EPS between $0.31 and $0.36, and non-GAAP diluted net EPS between $0.47 and $0.52.

- Server operating margin forecasted to be between 10% to 11%, with a focus on AI systems and traditional compute.

Antonio Neri says,

Current Backlog and Pipeline

- The current backlog exceeds $3.5 billion, indicating strong business demand and future revenue potential.

- The pipeline is multiple times larger than the current backlog, suggesting significant growth opportunities ahead.

- Focus on four key market segments, with particular emphasis on segments providing GPU capacity on a per-hour basis.

Key Market Segments and Growth Drivers

- Primary growth drivers include hyperscalers and Tier 2 and Tier 3 providers offering GPU capacity.

- Steady growth observed in the enterprise AI pipeline, with hundreds of customers and several large-sized deals underway.

- The enterprise AI segment is expected to become a significant growth driver by 2025.

Enterprise AI Segment Developments

- Recent collaborations with NVIDIA led to the co-engineering of solutions, available since September 9, resulting in closed deals within 7 weeks.

- Additional offer enhancements, including partnerships with firms like Deloitte, signal strategic positioning for growth.

Guidance and Future Expectations

- Expectations of transitioning to the latest GPUs in the coming quarters, focusing on high-performance computing capabilities.

- Strong anticipated growth in enterprise AI to positively influence financial performance in 2025 and beyond.

| Event | Date | Outcome |

|---|---|---|

| Co-engineered Solution Announced with NVIDIA | June 2024 | Boost in enterprise AI deals |

| Solution Availability | September 9, 2024 | Closed deals within 7 weeks |

| Additional Enhancements with Partners | October 2024 | Strategic growth positioning |

Q & A sessions,

Segmentation and Growth Outlook

- The transition to the latest technology is expected in the first half of 2025 for service providers and hyperscalers, leading to potential growth in HPE’s platform during this period.

- Enterprise customers are projected to remain 1 or 2 generations behind in technology adoption, focusing more on deployment simplicity and time to value.

- HPE Private Cloud AI, based on H100, continues to serve current enterprise demands efficiently.

Hybrid Cloud and GreenLake Platform

- Alletra MP Storage has shown the fastest-ever adoption in HPE’s history, reaching a $1 billion annualized basis, although part of this revenue is deferred due to subscription models.

- The GreenLake platform added more than 9,000 new customers this year, bringing the total to 39,000.

- Aruba and other services contribute to growth through subscription models.

AI and Networking Developments

- The AI pipeline expanded quarter-over-quarter, now surpassing $3.5 billion, indicating strong future demand.

- Intelligent Edge order growth has been recorded for three consecutive quarters, although this has yet to fully translate into revenue.

- Recent collaboration with Juniper Networks is expected to enhance HPE’s networking capabilities, with specific focus on AI-driven innovations.

Financial Performance and Margins

- The AI server revenue hit a record $1.5 billion in the latest quarter, showcasing strong performance in this sector.

- Q4 gross margin was 30.9%, impacted by lower Intelligent Edge revenue but offset by AI systems revenue and product mix.

- Expectations for gross margin improvements are primarily driven by Intelligent Edge and the pending Juniper acquisition.

Innovation and Strategy

- HPE’s innovation-driven strategy is credited for the successful financial performance and increasing relevancy to customers.

- Focus areas include AI workloads, flexible hybrid models, and sustainable solutions, responding to both market trends and customer needs.

- Cost control measures, aided by GenAI tools, are expected to improve productivity and operational efficiency moving forward.