Oracle Corporation

CEO : Ms. Safra Ada Catz

Quarterly earnings growth(YoY,%)

| Period | Revenue | Operating Income | EPS | Release Date |

|---|---|---|---|---|

| 2025 Q2 | 8.6% YoY | 16.5% | -216.5% | 2024-12-09 |

Safra Catz says,

Q2 Financial Performance

- Total revenue for Q2 reached $14.1 billion, up 9% from last year.

- Earnings per share (EPS) were $1.47 in non-GAAP terms, up 10% in USD and constant currency.

- GAAP EPS was $1.10, marking a 24% increase in USD terms.

- Operating income increased by 10%, with the operating margin rising to 43%, an uptick of 60 basis points.

Cloud and Infrastructure Growth

- Cloud services and license support now represent 77% of total revenue, driving overall revenue growth.

- Cloud revenue is projected to reach $25 billion this fiscal year, fueled by high AI demand and partnerships with major cloud providers like Microsoft, Google, and AWS.

- Total cloud revenue for Q2 was $5.9 billion, with SaaS revenue at $3.5 billion (up 10%) and IaaS revenue at $2.4 billion (up 52%).

- Oracle Cloud Infrastructure (OCI) revenue grew 52%, with GPU consumption up 336% in the quarter.

Remaining Performance Obligations (RPO) and Future Projections

- The RPO stands at $97.3 billion, up 50% in constant currency, reflecting larger and longer-term contracts.

- Approximately 39% of the RPO is expected to convert into revenue over the next 12 months.

- Cloud RPO grew nearly 80% and now accounts for nearly three-quarters of the total RPO.

Capital Expenditures and Cash Flow

- Capital Expenditures (CapEx) for Q2 amounted to $4 billion, with free cash flow at negative $2.7 billion and operating cash flow positive at $1.3 billion.

- Fiscal year 2025 CapEx is expected to double from fiscal year 2024 levels, aligning with booking trends and demand.

- On a trailing 12-month basis, operating cash flow grew 19% to $20.3 billion, while free cash flow was $9.5 billion.

Guidance for Q3 and Fiscal Year 2025

- Total revenue is expected to grow between 9% to 11% in constant currency and 7% to 9% in USD for Q3.

- Total cloud revenue growth is forecasted at 25% to 27% in constant currency, and 23% to 25% in USD.

- Non-GAAP EPS is projected to grow from 7% to 9%, estimated to be between $1.50 and $1.54 in constant currency.

- The EPS guidance for Q3 is negatively impacted by $0.05 due to an investment loss, with a base tax rate assumption of 19%.

Lawrence Ellison says,

Oracle’s AI Infrastructure and Client Base

- Oracle Cloud Infrastructure supports major AI models from prominent clients such as OpenAI, xAI, Nvidia, Cohere, and Meta.

- Oracle has launched the largest and fastest AI supercomputer globally, equipped with up to 65,000 Nvidia H200 GPUs.

- The company is positioned as a leader in AI training workloads due to competitive advantages in speed and cost-effectiveness.

Innovative AI Applications and Impact

- AI agents developed by Oracle automate critical tasks across various sectors including healthcare, agriculture, and security.

- Applications include automated drug design, cancer diagnostics, electronic health record updates, and real-time video weapons detection.

Oracle 23ai Vector Database Capabilities

- The new AI version of Oracle’s database, Oracle 23ai, enhances the capability for customers to leverage existing data for AI model training.

- It facilitates the integration with industry-standard AI models such as ChatGPT, Grok, and Llama, allowing customers to build specialized AI agents.

Financial Projections and Market Potential

- Oracle projects its Cloud revenue to exceed $25 billion for the fiscal year.

- The financial outlook signifies early stages of expansive growth opportunity in the AI market.

Competitive Position and Future Growth

- Oracle’s advancements in AI infrastructure position it as a formidable competitor in the cloud services sector.

- The scale of AI-related opportunities is described as “unimaginable,” hinting at substantial future growth potential.

Q & A sessions,

Data Center Standardization and Expansion

- Oracle’s data center strategy revolves around a completely modular design, allowing for uniformity across all centers.

- The smallest data center region requires 6 racks at 50 kilowatts, while the largest currently being built will be 1.6 gigawatts.

- Standardization across data centers ensures lower manufacturing costs and inventory requirements.

- All cloud regions provide the same services, unlike competitors who have varied offerings across regions.

- This standardization and automation could enable Oracle to scale to potentially thousands of regions, addressing markets competitors cannot.

Advancements in GPU Clusters and Networking

- Oracle is focused on enhancing GPU clusters by making them faster and larger to speed up training processes.

- Significant investment is directed towards network infrastructure to efficiently handle large data transfers to GPU clusters.

- Improving network speeds is crucial to prevent bottlenecks and ensure efficient AI training capabilities.

- Oracle’s strategy in networking positions it ahead in maintaining a competitive edge in AI-driven markets.

Efficiency in Back Office Systems

- There is intense industry pressure for companies to improve efficiency, focusing on automation and simplification.

- Oracle’s operational efficiency is exemplified by their quick turnaround post-quarter close, achieved within nine days including weekends.

- Enormous customer interest in Oracle’s AI capabilities for back and front office improvements to reduce costs and enhance service.

- Oracle’s booking trends show a significant increase from the previous year, indicating growing demand for their solutions.

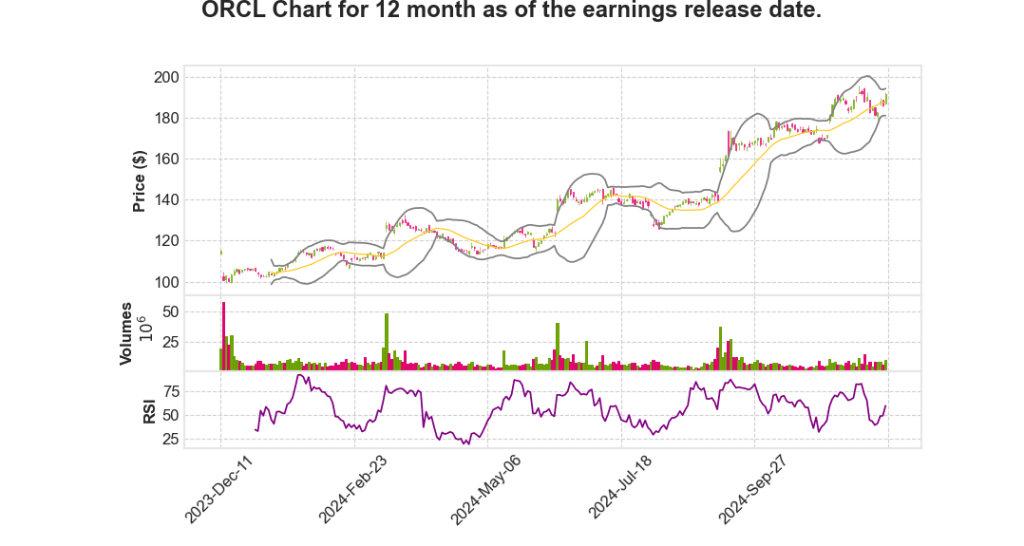

Implications on Stock Movement

| Factor | Impact |

|---|---|

| Data Center Growth | Potential for increased market share and revenue growth due to modular expansion capability. |

| AI and Networking Advances | Sustained competitive advantage through investment in cutting-edge technologies could drive long-term growth. |

| Booking Trends | Accelerated bookings suggest positive future revenue outlook, enhancing stock valuation prospects. |

Conclusion

- Oracle’s strategic focus on standardization, AI, and network capabilities positions the company for competitive growth.

- The company’s efficient operational practices and increasing demand reflected in booking trends are positive indicators for stock performance.

- Investors should consider Oracle’s robust infrastructure and innovative strategies as key factors in potential stock appreciation.