Accenture plc

CEO : Ms. Julie T. Spellman Sweet J.D.

Quarterly earnings growth(YoY,%)

| Period | Revenue | Operating Income | EPS | Release Date |

|---|---|---|---|---|

| 2025 Q1 | 9.0% YoY | 15.0% | -99.9% | 2024-12-19 |

Angie Park says,

Revenue and Earnings Performance

- Revenue for Q1 FY25 reached $17.7 billion, marking a 9% increase in U.S. Dollars and 8% in local currency, surpassing the top end of the guided range by approximately $240 million.

- Earnings per Share (EPS) increased to $3.59, reflecting a 10% growth over the adjusted EPS from Q1 last year.

- The operating margin for the quarter was 16.7%, consistent with last year’s adjusted results, despite significant investments made in personnel and business operations.

- Gross margin decreased slightly to 32.9% from 33.6% last year.

Geographic and Industry Performance

- Americas showed strong revenue growth of 11% in local currency, driven by sectors such as industrial, software and platforms, banking and capital markets, and consumer goods.

- EMEA revenues grew by 6% in local currency, with public service, life sciences, and health as the leading sectors.

- Asia Pacific experienced a 4% revenue growth, led by utilities, industrial, and health, with Japan contributing significantly.

Financial Operations and Cash Flow

- Free cash flow for the quarter was significant, standing at $870 million.

- The company returned $1.8 billion to shareholders through share repurchases and dividends.

- The cash balance increased to $8.3 billion as of November 30th, following a $5 billion inaugural debt offering.

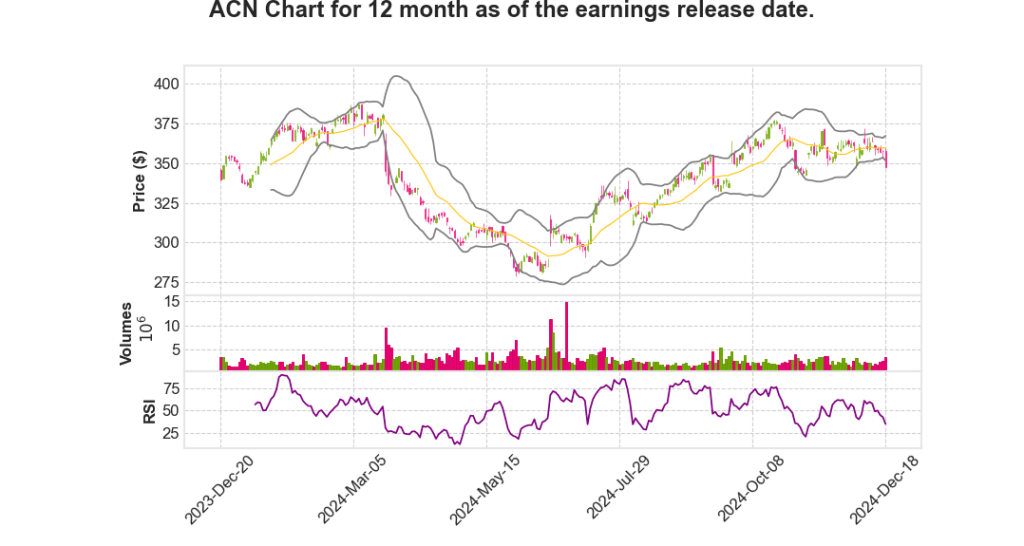

- Net share repurchases totaled 2.5 million shares for $898 million, at an average price of $355.03 per share.

New Bookings and Business Segments

- New bookings for the quarter totaled $18.7 billion, marking a 1% growth in both U.S. Dollars and local currency.

- Consulting bookings contributed $9.2 billion with a book-to-bill ratio of 1.0, while managed services bookings were $9.5 billion with a book-to-bill of 1.1.

- Consulting revenues rose by 7% in U.S. Dollars and 6% in local currency.

- Managed services experienced robust growth with an 11% increase in both U.S. Dollars and local currency.

Shareholder Returns and Dividends

- A quarterly cash dividend of $1.48 per share was announced, representing a 15% increase from last year.

- The Board declared a dividend to be paid on February 14th, maintaining the 15% increase.

- There is approximately $5.9 billion of remaining share repurchase authority as of November 30th.

| Metric | Q1 FY25 | Change |

|---|---|---|

| Revenue | $17.7 billion | +9% in USD, +8% in local currency |

| EPS | $3.59 | +10% over last year |

| Free Cash Flow | $870 million | – |

| Dividend per Share | $1.48 | +15% |

The company’s strong financial performance, increased guidance, and commitment to shareholder returns are key factors likely to positively impact the stock movement in the near term.

Julie Sweet says,

Strategic Focus on Large Deals

- The strategy centers on securing larger deals, particularly those exceeding $100 million.

- Last year, the company successfully closed 125 deals of this size, demonstrating significant traction in this area.

- This strategic pivot was crucial in positioning the company for a robust growth recovery in 2025.

- The focus on larger reinventions is a deliberate move to capture increased demand in this segment.

Agility and Market Adaptation

- The company’s ability to quickly adapt to changing market conditions has been a key factor in its strategic execution.

- Last year’s market shifts prompted a swift pivot and agile response, allowing the company to seize new opportunities.

- Despite the unchanged market environment, the company has managed to maintain and execute its strategic plans effectively.

Execution of Strategy and Skills

- The company’s unique combination of consulting and managed services capabilities has been pivotal in executing its strategy.

- These capabilities are highlighted as critical components that enhance the company’s ability to secure and execute large deals.

- Execution of the outlined strategy is expected to drive strong growth in 2025 as market conditions improve.

Positioning for Market Improvement

- As market spending returns, the company is strategically positioned at the core of clients’ business operations.

- The strategic programs pursued are deemed critical, which reinforces the company’s role in its clients’ reinvention efforts.

- Given its positioning, the company is well-capitalized to benefit from an uptick in market spending.

Projected Growth and Market Impact

- The company’s strategic initiatives are expected to significantly contribute to a resurgence in growth by 2025.

- Investors should monitor the execution of these large-scale deals as a key factor influencing future stock performance.

- The successful execution of this strategy is a critical driver for anticipated strong growth in the upcoming fiscal year.

Q & A sessions,

Federal Government Opportunities

- ACN is well-positioned due to its strong expertise in navigating federal government requirements and its capability to bring commercial solutions to federal needs.

- The company is extensively involved in U.S. federal agency projects focused on securing critical infrastructure, modernizing citizen services, and cloud modernization with the U.S. Air Force.

- The mission-critical nature of ACN’s work with the federal government provides stability and potential for growth as it continues to align with the new administration’s goals.

AI and Technology Adaptation

- ACN is witnessing varying degrees of interest and readiness for AI implementation among its clients, ranging from basic understanding to full integration.

- Client spending on AI is more focused on reprioritization within existing budgets rather than additional expenditure, with an expected potential increase once confidence grows.

- The strategy includes capturing a larger share of client budgets by pivoting towards services that enhance AI and data foundation capabilities.

Financial Guidance for Q2 Fiscal 2025

- Expected revenue for Q2 is between $16.2 billion and $16.8 billion, reflecting a negative 2.5% FX impact but a 5% to 9% growth in local currency.

- The company anticipates a positive impact from inorganic contributions, expected to be about 4% in the first half and 2% in the second half of fiscal 2025.

Full Fiscal 2025 Outlook

- Revenue growth is projected to be 4% to 7% in local currency, with an inorganic contribution slightly over 3%.

- Operating margin is expected to expand by 10 to 30 basis points, landing in the range of 15.6% to 15.8%.

- The effective tax rate is anticipated to be between 22.5% and 24.5%, while diluted earnings per share are forecasted to grow by 4% to 7%.

Cash Flow and Shareholder Returns

| Metric | Expected Range |

|---|---|

| Operating Cash Flow | $9.4 billion to $10.1 billion |

| Free Cash Flow | $8.8 billion to $9.5 billion |

| Investments in Acquisitions | $3 billion |

| Property and Equipment Additions | $600 million |

- ACN expects to return at least $8.3 billion to shareholders through dividends and share repurchases.

- Free cash flow is planned to maintain a ratio of 1.1 to 1.2 compared to net income.