Lennar Corporation

CEO : Mr. Stuart A. Miller

Quarterly earnings growth(YoY,%)

| Period | Revenue | Operating Income | EPS | Release Date |

|---|---|---|---|---|

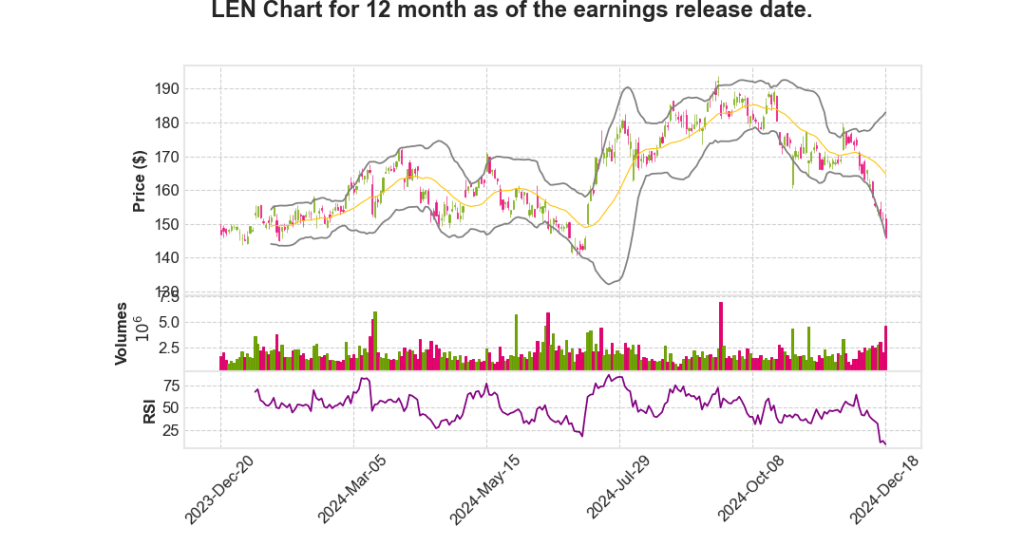

| 2024 Q4 | -9.3% YoY | -21.8% | -14.9% | 2024-12-19 |

Stuart Miller says,

Quarterly Performance and Adjustments

- The company reported that the fourth quarter results missed expectations, with new orders falling short by 95 from the anticipated 19,000.

- Gross margin was reported at 22.1%, which did not meet the anticipated 22.5% due to increased incentives on homes sold and delivered.

- Interest rates climbed approximately by 100 basis points, affecting affordability and necessitating price adjustments.

- The economic environment has become more challenging with rising long-term and mortgage rates since the last earnings call.

- Affordability remains a critical issue impacting sales volume and margins, leading to moderated expectations for Q1 2025.

Guidance for Q1 2025

- Expected sales and deliveries between 17,000 and 17,500 homes.

- Anticipated margins are set to be between 19% and 19.25%.

- Approximately 50% of the expectations are derived from backlog.

- The company plans to focus on driving sales for robust current cash flow, despite reduced profitability, to maintain managed inventory levels.

Strategic Initiatives and Operational Model

- Progress towards an asset-light operational configuration, transitioning from a land-heavy company to a manufacturing model.

- Emphasizing volume while maintaining cash flow; repurchased 3 million shares for $521 million in Q4.

- Sales incentives increased to 10.8% in the fourth quarter, mitigating affordability constraints.

- The Rausch Coleman acquisition and Milrose spin are pivotal in supporting strategic prospects and operational efficiencies.

Milrose Spin and Asset-Light Strategy

- Milrose Properties is set to become the first publicly listed land-banking REIT, managing home site options for Lennar and ventures.

- Milrose is expected to receive $5.2 billion in undeveloped land, $1 billion in cash, and $900 million in land assets from the Rausch Coleman acquisition.

- Lennar shareholders will receive an 80% share distribution of Milrose stock, translating to one Milrose share for every two Lennar shares.

- Milrose aims for consistent returns through Lennar-optioned home site transfers and expanding through inorganic opportunities.

Market Outlook and Future Projections

- Acknowledgement of potential concerns such as immigration and tariffs, though not expected to majorly impact in the immediate term.

- Forecasted delivery between 86,000 and 88,000 homes in 2025, representing an 8% to 10% increase over 2024.

- Optimistic outlook on strategic growth and asset-light strategy supporting market conditions normalization.

- The company remains focused on margin rationalization and capital efficiency in anticipation of renewed incentives and normalized margins.

| Metric | Q4 2024 Reported | Expectations |

|---|---|---|

| New Orders | 18,905 | 19,000 |

| Gross Margin | 22.1% | 22.5% |

| Q1 2025 Sales & Deliveries | 17,000-17,500 | N/A |

| Q1 2025 Margin | 19%-19.25% | N/A |

Diane Bessette says,

Balance Sheet Developments

- Lennar closed the fiscal year with $4.7 billion in cash and no borrowing from its $2.9 billion credit facility, resulting in total liquidity of $7.6 billion.

- The company continues to advance its land-light strategy, controlling 82% of homesites with 1.1 years owned, marking historic lows.

- Current portfolio holds 85k owned homesites and 394k controlled homesites.

- Q4 land procurement reached $2.1 billion, with 80% ready for immediate construction, supporting Lennar’s manufacturing model.

Debt and Capital Management

- No senior note redemptions occurred in this quarter, and Lennar has reduced over $7 billion in debt since 2018.

- The homebuilding debt-to-capital ratio has been reduced to an all-time low of 7.5%.

- There are no debt maturities before May 2025, ensuring financial stability in the near term.

Shareholder Returns

- Q4 saw repurchases of 3 million shares, with total purchases over the year exceeding $2 billion.

- The company distributed $135 million in quarterly dividends.

- Total returns to equity and debt stakeholders over 2024 approached $3.3 billion.

- Equity rose to nearly $28 billion, equating a book value of $104 per share.

First-Quarter 2025 Guidance

- Orders for Q1 are projected to be between 17,500 and 18,000 homes.

- Guidance remains unaffected by the potential impacts of the Rausch Coleman and Millrose spinoffs.

Summary of Key Financials

| Financial Metric | Value |

|---|---|

| Cash at Fiscal Year-End | $4.7 billion |

| Total Liquidity | $7.6 billion |

| Debt-to-Capital Ratio | 7.5% |

| Equity | $28 billion |

| Book Value per Share | $104 |

Q & A sessions,

Impact of Interest Rates and Inflation

- The ongoing challenge for consumers, especially at the entry and move-up levels, lies in acquiring a down payment amidst an inflated market.

- Despite a decrease in the rate of inflation, prices have not followed suit, maintaining high levels and complicating mortgage qualification processes.

- A fluctuating interest rate environment creates buyer hesitancy, impacting purchasing decisions significantly. **This hesitancy could negatively influence stock performance as potential sales may not materialize.**

Market Dynamics and Consumer Behavior

- Seasonality combined with other market factors has contributed to a challenging environment for buyer decision-making.

- Interest rate movements in the third quarter did not yield the expected consumer responsiveness, despite rates being lower at times.

- As interest rates increased in the fourth quarter, potential buyers perceived this as a surprise, further sidelining their participation. **Understanding these consumer shifts is critical for predicting future stock trends.**

Navigating Buyer Incentives

- The company utilizes a variety of tools such as incentives, rate buy-downs, and purchase price reductions to stimulate buyer interest.

- Successfully managing these tools has become more complex, requiring increased effort to overcome consumer hesitations.

- **The effectiveness of these strategies will be crucial for maintaining sales volumes and meeting financial targets, potentially impacting stock valuation.**

Fourth Quarter Observations

- An upward trajectory in interest rates during the fourth quarter has contrasted with previous quarters, altering consumer expectations and behaviors.

- The company’s adaptability in response to rate changes will significantly influence its ability to capture market share and affect its stock price trajectory. **Close monitoring of these adaptations is essential for future forecasts.**