NIKE, Inc.

CEO : Mr. Elliott J. Hill

Quarterly earnings growth(YoY,%)

| Period | Revenue | Operating Income | EPS | Release Date |

|---|---|---|---|---|

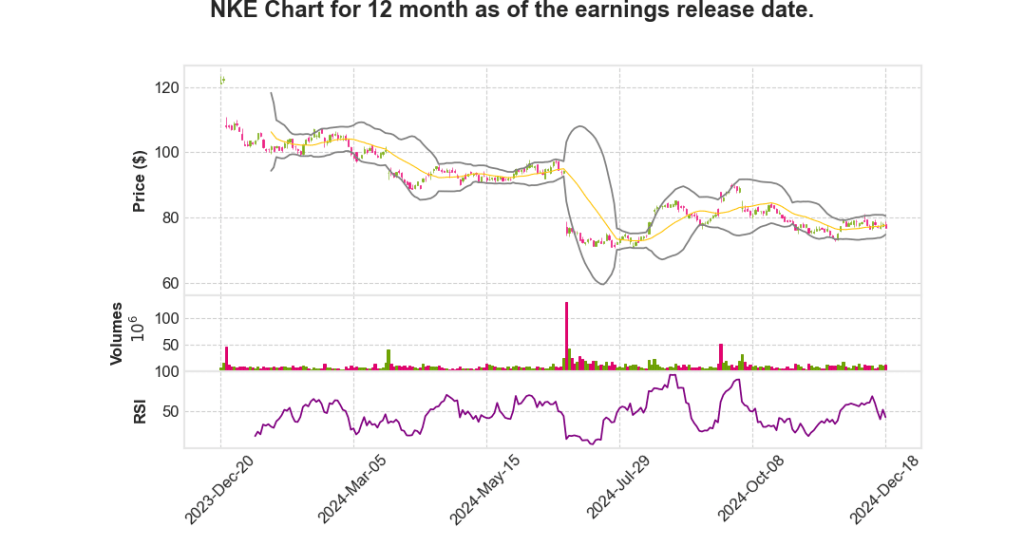

| 2025 Q2 | -7.7% YoY | -24.2% | -167.3% | 2024-12-19 |

Elliott Hill says,

Leadership and Vision

- There’s a reinvigorated focus on sport, with the intention to lead with sport and center every decision around athletes.

- Reinvestment in brand storytelling is prioritized to inspire and emotionally connect with consumers.

- There’s an emphasis on rebuilding a consumer-led, integrated marketplace both through NIKE Direct and wholesale channels.

- The leadership team is focused on clear direction and focus to drive immediate impact.

Product Strategy

- NIKE is sharpening its product strategy to be sport-specific, segmented by gender and age.

- Return to franchise management to manage inventory and move towards a ‘pull’ market for classic footwear franchises.

- The introduction of new franchises such as the Vomero 18 and Pegasus premium aims to spark consumer interest.

- Product innovation is focusing on high-volume areas such as running, training, and core product lines.

Brand and Marketing Initiatives

- NIKE aims to deliver bold creative marketing and leverage athletes in key sport moments.

- Sports marketing will remain aggressive, with recent re-signings including the NBA, WNBA, and other notable partners.

- Increase investment in key countries and cities to strengthen consumer connections through local teams and influencers.

- Addressing the impact of digital revenue prioritization on marketplace health, with plans to return to premium status and full-price sales.

Wholesale and Direct-To-Consumer Strategy

- NIKE intends to rebuild trust with wholesale partners by delivering new innovative products and consistent engagement.

- Plans include providing wholesale partners with access to the best NIKE products and marketing support.

- Focus on a balanced product offering to ensure profitability for both NIKE Direct and wholesale channels.

- Commitment to collaborative growth with partners, ensuring mutually profitable sell-through strategies.

Outlook and Near-Term Actions

- The focus will be on immediate actions to ignite culture, accelerate product portfolio, and enhance brand marketing.

- Investment in teams across key geographies to win at the local level is prioritized.

- Expectations for some near-term results to be negatively impacted due to strategic shifts.

- Decisions are guided by long-term health and shareholder value, with a foundational belief in sustainable growth through sport.

Matt Friend says,

Q2 Financial Performance Overview

- Revenues were down 8% on a reported basis and 9% on a currency-neutral basis.

- Gross margins declined 100 basis points to 43.6%, influenced by higher markdowns and wholesale discounts.

- SG&A decreased by 3%, with reductions offsetting increased investments in sports marketing.

- Earnings per share were reported at $0.78.

Marketplace Trends and Segment Performance

- NIKE Direct sales fell 14%, with digital channels declining 21% and stores down 2%.

- Black Friday in North America saw a significant increase in digital sales, rising double-digits.

- NIKE Digital off-price mix increased high single-digits year-over-year, emphasizing need for enhanced consumer experience.

- Overall inventory levels were flat year-over-year, with footwear declining but apparel and accessories increasing.

Regional Breakdown and Highlights

| Region | Revenue Change | NIKE Direct Change | Wholesale Change |

|---|---|---|---|

| North America | -8% | -15% | -1% |

| EMEA | -10% | -20% | -4% |

| Greater China | -11% | -7% | -15% |

| APLA | -2% | -4% | -1% |

Strategic Actions and Near-Term Outlook

- Shifting NIKE Digital towards a full-price model to reduce dependency on promotions.

- Plans to liquidate excess inventory through less profitable channels in the short term.

- Projected significant reduction in weeks of supply for classic footwear franchises.

- Increased investment in brand marketing and sports marketing partnerships to support product launches and sports events.

Q3 Financial Guidance

- Revenue expected to decline low double-digits, considering strategic actions and foreign exchange headwinds.

- Q3 gross margins projected to drop approximately 300 to 350 basis points.

- SG&A expenses anticipated to be slightly down year-over-year, despite strategic investments.

- Other income and expenses, including net interest income, forecasted to be between $30 million and $40 million.

Q & A sessions,

Commitment to Consumer-Led Strategy

- Nike is dedicated to leading and growing a consumer-led marketplace.

- Focus on presenting the best representation of the Nike brand across various shopping channels: direct, wholesale, digital, and physical.

- Investing in specialty channels, particularly running and football specialty areas, to enhance product innovation and engagement.

- Emphasis on maintaining an unrelenting flow of innovative products across all sports and price points to drive mutually profitable growth with wholesale partners.

Product and Brand Innovations

- Reduction of inventory in the marketplace to make space for innovative products.

- Strategic focus on five key sports: running, basketball, training, football, and sportswear.

- Planned investments in brand marketing, shifting focus from performance marketing.

- Introduction of exciting new products in the basketball segment including the Jordan, LeBron, Kobe, and new GT series.

Regional Focus and Leadership Appointments

- Tom Petty appointed as the new leader for North America to drive growth through strategic investments in brand and marketplace.

- Focused growth strategy in China, leveraging product innovation tailored for the local market with the help of the GEO Express Lane.

- Plan to redefine and strengthen Nike Direct and Digital as premium channels.

Financial Strategies and Guidance

- SG&A down 3%, while demand creation investments increased by 1% in the current quarter.

- Guidance for Q3 indicates revenue down in low double-digits with margins decreasing by 300-350 basis points.

- Projections indicate a mid-single-digit financial headwind affecting the balance of the year due to accelerated actions to reposition the product portfolio.

| Quarter | Revenue Outlook | Margin Impact |

|---|---|---|

| Q3 | Down low double-digits | Down 300-350 basis points |

| Q4 | Expected greater headwind than Q3 | Expected to face larger margin impact |

Long-Term Partnerships and Market Investments

- Strong, long-term partnerships with major sports organizations like the NFL, NBA, and WNBA.

- Continued focus on demand creation investments through sports marketing and brand enhancement.

- Strategic actions to reposition Nike Direct and manage inventory to ensure a balanced marketplace and promote growth.