Citizens Financial Group, Inc.

CEO : Mr. Bruce Winfield Van Saun

Quarterly earnings growth(YoY,%)

| Period | Revenue | Operating Income | EPS | Release Date |

|---|---|---|---|---|

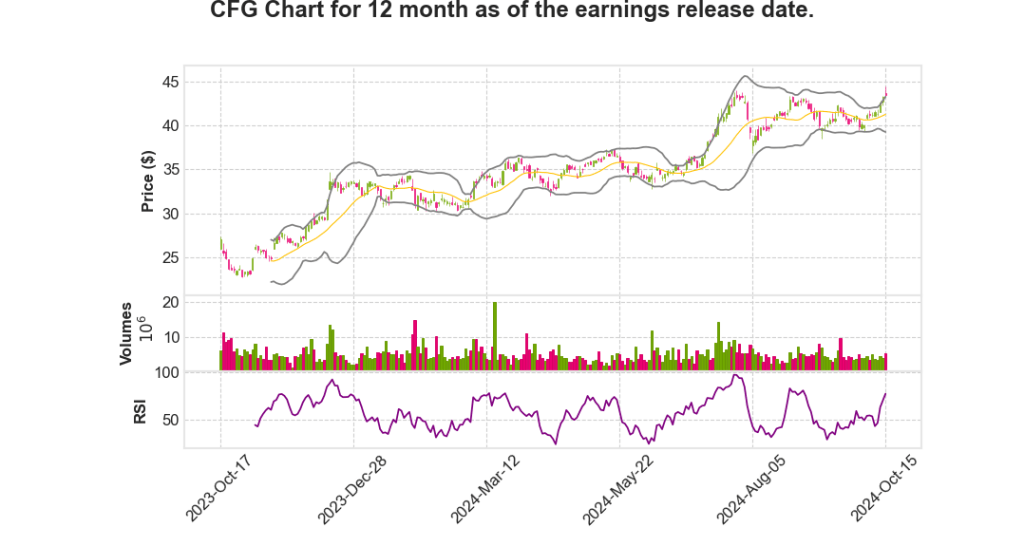

| 2024 Q3 | -5.5% YoY | 15.1% | -9.4% | 2024-10-16 |

John Woods says,

Third Quarter Financial Highlights

- The company reported an underlying net income of $392 million for Q3 2024, resulting in earnings per share (EPS) of $0.79 and a return on tangible common equity (ROTCE) of 9.7%.

- There was a $0.11 negative impact on EPS due to the non-core portfolio, which is expected to run off steadily, creating a future performance tailwind.

- The private bank reached breakeven mid-third quarter and is expected to contribute positively to earnings from Q4 2024 onward.

- Capital position remains solid with a CET1 ratio of 10.6% as of September 30, 2024, with $325 million in stock buybacks executed during the quarter.

Net Interest Margin and Income

- Net Interest Income (NII) decreased by 2.9% sequentially, influenced by a 10 basis points drop in net interest margin (NIM) to 2.77%.

- The decline in NIM was primarily due to increased hedge costs as forward starting swaps commenced during the quarter.

- The company anticipates a 5 basis point improvement in NIM for Q4 2024, driven by favorable swaps, deposit repricing, and non-core runoff.

Non-Interest Income and Fees

- Non-interest income decreased by 2.7% sequentially due to seasonality in capital markets, although capital markets fees increased by 40% year-on-year.

- Card and wealth results remained strong, while client hedging revenue decreased slightly.

- Total assets under management stand at approximately $30 billion, with private bank wealth fees experiencing moderate growth.

Loan and Deposit Dynamics

- Period-end loans were stable, with a $1 billion run-down in the non-core portfolio and an $800 million increase in the core loan portfolio.

- Average deposits remained stable, with a 1% decrease driven by higher-cost treasury deposit paydowns, offset by $1.6 billion growth in private bank deposits.

- The interest-bearing deposit costs rose by 4 basis points sequentially, with total deposit costs increasing by only 2 basis points.

Credit and Risk Management

- Net charge-offs increased by 2 basis points to 54 basis points due to seasonal impacts in auto, while commercial real estate charge-offs declined.

- The allowance for credit losses (ACL) coverage ratio decreased slightly to 1.61%, reflecting an improved macroeconomic outlook.

- The general office reserve increased to 12.1%, up from 11.1%, with a $382 million reserve representing a 12.1% coverage.

| Metric | Q3 2024 | Guidance/Expectations |

|---|---|---|

| NIM | 2.77% | 5 basis points improvement in Q4 2024 |

| CET1 Ratio | 10.6% | Stable with $200M to $250M share repurchases expected |

| Private Bank Loans | $2 billion | Growth expected, contributing positively to earnings in Q4 2024 |

Strategic Initiatives and Outlook

- Launch of the TOP 10 program is planned, targeting over $100 million in run rate efficiencies by the end of 2025.

- The medium-term target remains a 16% to 18% return, with strong defense and offense strategies in place for potential regulatory changes and economic challenges.

- Q4 2024 guidance includes expectations of a 25 basis point rate cut in November and December, with NII projected to increase by 1.5% to 2.5%.

Brendan Coughlin says,

Consumer Banking Performance

- The rundown on non-core assets is slowing, transitioning to a net positive: Last year, the rundown was at $1.2 billion to $1.3 billion per quarter and has now slowed to $800 million to $900 million.

- Growth is being observed in mortgage and home equity portfolios, with expectations of a modest pickup in mortgage originations as interest rates decrease.

- The HELOC (Home Equity Line of Credit) business is strong, placing the company at the top of national HELOC origination tables, particularly in the super prime space.

- With consumer confidence and economic stability, HELOC will be a key lever for future consumer borrowing against accrued home equity.

Student Loan Refinancing Opportunities

- Previously sidelined due to high interest rates, the student loan refinance product is expected to see modest recovery.

- As federal collections on student loans resume and rates decrease, late 20s to early 30s individuals with strong credit are expected to refinance their student debt.

Private Banking Growth and Credit Usage

- Decreasing interest rates are expected to encourage more credit usage among private bank clients, who currently favor cash transactions.

- High net worth individuals may begin to leverage credit for residential investments and business growth as rates become more favorable.

- The company has been proactive on the deposit front, aiming to enhance customer engagement by offering comprehensive day-to-day banking solutions.

Rate Environment and Market Position

- The reduction in interest rates is perceived to create embedded demand across consumer and private banking sectors.

- The company’s strategic focus on capturing full wallet share involves leveraging low rates to drive borrowing and expand deposit relationships.

- Further growth is anticipated as the market adjusts, with confidence in the operations’ ability to attract and retain customers through enhanced service offerings.

| Category | 2023 Runoff ($Billion) | 2024 Runoff ($Billion) | Expected Trend |

|---|---|---|---|

| Non-core Asset Rundown | 1.2 – 1.3 | 0.8 – 0.9 | Slowing |

Q & A sessions,

Balance Sheet Strategy and Asset Sensitivity

- The company is transitioning from a headwind to a tailwind with its receipt swaps, which will contribute positively in Q4 2024.

- Proactive management of down betas is being implemented, leveraging learnings from previous cycles.

- Deposit portfolio adjustments show better-than-peer average up betas, and efforts are being focused on the consumer side for down beta management.

- The commercial deposit majority is at 100% beta, which is a significant factor in managing asset sensitivity.

Financial Projections for Q4 2025

- Expectations for Q4 2025 include achieving around a 3% Net Interest Margin (NIM) driven by fixed loan portfolios and securities turnover.

- Incremental benefits of approximately 5 basis points are expected, pushing the total to $295 million from a base of $277 million in Q3.

- Front book back book turnover is expected to generate 200-300 basis points of benefit over the next five quarters.

- Deposit growth strategies in New York Metro continue to provide positive contributions.

Interest Rate Environment and Swap Strategy

- The company terminated $4 billion in short-dated swaps in Q3, capitalizing on an environment predicting 7-8 Fed rate cuts by Q2 2025.

- The swap strategy provides stability, with the amortization of impacts expected to positively influence financials through May 2025.

- The firm maintains a slightly asset-sensitive position, with the swap portfolio offering protection until mid-2026.

- Net interest margin stability is anticipated across various rate environments into 2025, even if rates fall below the projected 350 basis points.

Consumer and Auto Loan Performance

- Consumer net charge-offs have normalized to pre-COVID levels, hovering between 50-55 basis points.

- Auto loan charge-offs showed a seasonal reversion to the mean after a strong recovery in used values last quarter.

- Published delinquency numbers in auto loans are not a concern due to reduced new originations affecting the denominator in delinquency calculations.

- Auto portfolio is performing as expected, with no alarming trends observed.

Key Financial Highlights

| Metric | Q3 2024 | Q4 2025 Projection |

|---|---|---|

| Net Interest Margin (NIM) | Approximately 18 basis points | Approximately 3% |

| Total Income | $277 million | $295 million |

| Swap Maturity | May 2025 | Mid 2026 (Protection intact) |