Schlumberger Limited

CEO : Mr. Olivier Le Peuch

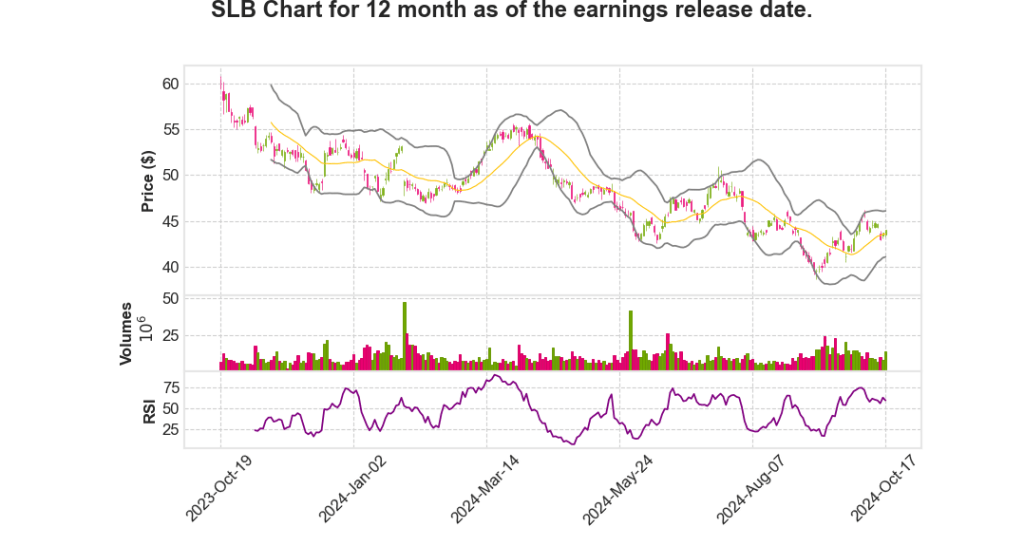

Quarterly earnings growth(YoY,%)

| Period | Revenue | Operating Income | EPS | Release Date |

|---|---|---|---|---|

| 2024 Q3 | 10.2% YoY | 13.4% | 6.3% | 2024-10-18 |

Olivier Le Peuch says,

Q3 2024 Financial Highlights

- SLB delivered strong Q3 results with adjusted EBITDA margin expanding by over 50 basis points, reaching 25.6% despite flat revenue.

- Generated very strong free cash flow of $1.81 billion.

- Revenue in North America increased by 3% sequentially due to higher offshore activity in the Gulf of Mexico. This was partially offset by lower drilling activity in U.S. land due to gas prices and capital discipline.

Division Performance

- Digital & Integration: Strong sequential growth with digital business hitting a new quarterly revenue high and pretax segment operating margin expanding to 36%.

- Production Systems growth driven by long-cycle development activity, especially in the Middle East & Asia and Gulf of Mexico.

- Reservoir Performance steady, supported by stable production and recovery spending.

- Well Construction saw slight decline due to weaker land activity in North America and international markets.

Digital Advancements and Partnerships

- Strong digital growth driven by increased investments by operators.

- Launch of the Lumi data and AI platform to accelerate advanced data and AI capabilities.

- Announced collaboration with NVIDIA for generative AI solutions and partnership with Amazon Web Services for expanded digital infrastructure capabilities.

- SLB positioned as a key partner in digital and sustainability across the industry.

Macro Environment and Market Outlook

- Commodity prices under pressure due to market oversupply and geopolitical tensions, resulting in cautionary approaches by customers.

- Long-term fundamentals for oil and gas remain robust, with gas playing an increasing role in energy transition.

- Anticipated sustained level of global upstream investment with emphasis on digital and decarbonization trends.

- Potential for upstream spending growth in international markets in 2025, with North America expected to be flat to slightly down.

Full-Year 2024 Outlook and 2025 Early Projections

- Muted revenue growth expected in Q4 2024, but EBITDA margin expansion anticipated through continued cost optimization.

- Full-year 2024 adjusted EBITDA margins projected to be at or above 25%.

- Strong cash flows and sale of Palliser asset in Canada to support increased shareholder returns.

- 2025 outlook dependent on geopolitical environment and commodity prices, with updates expected in January.

| Quarter | Adjusted EBITDA Margin | Free Cash Flow (Billion USD) |

|---|---|---|

| Q3 2024 | 25.6% | 1.81 |

| Q4 2024 (Projected) | TBD (Expansion Expected) | TBD |

Stephane Biguet says,

Earnings and Revenue Performance

- Earnings per share (EPS) for Q3 was $0.89, a 14% increase compared to the same quarter last year.

- Sequentially, EPS increased by $0.04, after excluding charges and credits.

- Third-quarter revenue remained flat at $9.2 billion sequentially.

- Adjusted EBITDA margin reached its highest since Q1 2016, increasing by 55 basis points to 25.6%.

Division-Specific Results

- Digital & Integration: Revenue rose 4% sequentially to $1.1 billion, with margins expanding 456 basis points to 35.5%.

- Reservoir Performance: Revenue was flat at $1.8 billion; margins contracted 53 basis points.

- Well Construction: Revenue fell by 3% to $3.3 billion, with margins decreasing 19 basis points.

- Production Systems: Revenue increased by 3% to $3.1 billion; margins expanded 110 basis points to 16.7%.

Cash Flow and Capital Investments

- Generated $2.4 billion in cash flow from operations, with free cash flow of $1.8 billion, marking a $1 billion increase from last quarter.

- Capital investments for Q3 amounted to $644 million, with full-year expectations remaining at approximately $2.6 billion.

Strategic Transactions and M&A

- A definitive agreement was signed to sell interests in the Palliser APS project, expecting $430 million in cash proceeds.

- The transaction will remove asset retirement obligations valued at $280 million from the balance sheet.

- ChampionX acquisition integration is progressing well, with an expected close in Q1 2025.

Shareholder Returns

- Returned approximately $2.4 billion to shareholders year-to-date through stock repurchases and dividends.

- Repurchased 11.3 million shares in Q3 for $501 million.

- Plan to exceed the $3 billion return commitment to shareholders in 2024 and reaffirm a $4 billion return goal in 2025.

Q & A sessions,

Digital Transformation and Platform Expansion

- SLB showcased their integrated digital platform at the forum, driving customer realization of its value in productivity and cost reduction.

- There is a significant expansion in the Total Addressable Market (TAM) as customers recognize the maturity of SLB’s offerings and partnerships.

- The company sees accelerated adoption of their digital toolbox, including AI and edge applications, particularly in drilling and production operations.

- The Lumi data platform, in collaboration with partners like NVIDIA and Mistral, is generating significant interest and is expected to drive future growth.

Financial Outlook and CapEx

- SLB expects offshore Final Investment Decisions (FIDs) to remain around $100 billion annually through 2026, with cumulative offshore FID exceeding $500 billion.

- Capital discipline remains a priority, with free cash flow projected to increase in 2025, aided by strong customer collections and the addition of ChampionX.

- The company reaffirms a $4 billion target in shareholder returns for 2025, reflecting confidence in financial performance.

Operational Efficiency and Customer Engagement

- SLB’s digital services are driving operational efficiency through autonomous drilling and production optimization.

- Adoption of SLB’s digital offerings is happening one customer at a time, with customers increasingly focusing on data utilization rather than just applications.

- The company’s coalescing of planning and operational capabilities under a single platform is accelerating digital transformation and customer engagement.

Market Dynamics and Competitive Landscape

- Despite commodity price pressures, SLB expects long-cycle projects to remain largely unaffected, supported by strong exploration activities and new reserve discoveries.

- The industry is experiencing tight capacity and strong capital discipline, which helps defend SLB’s pricing and margins.

- The company emphasizes maintaining high customer satisfaction levels through performance and technological innovation to mitigate competitive pressures.

Key Challenges and Strategic Initiatives

- SLB acknowledges volatility in customer collections, which impacts free cash flow, but plans to continue focus on working capital management.

- The company is investing in innovation to develop tailored digital solutions for specific customer needs, enhancing its value proposition.

- SLB is committed to unlocking growth through strategic partnerships and expanding its digital ecosystem to provide more options for customers.